Why the next plan matters for global investors

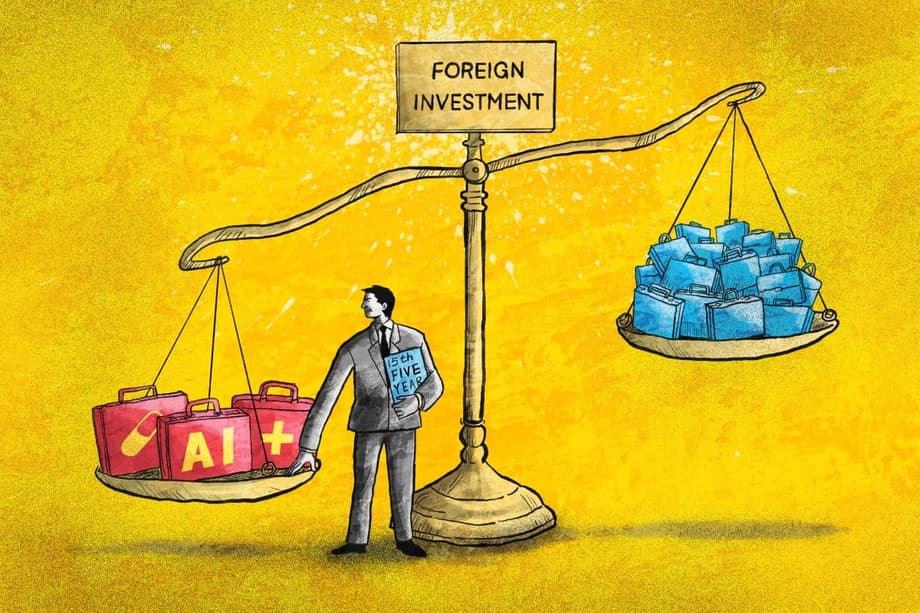

China is writing its next five year plan for 2026 to 2030, a blueprint that sets targets and policy directions for the economy, society, and the state. These plans guide ministries, provinces, and cities, and they shape the operating environment for both domestic and international companies. For foreign investors, the coming cycle looks different from the past. The policy signal points to selectivity, supply chain resilience, and technology depth rather than a broad push to expand capital inflows at any cost.

- Why the next plan matters for global investors

- From quantity to quality in foreign investment

- What Beijing is signaling on priorities

- Security first, growth second

- Opening up continues, but on China’s terms

- What this means for multinationals

- Domestic demand and the consumption challenge

- Energy transition and green growth

- Rural revitalization and supply chains beyond coastal hubs

- Timeline and how the plan is made

- Risks and compliance

- What to Know

The shift is visible on the ground. Sun Xueguang, a veteran broker of cross border deals and president of a Franco Chinese start up incubator, described a recent meeting with local officials in the Yangtze River Delta near Shanghai. In earlier years, foreign investors often heard welcomes backed by tax breaks and quick approvals across a range of sectors. This time, the request list was more focused. Officials sought projects in pharmaceuticals, healthcare, and artificial intelligence. They emphasized how a new project would help complete local supply chains and support strategic industries.

The political calendar reinforces the stakes. The Communist Party will set recommendations for the plan at a Central Committee plenum in late October, then the final text will be adopted at the national legislature in early 2026. International policymakers are watching for signals on consumption, trade, and technology. The United States treasury secretary Scott Bessent has urged Beijing to make consumer demand a pillar of the next half decade. Investors are watching whether Beijing can balance a push for high tech self reliance with a pledge to keep opening up.

From quantity to quality in foreign investment

Local governments are now asking harder questions about the value a foreign project brings. Does it fill a gap in a regional supply chain. Does it bring proprietary know how. Can it help upgrade traditional industries or seed a new cluster. Officials are still keen on foreign capital and global expertise, but they want to see stronger links between new projects and local industrial goals, from biopharma trial capacity to smart manufacturing lines and healthcare services.

After that meeting, Sun described the change in tone. He said the officials put a premium on projects that make local ecosystems more complete and competitive.

The mentality is shifting from quantity to quality.

The policy setting supports this move. China has cut the negative list that restricts foreign investment to a far smaller set of sectors than a few years ago, and manufacturing entry is fully open. Pilot programs in services have expanded access in cities such as Beijing, Shanghai, Hainan, and Shenzhen. At the same time, security and compliance reviews are tighter in sensitive areas like data, telecoms, and finance. This mix delivers a clearer welcome in advanced manufacturing and applied technology, while sensitive data and core tech receive extra scrutiny.

