Why young Thais are trading down

Young Thais enjoy shopping and small treats, yet many are stretching every baht. More than 70 percent of Gen Z shoppers in Thailand have switched to lower priced brands for food, drinks, and everyday items in recent months. The change is not a retreat from consumption. It is a careful recalibration of wants and needs as living costs bite, savings goals rise, and trust in marketing faces new tests.

- Why young Thais are trading down

- The consumer paradox steering the Thai market

- How Thai Gen Z shop today

- Where they splurge and where they save

- Constant connection, rising fatigue

- Trust, authenticity, and the quest for wow

- From awareness to checkout, closing the gap

- How Thailand fits in Asia and the world

- What brands can do now

- Key Points

Researchers describe a consumer paradox at the heart of this shift. Gen Z Thais still crave novelty, social connection, and experiences, yet they are highly price sensitive and increasingly methodical in how they decide what to buy. This tension is reshaping product mixes, pricing strategies, and digital engagement across categories from noodles and iced coffee to sunscreen and skincare devices. It is also exposing a costly weakness in the path to purchase, where interest often fails to convert to checkout.

The consumer paradox steering the Thai market

Four forces stand out in recent Thai consumer studies and are now visible across the retail economy:

- Desire to spend versus limited capacity: Gen Z shows strong appetite for food, beverages, personal care, and small luxuries, yet budgets are tight. More than 70 percent are trading down to cheaper brands, and nearly half of these young shoppers also say they want to save and invest for the future.

- Always connected, yet craving offline breaks: More than 90 percent of Thais are connected to the internet and social platforms most of the time. At the same time, 71 percent report technology fatigue and nearly 80 percent are considering ways to control data use. About 38 percent have sought real world activities for better mental health.

- Authenticity and value, plus a demand for wow: Over 80 percent worry about fake news online. This fuels a strong call for authenticity and trustworthiness from brands, with two out of three consumers citing authenticity and seven in ten citing trust. Honesty alone is not enough for this audience, since roughly 73 percent also want brands to be entertaining and memorable with eye catching moments that feel fresh.

- Health and wellness as a priority spend: Thais are prepared to pay extra for health and wellness. Younger Gen Z consumers focus on appearance and prevention, while many Baby Boomers say age is just a number and spend on products and experiences that extend an active lifestyle.

These tensions are rewriting playbooks across retail and media. Price remains critical, yet product proof, transparent labeling, and engaging content sit side by side with deal hunting. The winners are those that feel good value without feeling cheap, while still creating a bit of delight.

How Thai Gen Z shop today

Shopping is now research heavy, social, and mobile. Consumer intelligence tracking shows 86 percent of young Thai buyers research thoroughly before purchasing, well above regional averages. Three out of four rely on influencers or peers for advice, and more than four in ten shop directly through social platforms using creator links, in app checkouts, sponsored posts, or live streams. This audience often checks price comparison sites and apps, with roughly two thirds using these tools regularly. Seven in ten say they will switch brands for a better deal.

Daily rhythms also matter. Retailers in Thailand report a pronounced shop before bed pattern, with a spike in traffic around 9 PM when people unwind and scroll for personal purchases. Health and beauty items often sit at the top of wish lists, led by sunscreen searches and quick refresh products like lipstick. Bangkok generates the largest volume, yet secondary cities such as Nonthaburi, Chiang Mai, and Khon Kaen are gaining momentum. Across age groups, self care anchors this evening shopping window, linking value for money with routines that feel restorative.

Where they splurge and where they save

Trading down does not mean settling for less in every category. Young Thais are mixing premium picks in a few priority areas with cheaper alternatives elsewhere. Everyday essentials often shift to private labels or value brands, while select items that deliver visible results, comfort, or status keep their place in the basket.

