The Global Memory Shortage Reshaping the Tech Industry

Memory chips function as the fuel lines feeding the engines of modern computing. As artificial intelligence engines made by companies like Nvidia become more powerful, they require increasingly more memory, both traditional types and an advanced form known as high-bandwidth memory, or HBM. This surge in demand has created a severe global shortage that is rippling through the entire technology supply chain, from data centers to consumer electronics.

- The Global Memory Shortage Reshaping the Tech Industry

- The Rise of China’s DRAM Challenger

- A Multi-Billion Dollar Bet on Future Growth

- The High-Bandwidth Memory Race

- Global OEMs Forced to Adapt

- Geopolitical Headwinds and Trade Restrictions

- Trade Secret Allegations and Legal Battles

- China’s Broader Semiconductor Strategy

- What the Future Holds for Global Memory Markets

- The Path Forward

- Key Points

A single AI server now consumes more dynamic random-access memory, or DRAM, than entire fleets of laptops. According to research firm TrendForce, the price of conventional DRAM is forecast to surge more than 50% this quarter compared with the previous quarter. This unprecedented demand from AI data centers is grabbing chip capacity that would otherwise serve makers of computers, videogame consoles, and smartphones, driving up prices for American consumers and creating opportunities for new players to enter the market.

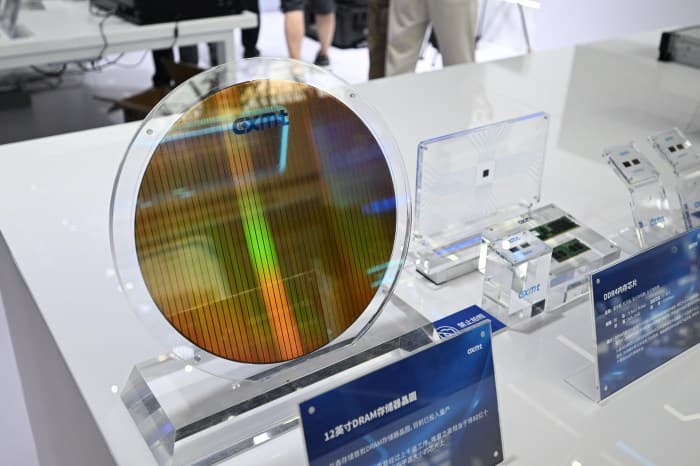

Into this volatile environment steps ChangXin Memory Technologies, known as CXMT, China’s national champion in memory-chip manufacturing. The company is preparing a $4 billion share offering after making significant technical advances, attempting to upend an industry long dominated by South Korean and U.S. companies. This development represents one of the biggest chip maker offerings this century and comes at a critical moment for the global semiconductor landscape.

The Rise of China’s DRAM Challenger

Founded in 2016 and headquartered in Hefei, CXMT has rapidly grown into China’s largest DRAM producer through a combination of government backing and strategic technology acquisition. The company initially built its foundation by acquiring patents from Qimonda, a defunct German memory chipmaker, giving it a starting point for development. By production volume, CXMT has already become the world’s fourth-largest DRAM manufacturer, supplying memory for everything from smartphones and PCs to servers used by major Chinese tech firms.

CXMT’s market share reached 4.1% in the first quarter of 2025, with projections from research firm TrendForce suggesting this could rise to between 7% and 10% by 2027. The company nearly doubled its revenue year-over-year in 2025 and expects to swing back into profitability, largely thanks to the rebound in DRAM pricing driven by AI infrastructure, cloud providers, and device manufacturers all competing for a finite supply of memory chips.

This rapid ascent has not gone unnoticed by established industry leaders. South Korea’s Samsung Electronics and SK Hynix, along with U.S.-based Micron Technology, have controlled the global memory market for years. The emergence of a serious Chinese competitor threatens to disrupt this delicate balance, especially as CXMT receives substantial support from Beijing’s industrial policy aimed at achieving semiconductor self-sufficiency.

A Multi-Billion Dollar Bet on Future Growth

CXMT is accelerating its entry into the domestic capital market with plans to raise approximately $4.2 billion through an initial public offering on Shanghai’s STAR Market. The company officially initiated the IPO process in July by registering for “listing guidance” with the China Securities Regulatory Commission, or CSRC. Analysts expect the offering could be completed as early as this year, making it one of the largest domestic semiconductor flotations in years.