What Beijing is signaling on priorities

Early discussions around the plan point to a few anchors. Economic resilience, stronger domestic demand, and a sharper focus on science and technology will lead the agenda. Policymakers often speak of new quality productive forces, which means using innovation to lift productivity across the economy. They want to upgrade traditional sectors with digital tools and robotics, and build out new engines like advanced materials, biomanufacturing, clean energy equipment, and artificial intelligence.

AI Plus and industrial upgrades

One policy theme is AI Plus, the idea of embedding artificial intelligence across factories, logistics, healthcare, finance, research, and public services. The target is to integrate AI into a very high share of manufacturing lines by 2030. China Mobile gave a glimpse of the scale behind this push. The state telecom group plans to rely on domestic chips for the country’s largest AI computing network by 2028 and aims to expand to about 100 EFLOPS of AI compute, which would be a large step up from current capacity. The move pairs industrial digitization with efforts to reduce dependence on foreign chip supplies.

China Mobile chairman Yang Jie framed the moment at a recent conference before detailing the company’s plan.

Human society has fully entered the ‘AI Plus’ era, with AI as the core engine of new productive forces.

Green growth and rural revitalization are also set to remain central. The plan is expected to shift from controlling total energy use to managing total carbon emissions, with better monitoring and market tools to hit the goal of peaking carbon by 2030. Rural programs will continue to improve infrastructure, food security, and public services outside major cities, which in turn supports balanced growth and new areas for investment in logistics, agritech, and healthcare.

Security first, growth second

Recent speeches by top leaders place national security at the center of economic planning. The message is to align development with a broader security pattern, to withstand external pressure and domestic risks. That means building resilience in core technologies such as semiconductors, industrial software, aerospace, and energy systems, while maintaining steady growth in the wider economy.

Analysts describe an approach that concentrates resources in strategic high tech sectors and hedges against external shocks. Tools include targeted finance for priority industries, a greater role for capital markets to support industrial policy, and tighter risk controls in areas deemed sensitive. Growth near 4 to 5 percent per year is portrayed as sustainable if it is built on stronger foundations rather than credit driven surges.

For foreign companies this security tilt shows up in more compliance checks, closer review of data flows, and stronger local content preferences in critical systems. It also creates clear avenues for cooperation in areas that the plan promotes, from industrial automation to clean power, where officials want advanced products, local research, and training to lift productivity.

Opening up continues, but on China’s terms

During the current five year cycle, officials say China reduced barriers to entry, improved intellectual property protections, and strengthened national treatment for foreign firms. The negative list for investment fell to fewer than thirty items nationwide. Manufacturing entry is fully open, and pilot free trade zones continue to test reforms in services. Consumer market expansion has been rapid, with retail sales on track to exceed 50 trillion yuan in 2025. China has ranked first in online retail sales for more than a decade and remains the largest market for cars and home appliances.

Commerce officials also report strong outcomes in foreign investment. Actual use of foreign direct investment during the current plan period has reached more than 700 billion dollars. Over 200,000 new foreign funded enterprises have been registered, and many multinationals have added regional headquarters and global research centers in Chinese cities. Cooperation within regional trade pacts has grown, and China offered zero tariff treatment to a wide set of products from least developed African countries.

At the same time, the global picture is more complicated. The United Nations trade body reported that foreign direct investment inflows into China fell last year from recent peaks. Many firms are rebalancing supply chains, and advanced chip export controls in the United States and Europe affect technology transfer. Beijing’s answer is to keep opening in priority areas while asking foreign investors to bring technology, standards, and long term commitments that align with its industrial goals.

What this means for multinationals

The direction of policy is not a retreat from foreign investment. It is a move to select partners that strengthen key sectors and spur productivity. Companies that match those priorities will likely find more doors open, along with incentives tied to research, training, and supply chain localization. Projects that do not add strategic value may face longer reviews or fewer policy supports.

Signals to watch

- Updates to the negative list and the catalog that encourages foreign investment by sector and region

- Funding and pilot programs under AI Plus, especially where provinces link industrial upgrades to AI adoption

- Rules that shift energy control toward total carbon caps and associated carbon market tools

- New free trade zone pilots in services such as telecom, cloud, and healthcare

- Government procurement updates that detail security and local content requirements for critical systems

- Implementation rules for cross border data transfers and cybersecurity review scopes

In practical terms, firms should be ready to demonstrate how a project strengthens a local supply chain, to commit research budgets in China, and to show a plan for data governance. Partnerships with universities and technical institutes can help build the talent pipeline officials want. Demonstrating environmental performance and a plan to meet carbon goals will also be valued as the plan leans into energy transition.

