Why a new growth game matters now

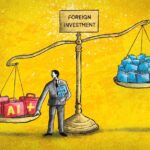

Thailand has reached a turning point. The World Bank is urging the country to change course and build new engines of growth if it wants to reach high income status by 2037. Growth has been stuck near 2 percent in recent years, well below the pace needed to lift incomes quickly and keep up with a fast changing world economy. The institution’s message is direct: the model that once relied on strong tourism, low cost manufacturing, and steady trade is no longer enough in a digital, knowledge driven, and climate stressed era.

- Why a new growth game matters now

- What is holding growth back

- The World Bank playbook for Thai growth

- Going green to unlock investment and resilience

- Opening the services economy

- Digital infrastructure is strong, skills are the gap

- Government moves and monetary stance

- Regional positioning and trade strategy

- What success could look like

- Key Points

The World Bank’s latest guidance centers on three forms of competitiveness, green, digital, and services, and five future facing sectors. Those sectors include digital services, advanced and green manufacturing, agribusiness under a renewed Kitchen of the World ambition, sustainable and wellness tourism, and the creative economy. Tapping these opportunities will require more open and competitive markets, a rapid upgrade of skills, and heavy investment in resilience, especially water and flood management that protects both communities and factories.

Melinda Good, division director for Thailand and Myanmar at the World Bank, summarized the urgency of the moment and the limits of past approaches.

‘What got Thailand here will not get it there.’

Thailand will host the IMF and World Bank Annual Meetings in Bangkok in October 2026. That gathering will bring global investors and corporate leaders to the country. It is also a deadline of sorts to demonstrate momentum on reforms, clean energy transition, and human capital upgrades that can anchor the next chapter of growth.

What is holding growth back

Economists often describe Thailand’s challenge as the middle income trap. The term refers to countries that grew quickly from low income levels, then slowed before reaching high income due to weak productivity, limited innovation, or aging demographics. Thailand fits that profile. Productivity growth has decelerated, private investment has softened, and the population is aging, which puts pressure on labor supply and public finances. Learning outcomes trail regional leaders, spending on research and development is modest, and the service sector remains relatively closed compared with peers in Southeast Asia.

Digital connectivity is strong, yet only about 5 percent of Thais have intermediate digital skills. That mismatch makes it hard for firms to adopt new technologies and for startups to scale. The World Bank argues that new growth must come from higher value activities, whether precision manufacturing, climate smart agriculture, or tradable services like cloud, data, design, gaming, and health care.

Financial headwinds are also visible. Bank credit growth has turned negative for the first time in many years, a sign of weak demand and tighter lending standards as bad debts rise. Analysts have trimmed growth forecasts amid trade tensions and softer tourism flows. Even with recent policy rate cuts, the Bank of Thailand has stressed that monetary policy can only do limited work against structural bottlenecks.

Deputy Governor Piti Disyatat of the Bank of Thailand has framed the issue clearly.

‘Monetary policy can only do so much, and the committee aims to ensure it does not constrain growth.’

The message from both the central bank and the World Bank converges on a single point. Without reforms that boost productivity and competition, short term stimulus and rate moves will not lift trend growth.

The World Bank playbook for Thai growth

The World Bank’s Systematic Country Diagnostic Update for Thailand lays out five priorities that knit together the social and the economic. The agenda calls for stronger human capital, a more competitive and innovative economy, growth in secondary cities, climate resilient development, and stronger fiscal institutions and public finance. Each piece aims to raise productivity, reduce inequality, and build resilience to shocks.

Human capital and skills

Thailand needs a step change in learning outcomes to compete in a technology rich global economy. The World Bank recommends higher and better targeted education spending, a stronger link between curricula and labor market needs, and large scale reskilling to close digital and technical gaps. That includes vocational tracks tied to industry, short cycle micro credentials for working adults, and incentives for firms to invest in worker training. Better childcare, health care, and elder care can lift labor force participation, particularly among women, and ease demographic pressures.

The payoff is direct. A workforce with strong foundational skills and digital fluency raises firm productivity, supports the adoption of automation and artificial intelligence, and attracts investors seeking reliable talent pools. It also allows regions beyond Bangkok to become magnets for quality jobs.

Innovation and the small business engine

Firms need a fair, dynamic marketplace to innovate. The World Bank urges stronger competition rules, simpler business licensing, and deeper access to finance for startups and small and medium enterprises. Thailand’s digital startups could attract up to 1.8 billion dollars in venture capital each year if the ecosystem expands, the talent pool grows, and policies encourage innovation. Public research funding and tax incentives for research and development can nudge firms toward higher value products and processes.

