The Semiconductor Industry at a Crossroads: AI, 5G, and Unprecedented Growth

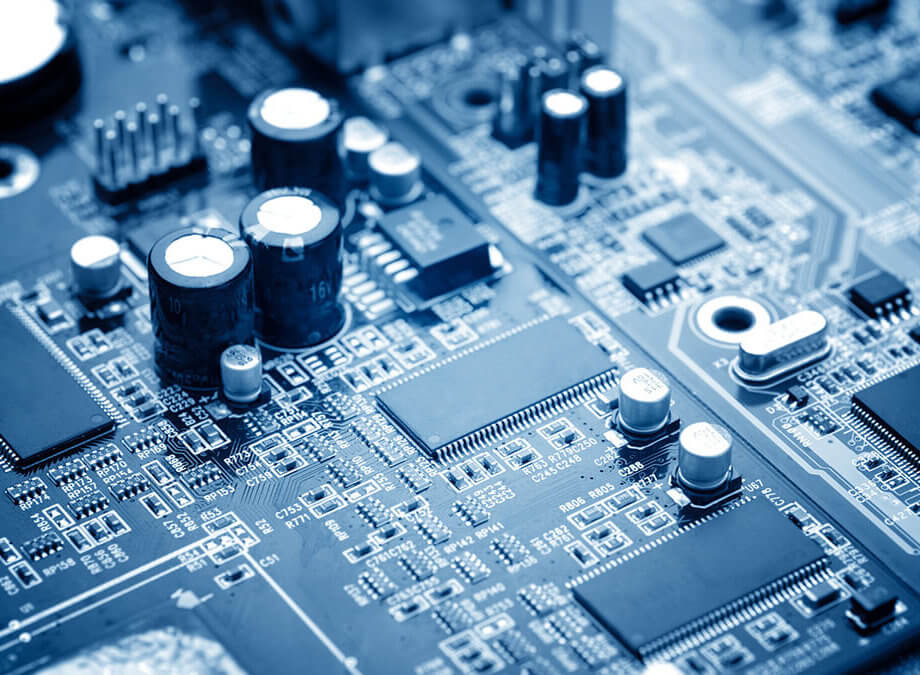

The global semiconductor industry is experiencing a transformative era, driven by the explosive growth of artificial intelligence (AI), 5G networks, and a host of emerging technologies. As chips become the backbone of everything from smartphones and electric vehicles to cloud computing and military systems, the stakes for innovation, supply chain resilience, and geopolitical strategy have never been higher. Industry forecasts predict the semiconductor market will surpass $1 trillion by 2030, with AI and 5G as primary catalysts. Yet, this rapid expansion brings with it a complex web of challenges, including supply-demand imbalances, talent shortages, and intensifying geopolitical rivalries.

- The Semiconductor Industry at a Crossroads: AI, 5G, and Unprecedented Growth

- What’s Fueling the Semiconductor Boom?

- Industry Leaders and the Race for Technological Supremacy

- Geopolitics and the Semiconductor Supply Chain: A High-Stakes Game

- Supply Chain Vulnerabilities and the Push for Resilience

- Technological Innovation: Pushing the Boundaries of Physics

- Sustainability and Security: The New Imperatives

- India’s Emergence as a Semiconductor Powerhouse

- Challenges Ahead: Talent, Costs, and the Pace of Change

- In Summary

What’s Fueling the Semiconductor Boom?

At the heart of the semiconductor surge is the insatiable demand for advanced chips capable of powering next-generation technologies. AI, particularly generative AI (Gen AI), is a major driver, requiring high-performance chips for data centers, edge computing, and consumer devices. The rollout of 5G networks, the proliferation of Internet of Things (IoT) devices, and the rise of electric and autonomous vehicles are further amplifying the need for more powerful, efficient, and specialized semiconductors.

According to industry research, the semiconductor market is projected to reach approximately $697 billion in 2025, marking an 11% year-over-year increase. This momentum is expected to continue, with the market on track to hit $1 trillion by 2030, growing at a compound annual growth rate (CAGR) of 7–9%. The electronics and semiconductor materials market, which supplies the essential building blocks for chip fabrication, is also set to expand, reaching nearly $120 billion by 2034.

