A $13 Million Renovation Project

The Grand Emperor Hotel in Macau has undertaken one of the most unusual asset liquidations in modern hospitality history, physically dismantling its signature lobby feature to capitalize on record precious metal prices. The Hong Kong listed parent company, Emperor Entertainment Hotel Ltd, announced in a February 4 regulatory filing that it had sold 79 kilograms of gold bricks that formed a glittering pathway through the hotel entrance for nearly two decades, generating approximately $12.8 million in gross proceeds.

- A $13 Million Renovation Project

- The Golden Pathway: Architecture as Marketing Strategy

- Market Timing: Geopolitical Turmoil and Precious Metals

- Macau’s Economic Transition: Beyond the Casino Floor

- Corporate Financial Pressures and Strategic Relief

- The Transaction Details and Future Renovation

- What to Know

The transaction represents a remarkable return on the company’s original investment nearly 20 years ago. According to financial details disclosed by the firm, the gold bricks were initially purchased for approximately HK$9.4 million ($1.2 million) when the luxury property opened in 2006. The recent sale to Heraeus Metals Hong Kong Ltd, a subsidiary of the German precious metals conglomerate Heraeus Holding GmbH, yielded HK$99.7 million, creating a gain of roughly HK$90.2 million ($11.5 million) after accounting for transaction costs of approximately HK$100,000.

The Golden Pathway: Architecture as Marketing Strategy

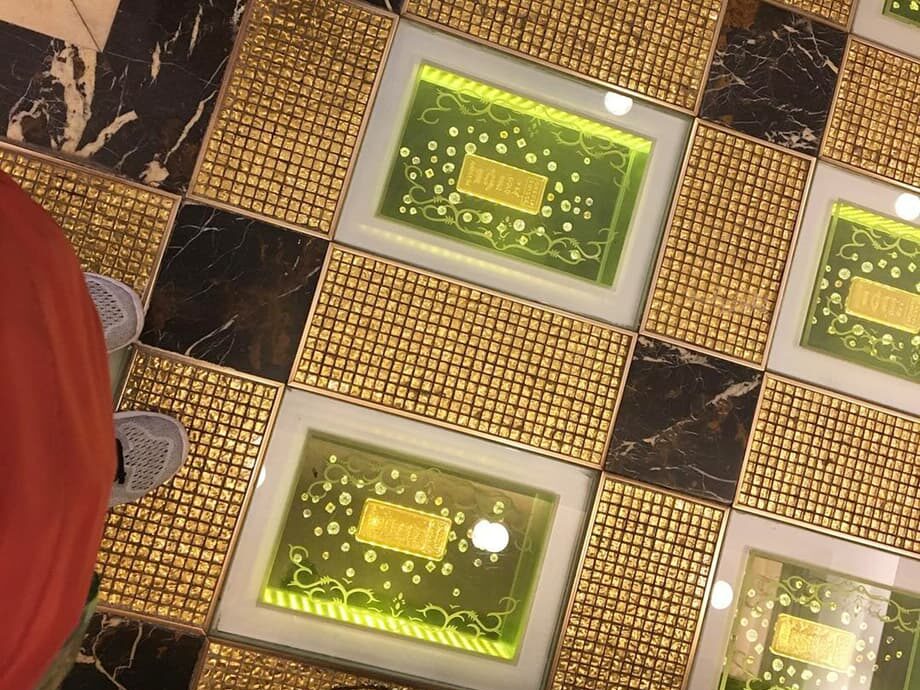

When the Grand Emperor Hotel welcomed its first guests in 2006, it sought to distinguish itself within Macau’s competitive luxury hospitality market through overt displays of tangible wealth. The property’s most distinctive architectural feature became known as the “Golden Pathway,” a corridor paved with 78 Swiss 999.9 fine gold bricks, each weighing precisely one kilogram and bearing individual identification numbers, all protected beneath secure glazing.

This installation served dual purposes as both interior design and marketing strategy. Emperor Entertainment Hotel stated in its regulatory disclosure that the bullion was intended to “create a sumptuous and resplendent atmosphere for brand building in the casino.” For over two decades, the feature attracted substantial foot traffic and became a local curiosity, helping position the property as a benchmark for European style luxury in the former Portuguese colony.

The hotel complemented its golden floor with other architectural flourishes emphasizing aristocratic opulence. An antique gold carriage displayed on the property, which the hotel’s website notes “exhibits the fine craftsmanship of 18th century Europe,” reinforced the aesthetic that defined Macau’s casino boom years. The gold bricks specifically covered the major passageway area of the lobby floor, creating what the company described as a “sumptuous atmosphere” designed to impress arriving guests.

Market Timing: Geopolitical Turmoil and Precious Metals

The decision to liquidate the lobby assets comes amid unprecedented volatility in global gold markets. Precious metal prices reached record highs in late January 2026, touching just over $5,600 per troy ounce in both futures and over the counter markets before settling slightly lower. The surge has been driven by institutional and retail investors seeking safe haven assets during periods of intense geopolitical instability.

Market analysts attribute much of the recent price appreciation to unpredictable trade policies and fluctuating tariff structures implemented during the early months of Donald Trump’s second presidential term in the United States. When macroeconomic conditions become uncertain, investors traditionally flock to gold because it tends to retain value better than fiat currency or equity markets during periods of turbulence. The metal functions as a store of value that transcends national currencies and remains unaffected by inflationary pressures that erode cash holdings.