The company has appointed China International Capital Corporation, or CICC, and CITIC Securities as lead underwriters for the offering. In its latest funding round, CXMT was reportedly valued at 140 billion yuan, approximately $19 billion. This substantial valuation reflects investor confidence in the company’s growth trajectory and the strategic importance of memory technology in the AI era.

The capital raised from this IPO will fund several critical initiatives. CXMT plans to expand wafer capacity, modernize fabrication lines, and invest heavily in next-generation DRAM development. The company’s pitch to investors emphasizes its role in strengthening China’s push for semiconductor independence, particularly in advanced DRAM and AI-oriented memory technologies where the country currently relies on foreign suppliers.

Analysts view this IPO as a key step toward China achieving independence in AI memory manufacturing. As U.S. export restrictions tighten, Chinese AI chip developers face growing difficulties securing advanced DRAM and HBM components. Major Chinese tech companies like Huawei, Alibaba, and Baidu are designing their own AI accelerators, but sourcing the accompanying high-end memory remains a major challenge that CXMT aims to address.

From Legacy Products to Cutting-Edge Technology

While CXMT initially focused on legacy products such as DDR4 memory, the company has recently shifted its efforts toward developing DDR5 and high-bandwidth memory technologies. This transition reflects both market realities and strategic priorities. Legacy DDR4 continues to power many consumer devices, but the margins are lower and the growth potential is limited. The real opportunity—and the real challenge—lies in advanced memory products that power AI systems.

Industry trackers describe CXMT as positioning Mobile DRAM as its core product, with plans to continue leading in global year-over-year growth of output bits through 2026. This focus aligns neatly with the needs of Chinese smartphone brands and PC makers seeking a domestic memory source, while also giving CXMT a foothold in export markets where cost-sensitive devices are proliferating.

The High-Bandwidth Memory Race

High-bandwidth memory has become the critical component for training large language models and running advanced AI applications. Unlike traditional DRAM, HBM stacks memory chips vertically to save space and reduce power consumption while dramatically increasing bandwidth. This architecture makes it ideal for processing the massive amounts of data generated by complex AI applications.

The global HBM market is currently dominated by three companies: South Korea’s SK Hynix, which until recently was the sole HBM supplier to AI chip giant Nvidia, Samsung, and to a lesser extent U.S. firm Micron Technology. All three manufacture the latest standard HBM3 chips and are working to bring fifth-generation HBM, or HBM3E, to customers this year. SK Hynix alone predicts the HBM market will grow about 30% every year between 2025 and 2030.

CXMT has entered this race from behind but is progressing faster than many expected. The company has begun mass production of HBM2, placing it roughly three generations behind market leaders. However, the latest sources suggest Chinese memory makers have improved their HBM technology faster than previously projected. CXMT is reportedly working on HBM3 and planning for mass production in 2026, with HBM3E targeted for 2027. If achieved, this would narrow the gap between CXMT and HBM leaders to about three to four years.

An industry insider commented on the strategic importance of this development: “As the AI semiconductor market grows, the importance of HBM and server DRAM has surged. That’s why expectations for CXMT—the largest DRAM producer in China—are rising. Due to U.S. restrictions, China’s AI ambitions are being constrained by the shortage of high-end memory chips, prompting companies like CXMT and YMTC to intensify R&D in HBM and other advanced AI memory solutions.”

Global OEMs Forced to Adapt

The memory shortage has created real consequences for companies beyond the AI sector. HP, one of the world’s largest personal computer manufacturers, has reportedly been forced to turn to Chinese memory makers over the DRAM supply shortage. Barron’s analyst Tae Kim noted that HP is struggling to obtain supply from traditional vendors like Micron and Samsung, leading the company to consider adding Chinese memory suppliers to its list of component sources.

HP is reportedly looking to ship “limited” products into Asia and Europe using Chinese memory. This development marks a significant shift, as it represents the first time a major Western PC manufacturer has actively considered sourcing memory from Chinese suppliers out of necessity rather than choice. The situation underscores how severe the memory shortage has become and how it’s reshaping supply chain decisions across the technology industry.

