Why UOB is putting people at the center of AI

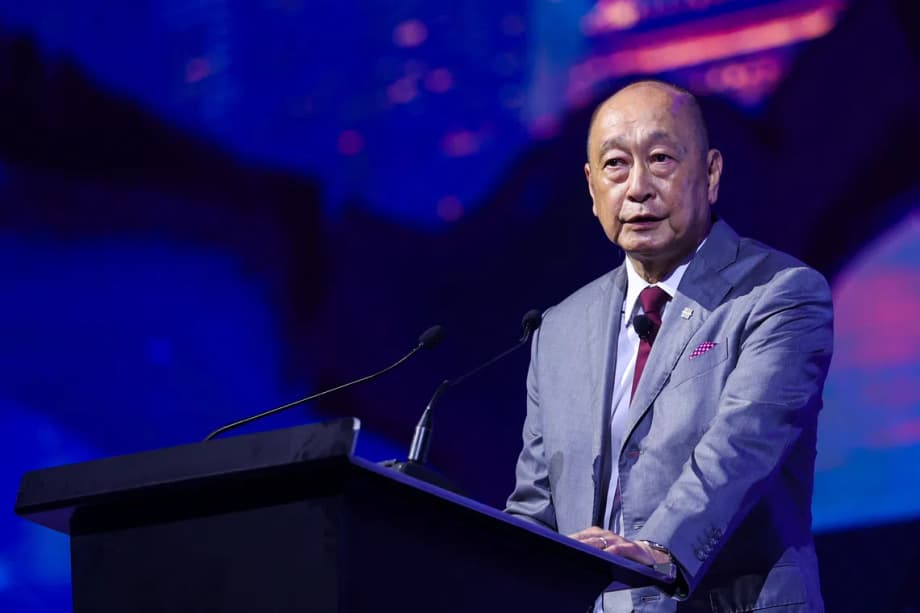

At the Singapore FinTech Festival 2025 in Singapore Expo on Nov 12, UOB deputy chairman and chief executive Wee Ee Cheong set a clear line on artificial intelligence in banking. He said AI should raise productivity and speed while keeping empathy, ethics and judgment at the heart of finance. The message, delivered as UOB steps up major partnerships and workforce training, aligns advanced data and automation with a simple principle: trust is a human asset that technology must support, not replace.

Wee framed AI as an accelerator for better advice and safer decisions. He said the goal is to give customers tailored insights and round the clock access to services, then spot risks earlier and manage them before they grow. He also highlighted tokenization and near instant settlement, the use of digital ledgers to represent assets and speed up the completion of trades, as tools that will link ASEAN markets more tightly to global capital and commerce.

That vision requires hard choices on security and standards. Wee stressed that reliability, data protection and resilience cannot be compromised as systems become more connected. He called for clearer common rules and technical compatibility to scale AI and blockchain in a safe way. He also pressed for industry collaboration on trusted digital identities and secure data networks so that banks and fintech firms can move fast without breaking confidence.

Behind the stage lines are concrete steps. UOB has created an academy to upskill its 32,000 employees in generative AI and automation. It has signed a memorandum of understanding with Workforce Singapore, the Institute of Banking and Finance and Ngee Ann Polytechnic to equip staff with foundational skills. The bank has also launched new graduate and mid career pathways into AI and data roles, and it has entered a new partnership with Accenture to apply AI across the bank in areas from operations to risk and customer experience.

What Wee Ee Cheong said on stage

Wee, who leads one of the largest banks in Southeast Asia, drew a line between what AI does well and what people must still do. He underscored that machines can process vast datasets and run at speed. Human advisors and leaders bring judgment, empathy and ethics. He cast leadership as a human responsibility, including the handover of roles to the next generation when the time comes.

Introducing his view on how AI should support people, Wee said:

AI should help people do more and work faster, rather than displacing them and their jobs.

He then pointed to the role of values and responsibility in leadership transitions, saying that succession and stewardship remain human decisions.

The baton is passed to people, not machines.

Wee also linked technology progress to trust. He stressed that trust is earned across years of fair decisions, prudent risk management and good service. That belief reflects a tradition at UOB shaped by his late father, Wee Cho Yaw, who led the bank for decades and was known for disciplined growth, community service and a focus on long term relationships. UOB’s current push to digitize services and raise AI capability sits within that culture. The goal is to strengthen, not erode, the human touch that defines the brand.

From vision to practice, how UOB plans to use AI

The bank has begun a multi year collaboration with Accenture to apply advanced AI across its businesses. The work will cover automation of internal processes, better credit and fraud risk models, and more personalized customer interactions at scale across ASEAN. Accenture is providing consulting support, technology assets such as its AI Refinery platform, and training access for UOB staff through its LearnVantage services. The focus is to build AI fluency in the workforce, not only to install new tools.

Julie Sweet, chair and chief executive of Accenture, welcomed the plan to scale use of generative and agentic AI and to bring staff along with it.

This partnership will help UOB realize its vision for the future of banking by scaling generative and agentic AI, and by helping their people develop valuable advanced technology skills.

Generative AI can draft content, summarize long texts, detect patterns in behavior and prepare data for analysis. In a bank, that can save staff hours on routine checks, speed up product design and help relationship managers prepare for meetings with tailored insights. Agentic AI goes a step further. It refers to AI systems that can plan tasks and take bounded actions through tools and application programming interfaces, under strict policy constraints and audit trails. In banking that might include preparing a loan application file, scheduling a payment, or monitoring a portfolio against preset risk alerts, then asking a human to approve the next step.

