A savings twist for a weekly habit

Thailand is preparing to let lottery players turn losses into future savings. The government has outlined a new policy that converts money spent on non-winning digital lottery tickets into retirement savings. The plan, championed by Deputy Prime Minister and Finance Minister Ekniti Nitithanprapas, is slated to launch within four months. It is part of a broader push to boost household savings as the country ages and to steer a popular pastime toward long term financial security.

- A savings twist for a weekly habit

- How the lottery to savings conversion works

- Digital only, identity checks, and consumer protection

- How it differs from the retirement lottery under the National Savings Fund

- Why the government is doing this now

- Where the money comes from and how funds will be managed

- Public reaction and open issues

- International perspective and potential influence

- What to expect next

- Key Points

This conversion scheme will run alongside, and separate from, a new retirement lottery being set up under the National Savings Fund (NSF). The retirement lottery is a weekly draw where every ticket becomes savings that are returned at retirement age, win or lose. Together, the two initiatives aim to turn frequent lottery spending into a lasting cushion for old age without encouraging more gambling.

Officials say the conversion plan is legally and technologically ready. It will rely on the government’s Pao Tang digital platform so each purchase can be matched to a verified identity and credited to a saver’s account. The goal is simple: if a ticket fails to win a prize, a defined share of that outlay will not vanish. It will be preserved in a savings vehicle with rules similar to Thailand’s Retirement Mutual Fund framework.

How the lottery to savings conversion works

Under the new scheme, a portion of the price of non-winning digital lottery tickets will be automatically credited to an individual savings account. The money will sit in a fund that follows conservative investment rules. Withdrawals will be allowed from age 55, a familiar threshold for Thai savers who use Retirement Mutual Funds. The Ministry of Finance has signaled that safety and capital preservation will be the guiding principles.

The government plans to redirect resources from the lottery’s existing revenue split to support the savings credit. The share now allocated to the Government Lottery Office will help fund the transfer into savers’ accounts. This reallocates a slice of lottery economics from administration back to players in the form of long term savings.

What savers can access and when

Participants can begin withdrawals once they reach age 55. People aged 56 and above will be able to keep adding to the savings for another five years. The accumulated balance can be pledged as collateral for loans, a feature intended to unlock liquidity without forcing early redemption. That could help households smooth emergencies while keeping the retirement goal intact.

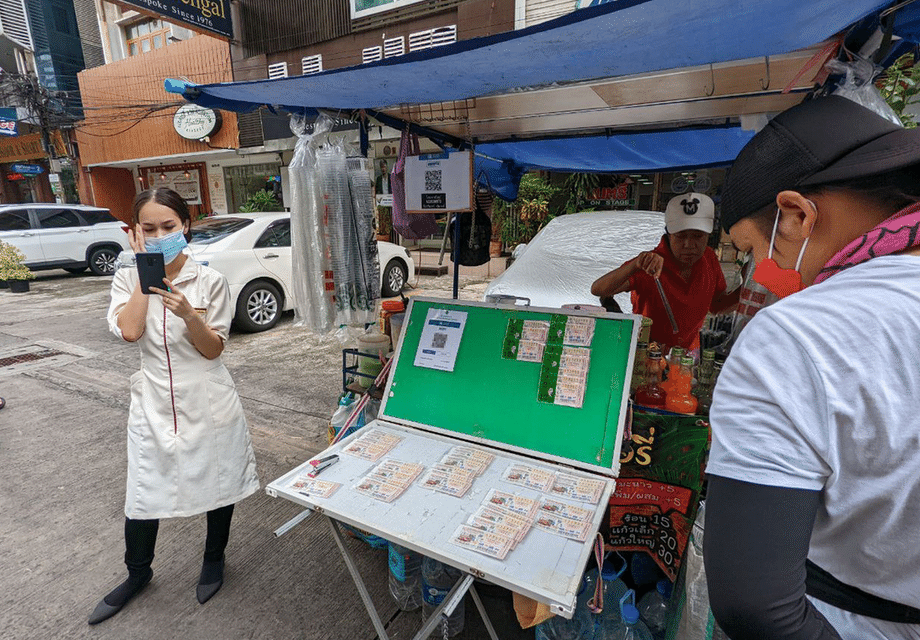

Authorities are clear that this is meant to promote thrift, not to stimulate gambling. The conversion applies only to digital tickets bought through Pao Tang, which enables accurate tracking, identity checks, and automated crediting of the right account. Paper tickets are outside the scope, at least at launch, because they cannot be reliably matched to a verified saver in real time.