Food, beverage, and small treats

Quick meals, iced coffee, and affordable treats remain popular, yet more Gen Z shoppers work within strict budgets for these categories. Smaller pack sizes, bundle deals, and flash promotions attract attention. Price transparency on delivery apps and supermarket platforms shapes choices. This is where brand switching is fastest if prices drift or if deals are poorly timed.

Beauty and personal care

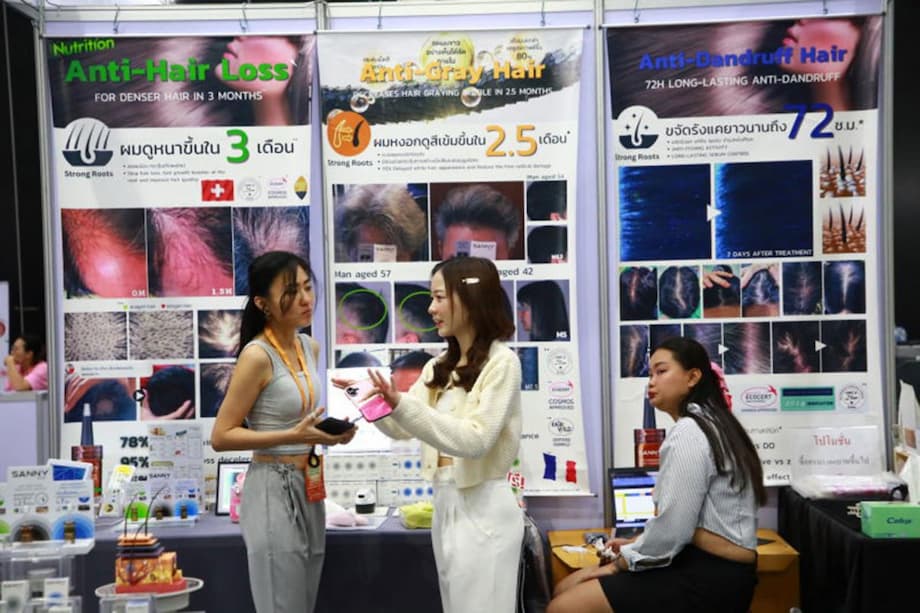

Skincare is a standout. Thai Gen Z values efficacy, ingredient transparency, and science backed claims. Many prefer minimalist routines that still deliver strong results, a style often called skinimalism. Cruelty free and vegan formulas gain ground. Packaging aesthetics matter less than clear ingredient stories and value, unless sustainable materials are part of the appeal. Preventative care is rising, from daily SPF to early anti aging steps, and interest in hair and scalp health is growing. Young consumers also show openness to non invasive professional treatments. Price sensitivity is high, but they will pay a premium for products that work and show proof fast.

Constant connection, rising fatigue

Thai consumers live online, yet fatigue is real. Most remain active on social platforms throughout the day for entertainment, community, and shopping. Many are pulling back at the same time, practicing screen limits, muting notifications, or favoring offline activities that support mental health. This push and pull shapes how content lands. Short, useful, and honest often beats long and glossy. Live shopping can feel energizing, yet only when hosts are credible and the presentation is clear on ingredients, prices, and delivery times.

Brands that help audiences connect in the real world, like pop up testing, meetups, or wellness classes, are seeing strong interest. These touchpoints can offset fatigue and make digital follow ups feel less intrusive.

Trust, authenticity, and the quest for wow

Trust is a scarce currency online. With many Thais worried about misinformation, brands must show their work. That can mean third party testing for skincare claims, signed pricing on food delivery menus, or transparent shipping costs on ecommerce listings. Certifications and clear sourcing details build credibility without fancy language. Simple, verifiable proof works best.

Audiences also want excitement. Short form videos, creator collabs, and limited runs can stand out, yet the hook should not feel like a trick. The best wow moments deliver something genuinely useful, funny, or beautiful while staying true to the product. Surprise plus substance is the combination that keeps buyers coming back.