Memory chips are commodities that can be easily replaced, unlike the proprietary AI chips made by Nvidia. However, companies considering Chinese suppliers must navigate U.S. regulations on sourcing semiconductors from China. Given the current memory supply situation and insatiable demand, analysts believe new regulations may be put in place around seeking supply from Chinese memory makers, creating additional uncertainty for global OEMs.

Geopolitical Headwinds and Trade Restrictions

Despite its technical progress and ambitious growth plans, CXMT faces significant geopolitical obstacles. Successive U.S. administrations have tightened curbs on Chinese chip makers, and in December 2024, the U.S. released new export control packages specifically targeting Chinese access to high-bandwidth memory and various types of semiconductor manufacturing equipment, including tools essential for HBM manufacturing and packaging.

These new rules added over 140 Chinese chip manufacturers and chip toolmakers to the Commerce Department’s Entity List, effectively barring them from accessing American technology. The restrictions were designed to further constrain China’s AI development by leveraging the chokepoint on HBM, which is ultimately controlled by three companies worldwide—SK Hynix, Samsung, and Micron.

The export controls have immediate operational consequences. Although CXMT reportedly stockpiled enough semiconductor manufacturing equipment for HBM and DRAM production—likely sufficient to sustain operations through 2026 or 2027—the existing restrictions will limit its ability to develop and scale advanced DRAM and HBM production in the coming years. The December export controls restricted equipment critical to HBM manufacturing and packaging processes, including tools for through-silicon via, etching, and related steps.

Perhaps more damaging, maintenance personnel from U.S. semiconductor equipment firms embedded at CXMT have been instructed to leave the company amid the tightening restrictions. This loss of expertise and support will affect the company’s development in DRAM and HBM, potentially slowing its technological advancement at a critical moment.

The Technology Gap Challenge

From a technical standpoint, CXMT faces significant hurdles in catching up to global leaders. The company is currently able to manufacture DRAM at the D1y and D1z nodes, technologies that fall in the 17 nanometer to 13 nanometer range. These nodes are used in HBM2E and HBM3 generations. While CXMT’s R&D team is likely developing sub-15 nanometer DRAM nodes, specifically the D1α and D1β nodes, which are essential for HBM3E, the company will likely face major challenges without Extreme Ultraviolet Lithography, or EUV.

EUV has become essential for the development of cutting-edge DRAM and HBM for major memory manufacturers. Without access to this technology, CXMT could face challenges similar to those encountered by Semiconductor Manufacturing International Corporation, or SMIC, in recent years—struggling to improve yield, die size, and scale production. This choke point could continue to be the key roadblock for CXMT’s pursuit of cutting-edge DRAM and HBM.

Trade Secret Allegations and Legal Battles

Beyond technical and geopolitical challenges, CXMT faces legal headwinds in its pursuit of market share. Prosecutors in South Korea, home to memory-chip leaders Samsung Electronics and SK Hynix, are alleging that some of CXMT’s rise comes from theft of trade secrets obtained from former Samsung employees.

South Korean prosecutors have indicted multiple former Samsung employees over allegations that proprietary DRAM process technology was leaked to CXMT. Samsung has indicated these claims are tied to CXMT’s recent progress at advanced nodes like 10 nanometers. The situation highlights how difficult and resource-intensive cutting-edge memory development really is, raising questions about whether CXMT’s rapid technological advancement came entirely through legitimate means.

“Whether through legitimate R&D or contested technology transfer, moving the needle on modern DRAM production is slow, expensive, and heavily constrained, which means even aggressive expansion plans don’t guarantee rapid gains in usable supply,” noted an industry analyst covering the memory market.

These allegations add another layer of complexity to CXMT’s international ambitions. Even if the company resolves the legal issues, the reputational damage could make global customers hesitant to source memory from CXMT, particularly those in Western markets concerned about intellectual property protection and supply chain security.

China’s Broader Semiconductor Strategy

CXMT is not operating in isolation but represents a key component of China’s broader strategy to achieve semiconductor self-sufficiency. The company is part of a tandem approach with Yangtze Memory Technologies, which focuses on NAND flash memory while CXMT concentrates on DRAM. Together, these companies form the core of Beijing’s coordinated push to build a self-sufficient memory stack that can still compete abroad.