Wee also highlighted tokenization and near instant settlement, themes that are gaining traction in global finance. Tokenization uses distributed ledgers to represent ownership of assets in digital form, which can enable fractional ownership and programmable workflows. Near instant settlement reduces the time between a trade and final completion, which can lower counterparty risk and free up capital. For customers and businesses transacting across ASEAN and beyond, shorter settlement cycles and intelligent workflows can improve cash flow and reduce friction. The vision is a connected region where a business in Jakarta can sell to a buyer in Bangkok and settle almost immediately, with embedded compliance checks and real time risk screening behind the scenes.

Upskilling a 32,000 strong workforce

The human element in UOB’s plan is expansive. The bank has set up an internal academy for AI upskilling and signed an MoU with Workforce Singapore, the Institute of Banking and Finance and Ngee Ann Polytechnic to provide foundational courses in generative AI and automation. The aim is to give every employee a baseline understanding of how the technology works, where it is useful and how to use it responsibly. That approach reflects an assumption that AI will be present in daily tasks for most banking roles, from branch operations to technology and product teams.

The Better U Pivot programme is the clearest sign of how that translates to jobs. Up to 500 employees in operations and administrative roles are being selected over two years for a structured switch into areas with rising demand such as risk and compliance, sales and customer experience. Participants go through a 12 month curriculum with on the job training, external courses and intensive mentorship by hiring managers and coaches. The bank picks candidates whose current roles may be affected by automation, then gives them a clear pathway into sustainable roles with future growth. A pilot started in 2021 saw employees move successfully into new positions such as anti financial crime operations analysts.

UOB has also launched an Artificial Intelligence and Data Analytics Centre of Excellence with the Infocomm Media Development Authority and the National University of Singapore. The two year programme plans to take in 100 university graduates over three years. Participants join UOB in a full time role and spend the first year on business projects with training and mentorship from senior data practitioners, then move into specialized tracks within business units in year two. Graduates receive certifiable AI skills and a university credential that can be credited toward advanced study. Speaking at UOB’s employee festival, Singapore’s Manpower Minister Tan See Leng set the context for this approach.

Business transformation must go hand in hand with workforce transformation.

Alongside these initiatives, the Accenture collaboration brings staff access to the LearnVantage training library so employees can build data and AI fluency at pace. The idea is to pair new tools with people who know how to use them, then keep learning cycles continuous as the technology evolves.

Security, standards and trust

Wee cautioned that the pursuit of speed and personalization cannot come at the expense of safety. He called for clarity on regulations, standards and system compatibility to support scaling AI, data sharing and blockchain based solutions. Banks will still have to explain models, test for bias, track provenance of data and outputs, and keep humans in the loop where decisions affect customers. That aligns with ongoing work in Singapore to set practical guardrails for AI in finance, encourage strong model governance and strengthen cross border data protections.

Trusted digital identity and secure networks are another priority. Singapore has already invested in secure identity and payment rails, and the industry continues to harden defenses against scams. Sector groups have introduced safeguards such as face verification for high risk actions and timed cognitive breaks during transactions. Industry efforts helped prevent more than S$74 million in potential scam losses in 2024. That level of vigilance will need to rise as banks introduce AI driven experiences and connect more systems across markets.

What agentic AI means for banking

Agentic AI describes systems that can break a goal into steps, use tools to act and monitor results against rules. In a bank, an agent might scan transaction data overnight for anomalies, draft a fraud alert with context, file the case in a workflow system and notify a human analyst to review. Another agent might prepare a small business loan renewal pack by retrieving financials, updating cash flow estimates and proposing credit terms within policy. The promise is speed with control. The safety net is clear scope, human approvals at the right points, audit trails and stress testing so the system behaves predictably in real conditions.

What customers across ASEAN can expect

UOB operates across 19 markets and serves millions of consumers and businesses in ASEAN. If the strategy lands as described, customers should see faster turnaround times, more proactive advice and easier cross border payments and investing. A relationship manager in Kuala Lumpur could pull up analytics that flag a clients upcoming cash flow strain and propose steps before it bites. A retailer expanding from Singapore into Vietnam could open accounts, receive local currency payments and pool funds with fewer delays. For individual customers, digital assistants can answer questions at any hour and pass complex cases to people who can help.

UOB’s expansion into digital services in recent years, including a mobile only experience targeted at younger customers, shows how the bank has been blending traditional strengths in relationship banking with new channels. The current AI roadmap extends that direction. The bank says technology should raise productivity without compromising security, reliability or ethics. It also says the human touch is irreplaceable. That mix of speed, safety and service will decide whether AI makes finance more inclusive across a diverse region with many languages, regulations and stages of development.

Key Points

- UOB CEO Wee Ee Cheong told Singapore FinTech Festival 2025 that AI must augment people, not replace them.

- Wee said empathy, ethics and judgment remain human strengths, and leadership succession belongs to people.

- The bank is applying AI to deliver personalization, round the clock services and earlier risk detection.

- UOB is working with Accenture for three years to apply generative and agentic AI across the bank and to train staff.

- An internal academy and an MoU with Workforce Singapore, IBF and Ngee Ann Polytechnic aim to raise foundational AI skills for staff.

- The Better U Pivot programme will reskill up to 500 employees into roles such as risk, compliance, sales and customer experience.

- An AI and Data Analytics Centre of Excellence with IMDA and NUS will take in 100 graduates over three years on a paid two year track.

- Wee called for clear regulations, common standards and secure digital identity to scale AI and blockchain safely.

- Industry anti scam measures prevented more than S$74 million in potential scam losses in 2024, a sign of the focus on trust and safety.