From awareness to checkout, closing the gap

Even when awareness is high, conversion drops are steep. Studies across Thai industries show a 50 to 75 percent falloff as consumers move from consideration to purchase. The revenue at stake is large, with brands missing out on an estimated 35 to 55 percent of potential sales because interest fails to turn into orders or repeat business. Price friction, doubts about quality, slow delivery, and clunky checkouts are common culprits.

Practical fixes are more effective than splashy campaigns. Retailers and brands can remove friction and add confidence with steps like these:

- Publish clear, detailed product pages with ingredients, benefits, usage, and comparisons to help research heavy buyers decide.

- Offer price tiers, bundles, and time bound deals that reward commitment without hiding fees.

- Use loyalty programs with simple rewards and member only offers that feel achievable.

- Enable social and live shopping with real time answers, easy replays, and transparent inventory status.

- Show verified reviews, before and after photos where relevant, and links to certifications or lab results.

- Provide fast shipping options, clear return windows, and instant refunds on cancellations.

- Support flexible payment choices and installment options for higher ticket items.

How Thailand fits in Asia and the world

In regional comparisons, Thai Gen Z stands out for rigorous pre purchase research and a strong tendency to switch for better value. That mix of diligence and flexibility is already pushing retailers to publish better product information and to run smarter promotions. Across Asia, young consumers are also reshaping what luxury means. Many value experiences, well being, and community ties over flashy logos. Analysts describe this as a move toward low fidelity luxury, where authenticity, comfort, and meaning outrank status displays.

Travel and leisure habits underline the shift. Surveys of Asian Gen Z travelers show heavy reliance on TikTok and Instagram for trip ideas, more last minute bookings, and a preference for traveling with partners or friends. Budgets are often modest per person per night, yet interest in memorable experiences is high. Sustainability and wellness programs influence hotel choices, and local food scenes can make or break a destination. These patterns mirror shopping at home, where value, proof, and shareable moments carry more weight than old style prestige.

Globally, Gen Z spending power is on a fast climb. Research indicates the generation could account for trillions of dollars in annual spend by 2030. Health focused, clean label food, and science based beauty are growth hotspots. Brands that align with these values and price carefully for young wallets will benefit as incomes rise.

What brands can do now

Thai consumers are giving clear signals. They want value without gimmicks, proof instead of promises, and content that informs while it entertains. They are willing to switch, but also ready to reward brands that respect their time, their intelligence, and their budgets. Practical steps make the biggest difference: publish better product facts, simplify checkout, price in ways that feel fair, and build communities that are fun to be part of both online and offline.

For beauty and wellness, lean into transparent ingredients, credible testing, and routines that do more with less. For food and beverage, keep prices clear across delivery and in store, and use formats that stretch budgets without sacrificing taste. For fashion and lifestyle, help shoppers express identity at accessible price points, and tie products to experiences worth sharing.

Key Points

- More than 70 percent of Thai Gen Z have switched to cheaper brands for food, drinks, and daily items as budgets tighten.

- Four tensions shape behavior: spend desire versus limited capacity, constant connectivity versus tech fatigue, authenticity and value plus wow, and a strong tilt toward health and wellness.

- Thai Gen Z are heavy researchers, with 86 percent checking products thoroughly, 75 percent influenced by creators or peers, and many using price comparison tools.

- Shopping spikes around 9 PM, with health and beauty leading wish lists and sunscreen among the most searched items.

- Trust shortfalls drive demand for transparent ingredients, clear pricing, and verifiable claims, while entertaining content still matters.

- Conversion drop offs of 50 to 75 percent from consideration to purchase cost brands an estimated 35 to 55 percent in missed revenue.

- Simple fixes help: better product pages, fair price tiers and bundles, loyalty rewards, live shopping with real answers, verified reviews, fast shipping, and easy returns.

- Regionally, Thai Gen Z lead in research intensity and value seeking, while global trends point to rising Gen Z spending power and strong demand for health, clean label, and science backed products.