At the same time, predictable rules on data, privacy, and cross border services would give digital service exporters the clarity they need. That includes a modern framework for cloud and data centers, an area where foreign direct investment interest is already picking up.

Places and public finance

Unlocking growth in secondary cities is central to a broader and more inclusive pattern of development. Better transport links, reliable water and power, and area based investment plans can draw firms beyond traditional hubs. Those local agendas depend on public finance that is transparent, accountable, and well coordinated between central and local government. The World Bank highlights the value of stronger fiscal institutions, which help deliver services, reduce regional gaps, and crowd in private investment.

Flood and drought management sits at the heart of this agenda. Long run growth requires infrastructure that keeps factories running, farms productive, and communities safe during extreme weather. Water systems in the Eastern Economic Corridor carry outsized strategic value, protecting both industry and neighborhoods.

Going green to unlock investment and resilience

Climate risks are already reshaping Thailand’s economy. The World Bank’s Country Climate and Development Report warns that without stronger adaptation, floods, heat stress, water shortages, and coastal erosion could reduce GDP by 7 to 14 percent by 2050. With smart action, the country can turn those risks into opportunities. Cleaner power and transport lower energy costs over time and improve air quality. Better water and land management reduce disaster losses and lift farm yields. Carbon pricing and steady investment can put Thailand on a path to carbon neutrality by 2050 and net zero by 2065. Meeting adaptation and mitigation goals will require about 219 billion dollars over the next 25 years, roughly 2.4 percent of cumulative GDP, mobilized from public budgets, carbon revenues, and private capital.

The green economy is also a growth market. Thailand is an exporter of efficient air conditioners, supplies a share of the global solar photovoltaic value chain, and is building an electric vehicle production base. Yet green products remain a small slice of total exports. Policy moves that lower trade barriers, adjust tariffs, speed permits, and build skills could raise green exports to about 23 percent of GDP by 2030. That would mean more high quality jobs, stronger energy security, and a deeper pool of climate tech firms.

The costs of inaction are rising. Research points to agriculture production losses that could reach several billion dollars, significant risk to fisheries as ocean heat stress damages ecosystems, and a steady bill for cooling as temperatures rise that could reach 11 to 17 billion dollars a year by mid century. Without smarter land use, continued deforestation will amplify flood and erosion risks and erode natural capital. Major floods can shave several percentage points from annual GDP, while coastal erosion imposes growing costs on cities and tourism. A focused plan can change the trajectory. Early warning systems, strict land use enforcement, green infrastructure that manages stormwater, and reforestation can cut damages and even increase national wealth. Adaptation spending could run at about 1.6 percent of GDP, a significant cost that prevents much larger losses. Water resilience in the Eastern Economic Corridor is a textbook example. It supports both households and factories, and gives investors confidence that operations can withstand dry seasons and sudden storms.

Opening the services economy

Services are the fastest growing part of the global economy, from finance, health, education, and logistics to cloud, content, and digital business process exports. Thailand’s service sector is relatively closed compared with regional peers. The World Bank argues that easing foreign ownership limits in selected areas, streamlining permits, and signing trade agreements with deeper services commitments would bring in capital, know how, and competition that lift quality and lower prices. A more open services market would empower Thai entrepreneurs to build platforms and products for the region, not just the domestic market.

Practical steps include simpler licensing for professional services, predictable rules for cross border data flows, faster approvals for health and education investments, and modernized logistics and e commerce frameworks. The gains would show up in everything from telemedicine and elderly care to digital design studios and fintech, where Thailand already has talent and customers.

Melinda Good has framed the opportunity through a global lens, urging Thailand to turn near term trends into durable strengths.

‘Thailand must go green, go digital, become the Kitchen of the World, lead in digital services, and build high value service sectors.’

Digital infrastructure is strong, skills are the gap

Thailand has many of the building blocks for a digital economy. Mobile broadband is widespread, PromptPay is a popular instant payment system, and a national digital ID has improved access to services. Global cloud providers are investing in data centers, which can anchor a regional services hub if the talent is ready and regulation is clear.

The skills gap is the constraint. Only a small share of the workforce has intermediate or advanced digital skills, which limits productivity and the capacity to adopt new tools. A national program that blends school reform with adult upskilling can change that picture. Universities, technical colleges, and private bootcamps can offer short, stackable credentials in software, analytics, design, cybersecurity, robotics maintenance, and green tech. Employers can expand learn and earn pathways so that workers build skills on the job. Scholarships and mid career stipends can help lower income workers make the jump.