Domestic demand and the consumption challenge

China’s growth mix is still heavy on manufacturing and exports. Consumption remains soft compared with supply capacity. Household caution reflects the weak property market, a still uneven job outlook in some segments, and a tradition of saving for education, health, and retirement. Consumer prices fell year on year in late summer, and leaders have discussed ways to raise consumption as a share of GDP over time.

Economists inside the system have called for stronger support for household spending over the next five years, from childcare subsidies to better health coverage and pensions. Some measures are already in place, including trade in programs for durable goods and subsidies for families with young children. Large scale social transfers face budget and ideological constraints. Officials prefer targeted programs and to set goals such as incomes rising faster than GDP, which could lift spending power without a broad shift to what leaders call welfarism.

Energy transition and green growth

The plan is expected to sharpen focus on the carbon peak by 2030, adjust targets from energy consumption to carbon emissions, and improve monitoring of major emitters. This lays a foundation for a more comprehensive carbon market and a stronger push for renewables, storage, and grid upgrades. China already leads in solar and battery production, and new policy will deepen domestic deployment, strengthen grid flexibility, and support industrial decarbonization.

Foreign firms can find openings in clean power equipment, grid software, industrial energy management, and low carbon materials. Clear reporting on lifecycle emissions, strong local partnerships, and compliance with data and security rules will shape access to public and corporate procurement in this space.

Rural revitalization and supply chains beyond coastal hubs

Balanced development will continue to feature in the plan. Rural revitalization aims to raise incomes, modernize agriculture, and expand rural services such as healthcare and education. Projects include high standard farmland, cold chain logistics, disaster prevention systems, and digital infrastructure. Food security remains a core priority, which creates demand for advanced seeds, smart irrigation, farm machinery, and sensors.

For investors, this opens potential beyond the large coastal cities. Partnerships in agritech, rural healthcare services, and logistics can align with local plans. The ability to train local workers and to transfer know how will help projects win support in county level and prefecture level programs.

Timeline and how the plan is made

A plenum of the Communist Party’s Central Committee will set the recommendations for the plan in late October in Beijing. The National Development and Reform Commission then drafts the plan, adding numeric targets and detailed tasks across sectors and regions. The final plan is expected to be adopted at the annual legislative meetings in March 2026.

Between now and adoption, ministries and provinces will experiment with pilots, release consultations, and solicit input from academics, industry groups, and companies. Policy steps are likely to remain incremental. Monetary authorities will continue targeted tools to ease credit for priority sectors. Fiscal policy will back projects in disaster recovery, rural infrastructure, and industrial upgrades. The emphasis will be on continuity and testing rather than sweeping liberalization or large stimulus.

Risks and compliance

The coming cycle will sit within a more contested trade environment. Tariffs and trade remedies affect segments such as electric vehicles, batteries, and solar components. Export controls on advanced chips and lithography tools limit some technology transfers. Companies planning deep tech investments should assume long review timelines and strict compliance checks.

Data and security rules are central. Projects that handle personal information or critical data need clear data localization, cross border transfer protocols, and incident response plans. Procurement in public facilities and critical infrastructure will give priority to trusted suppliers. Strong due diligence, local partnerships, and transparent governance will help manage these requirements.

What to Know

- China’s next five year plan for 2026 to 2030 will favor foreign projects that strengthen supply chains, upgrade industry, and bring proprietary tech and research

- Local authorities are screening investors for strategic fit in sectors such as pharmaceuticals, healthcare, AI, clean energy, and advanced manufacturing

- Beijing is pairing high level opening with tighter security, data, and procurement rules in sensitive areas

- AI Plus, green growth, and rural revitalization are set to be major pillars, with AI integrated broadly across manufacturing and services

- Consumption support will grow, but sweeping social transfers are unlikely; officials prefer targeted measures and income gains above GDP growth

- The plenum in late October sets recommendations, with final adoption expected at the national legislature in March 2026

- FDI fell from recent peaks, yet policy aims to attract fewer but higher value projects; manufacturing entry is fully open and the negative list is smaller

- Compliance on data, cybersecurity, and carbon reporting will be essential for market access and procurement