In its official filing to the Hong Kong Stock Exchange, Emperor Entertainment Hotel Ltd explained the rationale behind the sale, stating that the timing allowed the company to capitalize on elevated commodity prices while reducing operational costs.

“In light of the prevailing market conditions and the market price of the Precious Metal currently at a high level, the Directors are of the view that the Disposal represents a good opportunity for the Group to realise and unlock the value of the Precious Metal whilst enabling the Group to save security and insurance expenses associated with the Precious Metal in the future.”

Macau’s Economic Transition: Beyond the Casino Floor

The dismantling of the Golden Pathway reflects broader structural changes transforming Macau’s economy. The territory, a Special Administrative Region of China since its handover from Portuguese control in 1999, remains the only location in China where casino gambling is legal. This unique status propelled Macau to become the world’s largest gambling market by revenue in 2025, surpassing Las Vegas and other global gaming centers despite covering just 13 square miles (33 square kilometers) of land area.

However, Beijing has increasingly pressured the territory to diversify its economic base beyond gaming dependency. This policy shift has triggered significant regulatory changes, including the systematic phasing out of “satellite casinos.” These venues operated under the gaming licenses of major concessionaires but were physically located within separate hotel properties, creating a complex regulatory structure that authorities sought to simplify. The Grand Emperor’s casino, which formerly operated under SJM Holdings Ltd’s gaming license, ceased operations on October 30, 2025, months ahead of the final regulatory deadline.

This closure fundamentally altered the hotel’s business model and rendered its interior design choices obsolete. As the company explained in its filing, “Following the cessation of its gaming operation, the Group has been actively planning for other entertainment and amusement facilities to enhance its overall hospitality experience and broaden the revenue base.” The gold bricks, originally selected to project casino luxury and create a “sumptuous atmosphere,” no longer aligned with the property’s planned repositioning toward general hospitality and family friendly entertainment.

Macau’s government has mandated that casino operators focus increasingly on non gaming attractions, including convention facilities, fine dining, retail, and cultural entertainment. This directive aims to transform Macau from a gambling focused destination into a broader tourism and leisure hub comparable to Las Vegas or Singapore, reducing its vulnerability to fluctuations in high roller gambling volumes and regulatory crackdowns.

Corporate Financial Pressures and Strategic Relief

Beyond favorable commodity prices, the sale addresses acute financial pressures facing Emperor Entertainment Hotel and its controlling shareholder, Hong Kong entertainment tycoon Albert Yeung. The hospitality group reported a net loss of HK$57.4 million for the six months ended September 30, 2025, representing a narrowing from previous losses but continuing a trend of negative profitability. The company had recorded a full year loss of HK$248 million ($31.7 million) in the previous fiscal period.

The company’s struggles mirror broader difficulties within Yeung’s business empire. Emperor International Holdings, a real estate development firm also controlled by Yeung, has recorded losses for six consecutive years totaling HK$13.8 billion ($1.8 billion). The real estate arm suffered a single year loss of HK$4.7 billion ($600 million) in the 12 months ended March 31, 2025, and has defaulted on HK$16.6 billion in bank loans according to recent financial disclosures.

The gold sale provides immediate liquidity without the complications of real estate transactions or equity financing dilution. Emperor Entertainment Hotel stated explicitly that “the net proceeds will strengthen the Group’s financial position and enable it to invest should suitable investment opportunities arise.” The transaction transforms a decorative asset that generated no revenue and required significant security protocols into liquid capital that can fund the hotel’s renovation or reduce debt burdens.

The Transaction Details and Future Renovation

The physical removal of the gold bricks occurred on January 29, 2026, sparking social media speculation and online debate before the official announcement clarified the situation. The vendor, Right Achieve Ltd, operates as a British Virgin Islands incorporated entity indirectly owned by Emperor Entertainment Hotel, a common corporate structure for Hong Kong listed firms with overseas assets.

Heraeus Metals Hong Kong Ltd, the purchaser, operates as part of one of the world’s largest precious metals refining and trading conglomerates. Based in Hanau, Germany, Heraeus Holding GmbH maintains extensive operations across global bullion markets, making it a natural buyer for such a specialized physical asset. The transaction involves the complete transfer of 78 individual gold bars, each composed of Swiss 999.9 fine gold with individual identification numbers.

The hotel’s lobby area is now scheduled for comprehensive renovation and reconfiguration to support its transition toward non gaming entertainment facilities. The company indicated that “given that the relevant area is planned to undergo renovation and redevelopment, the Precious Metal that were originally part of the hotel’s interior design and outfits are no longer relevant to the theme of the hotel in the future.” This renovation represents the physical manifestation of Macau’s broader economic transition, as properties that once competed for high rolling gamblers now seek to attract families, business travelers, and cultural tourists.

What to Know

- Emperor Entertainment Hotel Ltd sold 79 kilograms of gold bricks from the Grand Emperor Hotel lobby for approximately $12.8 million, generating an $11.5 million profit on an original 2006 investment of $1.2 million

- The sale to German refiner Heraeus capitalizes on record high gold prices driven by geopolitical uncertainty and trade tariff volatility

- The Grand Emperor closed its casino operations in October 2025 due to Macau’s regulatory phase out of satellite casinos, prompting a strategic pivot toward general hospitality and entertainment

- The “Golden Pathway” feature had adorned the hotel entrance for nearly two decades, attracting tourists and reinforcing the property’s luxury branding

- Proceeds will strengthen the parent company’s finances, which reported losses of HK$57.4 million in the first half of 2025, and eliminate security costs associated with the bullion display