A two day crackdown disrupts a major cigarette supply line

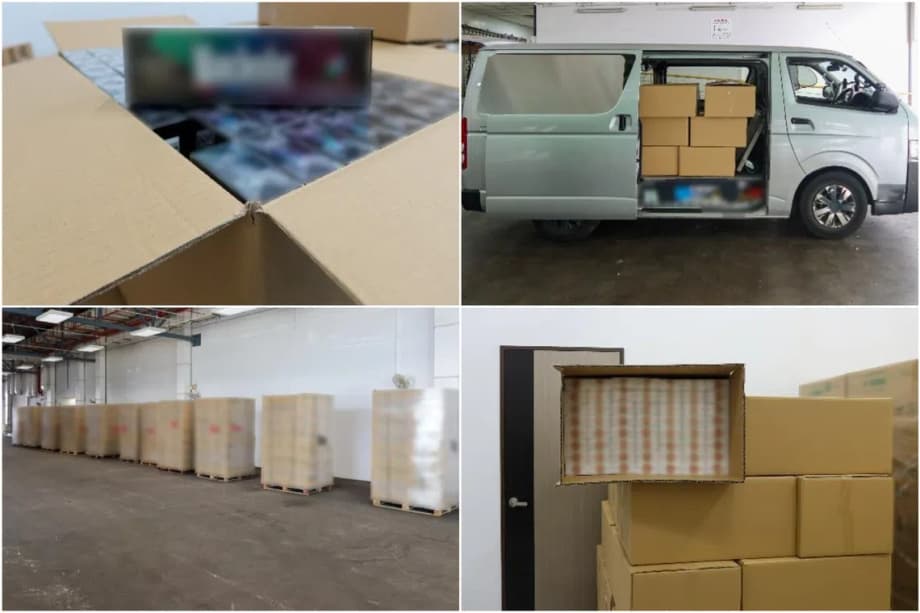

Singapore Customs seized 17,279 cartons of duty unpaid cigarettes in two operations on Nov 30 and Dec 1, the largest inland seizure reported in 2025. The haul represented more than S$1.87 million in unpaid duty and Goods and Services Tax, according to the agency. Four men were arrested and a van was seized after officers moved on an industrial unit in Pandan Loop, then a warehouse along Jurong Port Road the next day. Inland operations target smuggling networks that have already moved illicit goods past checkpoints and into storage or distribution sites across the island.

- A two day crackdown disrupts a major cigarette supply line

- How officers traced the stash from a van to a warehouse

- What duty unpaid cigarettes are and why they carry heavy penalties

- Laws and penalties at a glance

- A year of constant pressure on cigarette smugglers

- Borders, technology and teamwork

- What drives the black market and its cost to society

- What the public can do

- Key Points

At Pandan Loop on Nov 30, officers observed a Singapore registered van reversing into a loading bay as three men loaded brown boxes into the cargo area. Checks uncovered 2,400 cartons of duty unpaid cigarettes in the van. Questioning led officers to a unit in the same building, where another 3,195 cartons were found. Officers seized all 5,595 cartons together with the van.

One 27 year old Singaporean driver and three Indian nationals aged 30, 36 and 39 were arrested in connection with the Pandan Loop operation. Based on leads gathered, a follow up raid on Dec 1 at a warehouse along Jurong Port Road uncovered an additional 11,684 cartons. Court proceedings are ongoing against all four men.

These operations point to a supply chain that used local industrial spaces for storage and onward distribution. By acting in quick succession, officers disrupted both a loading operation and a larger warehouse stash, a pattern consistent with efforts to break syndicates into smaller vulnerable links.

How officers traced the stash from a van to a warehouse

Inland investigations often begin with surveillance and risk profiling, then move quickly once officers see movements that match known smuggling patterns. Raids are timed to secure the people, the contraband and any supporting records at once.

The Pandan Loop raid

The van in Pandan Loop became the entry point. The cargo of brown boxes hid cigarette cartons that did not carry any proof of duty payment. Industrial units are a frequent choice as they provide space, vehicle access and a stream of legitimate activity that can mask illicit loading or packing.

The Jurong Port Road warehouse

Information gleaned from the first raid led officers to a warehouse that held more than twice the volume seized on day one. The second search recovered 11,684 cartons, cementing the case as a record inland haul this year. The move from a vehicle to a warehouse in a single day shows how one lead can unlock a bigger cache when teams move with speed.

What duty unpaid cigarettes are and why they carry heavy penalties

Tobacco products in Singapore are subject to excise duty and GST. Duty is a tax on specific goods such as cigarettes and alcohol. GST is a broad tax on consumption. If a cigarette pack is imported or sold without the required duty and GST paid, it is duty unpaid. The law treats this as a serious offence because it undercuts tax policy, reduces health protections and deprives the public purse of revenue.

Singapore uses high tobacco taxes and strict controls to curb smoking. The minimum legal age to buy tobacco is 21. Retail sales require licences. Packaging rules mandate plain packs with health warnings. Alternative tobacco and nicotine products such as e cigarettes, vaporisers, shisha and chewing tobacco are banned. Smuggled cigarettes bypass these controls. They tend to be cheaper, they do not carry the warnings required, and they can contain unknown contents with no oversight.