Digital only, identity checks, and consumer protection

Pao Tang is the state-backed app used for government payments, welfare programs, and the sale of official digital lottery tickets. It ties purchases to a verified profile that includes a bank link. This infrastructure reduces fraud risk, simplifies reporting, and makes it possible to credit savings automatically when a ticket fails to win.

Limiting the scheme to digital purchases gives the government a clean transaction trail. It also supports consumer protection, since administrators can monitor unusual spending patterns and design guardrails if needed. Data privacy obligations still apply, and program rules are expected to set out how personal data are used, stored, and protected.

One trade off is that players who buy paper tickets do not receive the savings credit. Policymakers argue that the first phase must be digital to ensure accuracy and prevent abuse. Over time, more channels could be explored if validation issues can be solved without weakening protections.

How it differs from the retirement lottery under the National Savings Fund

The conversion of losing digital tickets is separate from the new retirement lottery being built into law under the National Savings Fund. In the retirement lottery, each ticket functions as savings from the start. Tickets are priced at 50 baht. Weekly draws are planned for Friday at 5 pm, with five top prizes of 1 million baht each and 10,000 second prizes of 1,000 baht each. Winnings will be transferred to bank accounts linked to PromptPay.

For those who do not win, every baht spent becomes savings at the NSF and will be returned with investment returns at age 60. Purchases are capped at 3,000 baht per person per month to ensure fairness and to limit concentration among wealthy buyers. People older than 60 can participate if they accept a ten year wait before accessing funds. Policymakers are also exploring limited early withdrawal options under ministerial regulations, such as partial access for medical needs.

Where the retirement lottery stands in the law

The Cabinet previously endorsed changes to the NSF law to authorize a retirement lottery. The House of Representatives has since passed the bill with overwhelming support. The measure now moves to the Senate and subsequent regulations. Officials have pointed to a rollout in the fourth quarter of this year if the final steps are completed on schedule. The NSF will publish operational details covering eligibility, prize distribution, and any early access criteria once the legal process is complete.

Why the government is doing this now

Thailand is grappling with a fast shift toward an older population and uneven household savings. Large numbers of workers move in and out of informal jobs that offer no pension. Many households rely on the state old age allowance and family support, which can be thin. At the same time, lottery play is deeply woven into daily life, and spending on both official and underground lotteries is widespread.

Officials want to capture a share of this regular spending and redirect it into savings that follow people into old age. The conversion of losing digital tickets acts as a nudge. Money that once disappeared becomes a growing pool that can supplement retirement income or serve as backup collateral in hard times. The retirement lottery takes that idea a step further by making every ticket a deposit from day one with a chance of a prize layered on top.

Deputy Finance Minister Paopoom Rojanasakul has framed the NSF retirement lottery in simple terms that reflect the policy intent.

It is structured saving, not gambling.

Finance officials, including Deputy Prime Minister Ekniti Nitithanprapas, say the new conversion scheme is a priority that can be delivered quickly because the digital ticketing and payment rails are in place. The design relies on existing platforms, prize allocation rules, and fund structures that the public already knows.

Where the money comes from and how funds will be managed

Thailand’s official lottery divides each ticket price among prizes, government revenue, and administrative costs. The government plans to draw support for the conversion from the portion currently set aside for the Government Lottery Office. That redirects part of the existing allocation into private savings accounts, a change meant to benefit players without altering the prize pool.