If the talent base grows, the startup pipeline will thicken. Analysts estimate Thailand’s startups could attract about 1.8 billion dollars in venture investment each year with the right mix of skills, investor protections, and regulatory clarity. Capital market reforms that support early stage funds, easier stock option rules, and fair competition enforcement would help founders scale. Combined with open services trade, Thai firms could sell digital content, software, and business services across ASEAN and beyond.

Government moves and monetary stance

The government has signaled a push to reshape the economy. Finance Minister Pichai Chunhavajira has outlined five pillars, shifting production toward future industries such as electric vehicles and green energy, lifting farm productivity with modern techniques, upgrading tourism with better infrastructure and services, building critical infrastructure from water management to logistics, and advancing human capital. The fiscal framework allocates funds for job creation and competitiveness programs, with a budget deficit planned to support growth while keeping debt manageable. Public debt stands near 60 percent of GDP, a level the authorities say can be stabilized with stronger growth.

Policy makers are also preparing carbon standards and credit systems to guide the clean transition, while working on debt restructuring tools and targeted relief for small debtors. The aim is to cushion vulnerable households through a period of change without slowing necessary restructuring.

On interest rates, the Bank of Thailand has lowered its policy rate in recent moves, bringing it to 1.5 percent. Officials have said that any further cuts would require a clear and material weakening in the outlook or an unexpected shock. They emphasize that weak growth mostly reflects structural issues, not a lack of monetary support. Credit contraction, rising non performing loans, and soft inflation show an economy that needs productivity reforms as much as it needs near term support.

Deputy Governor Piti Disyatat also underlined the central bank’s approach to avoid stifling activity.

‘The committee aims to ensure it does not constrain growth.’

Regional positioning and trade strategy

External shocks have complicated the outlook. Trade tensions and tariffs from major partners can trim exports and dent growth, with some scenarios pointing to softer performance in the second half of the year. Tourism has recovered but remains uneven by source market, and Chinese visitor numbers may take time to return to previous peaks. These trends strengthen the case for diversified trade agreements, especially those that reduce barriers in services, digital trade, and investment. A rules based framework for data and digital services would give Thai firms a platform to scale regionally.

Thailand’s geographic position in Southeast Asia remains a strategic asset. The Eastern Economic Corridor can serve as a hub for advanced manufacturing and logistics if infrastructure and water security continue to improve. Upgraded tourism, from health and wellness to eco tourism linked to conservation, can draw higher spending visitors and support small businesses across the country.

What success could look like

If Thailand follows through on reforms, the economy can move toward a higher growth path without sacrificing stability. Raising productivity, opening services, and upgrading skills would lift wages and create more resilient jobs. Increasing women’s labor force participation through better childcare and family policies would expand the workforce and improve household incomes. Warunthorn Puthong, a World Bank economist for Thailand, highlighted the need for a shared effort across society.

‘A better future does not rely solely on the work of economists and policymakers, it requires collective effort from everyone.’

By 2030 and beyond, measurable wins would include a rising share of green and high tech exports, more competitive and innovative small firms, stronger secondary cities that attract investment, and climate ready infrastructure that reduces flood and drought risks. With those pillars in place, the goal of high income status by 2037 comes within reach.

Key Points

- World Bank urges Thailand to build new growth engines in green, digital, and services to reach high income by 2037

- Recent GDP growth near 2 percent trails the 5 percent pace often cited as needed for high income ambitions

- Five priority sectors include digital services, advanced and green manufacturing, agribusiness, sustainable and wellness tourism, and the creative economy

- Reform blueprint targets human capital, innovation and competition, secondary city growth, climate resilience, and stronger public finance

- Only about 5 percent of Thais have intermediate digital skills despite strong connectivity and digital ID systems

- Startups could attract around 1.8 billion dollars in venture capital annually with better skills and policy support

- Climate risks could cut GDP by 7 to 14 percent by 2050 without adaptation, while green exports could reach about 23 percent of GDP by 2030 under supportive policies

- Adaptation and mitigation will require an estimated 219 billion dollars over 25 years, roughly 2.4 percent of cumulative GDP

- Government plan focuses on EVs and green energy, farm upgrades, tourism quality, water and logistics infrastructure, and human capital

- Bank of Thailand keeps policy accommodative, stressing that structural reforms, not only rate cuts, are needed to raise trend growth