How to tell if a pack is legal

Legal cigarettes carry the Singapore Duty Paid Cigarette mark, often referred to as the SDPC mark, on each stick. Packs sold through licensed retailers are priced consistently and display local health warnings. A pack without the SDPC mark or with unfamiliar branding, poor print quality or unusually low price is suspect. Buying, storing or transporting such items is illegal even if the quantity seems small.

Laws and penalties at a glance

Under the Customs Act and the GST Act, buying, selling, conveying, delivering, storing, keeping, possessing or dealing in duty unpaid goods are offences. Courts can impose a fine up to 40 times the amount of duty and GST evaded, jail of up to six years, or both. Vehicles used to carry contraband are liable to forfeiture. For repeat offenders, sentences can be higher within the statutory range in line with the value and scale of the case. The four men arrested in the two recent raids face court proceedings.

A year of constant pressure on cigarette smugglers

The latest case caps a year of frequent enforcement actions. In January, officers seized 4,228 cartons of duty unpaid cigarettes during an operation at Petir Road in Bukit Panjang. Two Singaporeans, a man and a woman both 29, were arrested, and two vans were seized. Officers found cartons in one van and used a key found inside to open a second nearby vehicle with a larger load. Items related to drugs were also found and referred to the Central Narcotics Bureau.

In mid November, officers moved on a heavy vehicle carpark at Pasir Laba. Four Malaysian men were arrested, and 3,100 cartons were seized. Three vehicles were taken into custody, including a prime mover with a bowser attached, a truck and a motorcycle. Part of the stash was hidden in a forested area where the cigarettes were being packed into boxes, and the group allegedly deployed lookouts to check the area.

Border checks remain a frontline. In March, officers at Woodlands Checkpoint arrested a 31 year old Malaysian motorcyclist after 570 packets of duty unpaid cigarettes were found hidden in compartments on his bike. Checkpoint teams use imaging to detect anomalies in cargo and vehicles, then conduct physical searches to confirm what scans suggest. Many cases are referred to Singapore Customs for investigation and prosecution.

Borders, technology and teamwork

Singapore Customs and the Immigration and Checkpoints Authority work in tandem across the supply chain. ICA secures the borders at land, sea and air checkpoints. Singapore Customs investigates inland, builds cases, and prosecutes offenders. Both agencies share intelligence and use technology such as scans, risk engines and mobile x ray systems to spot concealment in cargo, containers and vehicles.

Smuggling groups change tactics, shifting routes, hiding cigarettes among legitimate goods, and using short term storage in industrial estates to break shipments into smaller loads for delivery. Enforcement teams respond with flexible deployments, covert surveillance and quick follow through on leads. The record inland seizure over two days shows how coordinated action can dismantle multiple links at once.

What drives the black market and its cost to society

Price differences across borders create an incentive for smugglers. Illicit suppliers source cigarettes from lower tax environments, move them through multiple hands, and sell them in Singapore at prices that undercut lawful retail. The margin grows when taxes are unpaid. Demand exists because some smokers seek cheaper options, and criminals seek stable income through repeat sales.

Illicit tobacco harms more than tax revenue. It weakens public health measures that rely on price to deter smoking, and it exposes buyers to unregulated products. Retailers who follow the law face unfair competition. Government agencies must devote resources to investigations, storage and disposal of seized goods, and court proceedings. Those who buy or transport these goods risk arrest, fines and jail.

What the public can do

Avoid buying or carrying cigarettes without the SDPC mark, do not keep large quantities for others, and do not agree to deliver unknown parcels. If an offer seems too cheap, it probably involves duty unpaid goods. Members of the public who see suspected smuggling or sales of illegal cigarettes can report it to the authorities. Guidance and contact points are available on the Singapore Customs website at customs.gov.sg.

Travelers with tobacco products must declare them and pay duties and GST. This can be done through digital services, including the Customs@SG web application via the eServices portal. The authorities also advise the public to be wary of scams. Government officers do not ask for bank details or payments through unsolicited calls or messages.

Key Points

- Singapore Customs seized 17,279 cartons of duty unpaid cigarettes in two inland raids on Nov 30 and Dec 1.

- The unpaid duty and GST involved are valued at more than S$1.87 million.

- Four men were arrested, including a 27 year old Singaporean and three Indian nationals aged 30, 36 and 39.

- Raids took place at an industrial building in Pandan Loop and a warehouse along Jurong Port Road.

- Officers seized a van and recovered 5,595 cartons on day one and 11,684 cartons on day two.

- Dealing in duty unpaid goods carries fines up to 40 times the unpaid duty and GST, jail of up to six years, or both. Vehicles used are subject to forfeiture.

- Other 2025 cases include a 4,228 carton seizure at Petir Road and a 3,100 carton seizure at Pasir Laba, with arrests and multiple vehicles seized.

- ICA and Singapore Customs collaborate at borders and inland, using scans, risk engines and surveillance to counter smuggling.

- Legal cigarettes carry the SDPC mark, and many tobacco alternatives such as e cigarettes and shisha are banned in Singapore.

- The public can report suspected smuggling and should avoid buying, keeping or moving duty unpaid cigarettes.