Key demand drivers include:

- AI and Gen AI: The adoption of AI in data centers, cloud computing, and consumer electronics is fueling demand for custom chips, neural processing units (NPUs), and high-performance graphics processing units (GPUs).

- 5G Networks: The global rollout of 5G is creating a surge in demand for chips that enable faster, more reliable wireless communication.

- IoT and Edge Computing: Billions of connected devices require efficient, low-power chips for real-time data processing.

- Automotive Transformation: Electric vehicles (EVs) and advanced driver-assistance systems (ADAS) are increasing the need for specialized automotive semiconductors.

Industry Leaders and the Race for Technological Supremacy

The semiconductor industry is dominated by a handful of key players, each contributing unique strengths and facing distinct challenges. Companies like Taiwan Semiconductor Manufacturing Company (TSMC), Samsung, Nvidia, Intel, and ASML are at the forefront of innovation and production.

- TSMC: As the world’s largest contract chipmaker, TSMC holds a dominant 62% market share in the foundry sector and is responsible for producing 92% of the world’s most advanced chips. Its clients include Nvidia, Apple, and Broadcom. TSMC is investing heavily in global expansion, with new facilities in Japan, Germany, and the United States, aiming to enhance supply chain flexibility and meet regional demand.

- Nvidia: Renowned for its GPUs, Nvidia has become the leader in AI chips, commanding 70–90% of the AI chip market. The company’s rapid growth is reflected in its soaring profits and market capitalization, but it remains reliant on TSMC for manufacturing.

- Samsung: While a major player in memory and logic chips, Samsung has faced setbacks in its foundry business, including delays in production schedules and challenges in separating its design and manufacturing units to build customer trust.

- Intel: Once the undisputed leader, Intel is investing billions to reclaim its edge, including new advanced packaging plants and R&D centers.

- ASML: The Dutch company is the sole supplier of extreme ultraviolet (EUV) lithography equipment, a critical technology for producing cutting-edge chips.

Other notable players include Broadcom, which has seen its shares rise over 120% thanks to AI offerings, and China’s SMIC, which, despite export restrictions, has emerged as the third-largest foundry by revenue.

Geopolitics and the Semiconductor Supply Chain: A High-Stakes Game

Semiconductors are not just commercial products—they are strategic assets central to national security and economic growth. This reality has placed the industry at the center of a fierce rivalry between the United States and China, with both nations vying for technological supremacy.

The U.S. has implemented stringent export controls on advanced chips and manufacturing equipment to limit China’s access to cutting-edge technology. In response, China is investing aggressively in domestic semiconductor capabilities, with initiatives like the “Made in China 2025” roadmap and a $47.5 billion state investment fund. The U.S. has countered with the CHIPS and Science Act, providing billions in incentives for domestic manufacturing and R&D. Recent funding announcements include:

- $8.5 billion for Intel to expand U.S. chip production

- $6.6 billion in direct funding and $5 billion in loans to TSMC for a new Arizona facility

- $6.4 billion for Samsung to expand its Texas operations

Europe and India are also ramping up efforts to become key players. The European Chips Act aims to double the EU’s share of global chip production, while India’s “Semicon India” program and related incentives are attracting major investments from global firms and fostering a burgeoning domestic ecosystem.

Supply Chain Vulnerabilities and the Push for Resilience

The COVID-19 pandemic, natural disasters, and geopolitical tensions have exposed the fragility of the global semiconductor supply chain. The industry’s heavy reliance on a few geographic hubs—primarily Taiwan, South Korea, and the U.S.—means that disruptions can have far-reaching consequences. For example, a 7.4-magnitude earthquake in Taiwan in April 2024 temporarily halted production at TSMC, underscoring the risks of geographic concentration.

To mitigate these vulnerabilities, companies and governments are pursuing strategies such as:

- Decentralization: Building new fabrication facilities in the U.S., Europe, India, and Japan to reduce dependence on any single region.

- Domestic Sourcing and Nearshoring: Increasing domestic sourcing from 40% to 47% and nearshoring by 4% over the next two years.

- Supply Chain Innovation: Leveraging AI and machine learning to optimize production, improve yield rates, and enhance supply chain management.