Yangtze Memory Technologies, often shortened to YMTC, has already rocketed to a 13% shipment share in NAND Flash, with capacity expansion and technology gains underpinning a target of 15% global shipment share in 2026. The company is moving ahead with a third chipmaking fab in Wuhan, a project that mirrors Beijing’s appetite for high-risk, high-capex investment to boost domestic semiconductor output. This combination of market share, new fabs, and sanctions-resistant tooling suggests Chinese memory firms are not just surviving pressure from Washington but using it as a forcing function to accelerate domestic capability.

Both YMTC and CXMT are looking to equity markets to cement their challenge to the incumbents. Yangtze Memory Technologies is considering an initial public offering in mainland China, while CXMT pursues its $4.2 billion listing in Shanghai. These IPOs signal that Beijing wants its memory champions to be capitalized enough to keep pace with the capex cycles of Samsung and SK hynix, which invest billions annually in new fabrication facilities and technology development.

What the Future Holds for Global Memory Markets

CXMT’s expansion comes at a time when the global memory market is undergoing a fundamental transformation. Traditional cyclical patterns of surplus and shortage are being disrupted by structural changes in demand patterns. AI workloads continue to soak up enormous amounts of memory, and not just high-end HBM but also conventional DRAM for servers, storage systems, and supporting infrastructure.

Large customers are increasingly locking in long-term supply contracts, which reduces the amount of memory that ever reaches the open market. This means CXMT’s expansion may help stabilize things in the medium term, but it’s unlikely to provide immediate relief for PC builders or consumers wondering why DDR5 prices remain elevated. The company’s expansion could actually make things worse in the near term, as companies like CXMT ramp up and compete for the same fabrication equipment, materials, and engineering talent as Samsung, Micron, and SK hynix.

The result is what the market is already seeing: higher prices, longer lead times, and fewer options at the low end of the market. Industry observers predict the memory supply crisis could run into 2028 and beyond, as new fabrication facilities from major players like SK Hynix and Micron won’t come online until late 2027 at the earliest.

The Path Forward

Despite these challenges, CXMT’s emergence as a serious competitor represents a significant development in the global semiconductor industry. The company’s rapid technological progress—narrowing the gap with global leaders from an estimated six to eight years to just three to four years—demonstrates the effectiveness of China’s state-backed approach to technology development.

For CXMT, the immediate priority is successfully executing its IPO and using the proceeds to fund its expansion plans. The company must also navigate the complex legal and regulatory landscape, including potential additions to the U.S. Entity List that would further restrict its access to global markets and technology. Longer term, CXMT must demonstrate it can consistently refresh its product lineup generation after generation, matching the aggressive pace of companies like SK Hynix, which are launching HBM4 this year and planning HBM4E.

The implications for the global memory market are profound. If CXMT succeeds in scaling production efficiently, it could eventually help absorb some of the demand growth that’s currently pushing prices upward. It also adds another serious player to a market that’s been dominated by three companies for years, which is generally healthy for competition. However, the geopolitical overlay means this story will play out against a backdrop of trade tensions, export controls, and strategic competition between the United States and China.

For consumers and businesses, the takeaway is mixed. Relief from high memory prices is unlikely in the immediate future, but the long-term supply picture is at least moving in the right direction. Whether that translates into cheaper RAM on store shelves depends on how quickly global production can catch up to an industry that’s suddenly very hungry for memory, and whether geopolitical tensions continue to fragment what has traditionally been a global market.

Key Points

- CXMT is preparing a $4.2 billion IPO on Shanghai’s STAR Market to fund expansion and technology development.

- The company has grown to become the world’s fourth-largest DRAM manufacturer with 4.1% market share in Q1 2025.

- Global DRAM prices are forecast to surge more than 50% this quarter due to AI-driven demand.

- CXMT aims to produce HBM3 in 2026 and HBM3E in 2027, narrowing the gap with global leaders to 3-4 years.

- HP has reportedly turned to Chinese memory suppliers due to DRAM shortages from traditional vendors.

- U.S. export controls restrict CXMT’s access to advanced manufacturing equipment and have removed maintenance personnel from its facilities.

- South Korean prosecutors have indicted former Samsung employees over alleged trade secret theft benefiting CXMT.

- CXMT plans to use IPO proceeds to expand wafer capacity and develop next-generation memory technologies.