Investments will follow a conservative approach. Administrators have pointed to principles similar to Retirement Mutual Funds, which are long horizon products designed to preserve and prudently grow capital. A focus on safety means portfolios will lean toward bonds and high quality instruments rather than speculative assets. Oversight will fall under existing financial rules to protect savers.

The Ministry of Finance is also preparing a monthly government bond offering for elderly and retired citizens at a 1 percent coupon. The program provides a simple, safe option for people who want predictable income or a place to park cash without taking market risk. While a 1 percent return is modest, the instrument is easy to buy and integrates with the broader plan to strengthen retirement readiness.

Public reaction and open issues

The conversion scheme and the NSF retirement lottery promise several benefits. Savings will build automatically for millions who play the lottery. The option to use balances as collateral can help households facing cash flow stress without liquidating the account. A digital trail can also reduce fraud and allow targeted education about responsible spending.

There are trade offs. Limiting the conversion to digital tickets could sideline buyers who rely on paper. The digital divide may leave some rural or older players out unless outreach and assisted onboarding are robust. There is also a risk that attaching a savings feature to lottery play could normalize frequent purchases. Clear messaging, spending limits where appropriate, and responsible play warnings will be important to keep the focus on saving.

Lawmakers have raised technical questions during debate on the retirement lottery. Some want flexible early withdrawal rules for medical bills or other essential expenses. Others have asked for clarity on minimum returns or prize structures. Officials argue that conservative investment policies and a monthly purchase cap strike a balance between attractive features and risk control. Final regulations will determine how these elements are implemented in practice.

International perspective and potential influence

International institutions have taken interest in Thailand’s approach. By tapping a familiar habit and channeling it into formal savings, the country is testing a model that could fit other aging societies with low retirement coverage and high appetite for lotteries or similar games.

Following meetings with Thai officials, the World Bank praised the concept for using cultural habits to nudge long term saving at relatively low fiscal cost.

The retirement lottery is a remarkable innovation for boosting retirement savings.

Policy analysts see both schemes as experiments in behavioral finance. Success will depend on trust in the management of funds, a smooth user experience through Pao Tang, and timely communication about rights and rules. If people feel that their money is safe, easy to track, and available at retirement, participation is likely to grow. If execution falters, confidence will suffer.

What to expect next

In the coming four months, the Ministry of Finance plans to finalize rules for the conversion of losing digital tickets. That includes the exact crediting formula, withdrawal conditions, and the process for pledging balances as collateral. Updates to the Pao Tang app will be needed so users can see, track, and manage their balances in one place. Communications will emphasize that the program rewards saving, not gambling.

The NSF retirement lottery continues its path through the legislative process. If the Senate completes its review and the regulations are issued on time, a fourth quarter launch remains in view. The NSF will detail how weekly draws will be run, how refunds will be credited, and how early withdrawal exceptions will work. A public education campaign is expected so buyers understand that every ticket becomes savings and that winnings arrive by PromptPay without extra steps.

Key Points

- Thailand will convert a portion of spending on losing digital lottery tickets into retirement savings credited to individual accounts.

- Withdrawals from the conversion scheme will be available from age 55, with the option to keep saving for five more years.

- Balances may be used as collateral for loans, offering liquidity without breaking the savings plan.

- The program applies only to digital tickets purchased through the Pao Tang app to ensure traceability and accurate crediting.

- Funding support comes from the lottery revenue share currently allocated to the Government Lottery Office, with investments focused on safety.

- A separate NSF retirement lottery will sell 50 baht tickets with weekly draws, a 3,000 baht monthly cap, and full refunds at age 60 for non-winners.

- The House of Representatives has passed the NSF bill, which now awaits Senate review, with officials targeting a fourth quarter rollout.

- The Ministry of Finance plans a monthly 1 percent bond program for elderly and retired citizens as an extra safe investment option.

- Officials stress that the aim is to encourage thrift and reduce future insecurity, not to promote gambling.