Despite these efforts, only two in five semiconductor firms express confidence in their supply chain’s robustness. The supply-demand gap remains a pressing issue, with downstream organizations expecting demand to rise 29% by 2026—twice the rate anticipated by manufacturers.

Technological Innovation: Pushing the Boundaries of Physics

Meeting the surging demand for advanced chips requires continuous innovation in materials, design, and manufacturing processes. The industry is investing heavily in R&D, with budgets expected to increase by 10% over the next two years. Key areas of innovation include:

- Advanced Packaging and 3D Integration: Techniques like chiplet integration and 3D stacking are enabling higher performance and efficiency.

- New Materials: Silicon carbide (SiC), gallium nitride (GaN), and other advanced materials are being adopted for high-performance and power-efficient chips.

- Extreme Ultraviolet (EUV) Lithography: This technology allows for the production of chips with smaller process nodes, increasing transistor density and performance.

- AI-Driven Design and Manufacturing: AI is being used to accelerate chip design, optimize manufacturing, and discover new materials.

TSMC, for example, is on track to begin volume production of its 2-nanometer process, with next-generation nanosheet-based processes aimed at high-performance computing applications. Nvidia, meanwhile, continues to push the envelope in AI chip design, while Intel and Samsung are investing in advanced packaging and R&D to stay competitive.

Sustainability and Security: The New Imperatives

As the industry grows, so does its environmental footprint. Semiconductor fabrication is energy- and water-intensive, prompting companies to adopt green manufacturing practices. TSMC and Intel, for instance, have committed to carbon neutrality, investing in renewable energy, water recycling, and pollution prevention.

Security is another top priority. With the supply chain’s complexity and interdependence, protecting intellectual property (IP) and ensuring chip integrity are critical. Nearly three in five semiconductor design organizations are prioritizing cryptographic protections, and downstream industries are increasingly demanding chips with robust cybersecurity features.

India’s Emergence as a Semiconductor Powerhouse

India is rapidly positioning itself as a key player in the global semiconductor ecosystem. Backed by government initiatives like the India Semiconductor Mission and a $10 billion incentive package, the country is attracting major investments from global firms such as NXP Semiconductors, Analog Devices, and Micron Technology. India’s strengths include a large pool of chip design engineers, a growing electronics manufacturing base, and progressive state-level policies.

India’s semiconductor market was valued at $52 billion in 2024 and is expected to double by 2030. The government’s focus on innovation, R&D, and skill development is positioning India as a natural partner for companies seeking resilient and diversified supply chains. Notable projects and policy frameworks across states like Gujarat, Karnataka, and Tamil Nadu are further accelerating the country’s rise in the global semiconductor hierarchy.

Challenges Ahead: Talent, Costs, and the Pace of Change

Despite the industry’s robust growth, significant challenges remain. Talent shortages are intensifying, with the need to add over a million skilled workers by 2030. The high cost of building and maintaining advanced fabrication facilities—often exceeding billions of dollars—limits participation to a handful of major players, raising concerns about industry consolidation and reduced competition.

Technological complexity is also increasing, as companies push the boundaries of Moore’s Law and explore new computing paradigms like quantum and neuromorphic chips. The industry must balance the need for rapid innovation with sustainability, security, and supply chain resilience.

In Summary

- The global semiconductor industry is on track to surpass $1 trillion by 2030, driven by AI, 5G, IoT, and automotive transformation.

- Key players like TSMC, Nvidia, Samsung, Intel, and ASML are investing heavily in innovation, global expansion, and supply chain resilience.

- Geopolitical tensions, particularly between the U.S. and China, are reshaping the industry through export controls, domestic investment, and strategic alliances.

- Supply chain vulnerabilities exposed by the pandemic and natural disasters are prompting decentralization and increased domestic sourcing.

- Technological innovation in materials, packaging, and AI-driven design is critical to meeting surging demand and advancing chip performance.

- Sustainability and security are becoming central to industry strategy, with companies adopting green manufacturing and robust cybersecurity measures.

- India is emerging as a significant player, leveraging policy support, talent, and investment to build a resilient semiconductor ecosystem.

- Challenges such as talent shortages, high costs, and technological complexity remain, but the industry’s trajectory points to continued growth and transformation.