The 54-Day Transformation

China’s automotive industry has undergone a dramatic financial restructuring as major carmakers slash payment cycles to suppliers from nearly a year to less than two months. The China Association of Automobile Manufacturers (CAAM) revealed in a February 2026 study that 17 leading vehicle manufacturers now take an average of just 54 days to settle accounts with supply-chain vendors, with four companies achieving payment terms under 50 days. This marks a stunning reversal from the previous three years, when major assemblers routinely extended payment periods to approximately 300 days, effectively using their suppliers as a source of interest-free financing.

The payment revolution follows intense regulatory pressure from Beijing, which implemented new rules on June 1, 2025, requiring large companies to settle most supplier payments within 60 days. The State Council’s revised Regulations on Ensuring Payments to Small and Medium-sized Enterprises, combined with an industry-wide crackdown on what officials term “disorderly” competition, has forced automakers to abandon practices that had pushed many component makers to the brink of collapse.

Chen Jinzhu, chief executive officer of consultancy Shanghai Mingliang Auto Service, noted that government intervention has proven effective where market forces failed. The automotive groups faced severe punishment if they failed to comply with authorities’ requirements. Without delayed payments to suppliers, these manufacturers will no longer have sufficient cash on hand to sustain the aggressive discount wars that have ravaged profit margins across the sector.

The Price War That Broke the Supply Chain

The brutal competition in China’s auto market, which industry participants describe using the Chinese term “neijuan” or “involution,” has created a self-defeating cycle of excessive rivalry yielding little progress. What began as a strategy to promote electric vehicle adoption has devolved into a bloodbath involving over 100 domestic car companies fighting for survival in a market suffering from massive overcapacity. Factory utilization rates have plummeted to just 49.5%, with 3.5 million unsold vehicles sitting in inventory.

In May 2024, BYD, the world’s largest electric vehicle manufacturer, escalated the conflict by cutting prices by up to 34% across 22 models. Competitors including Geely, Chery, and SAIC-GM were forced to follow suit, triggering a race to the bottom that has decimated industry profitability. Average profit margins for automotive companies fell from nearly 8% in 2017 to just 4.3% in 2024, dropping further to 3.9% in the first quarter of 2025.

This environment created immense pressure on the supply chain. Automakers demanded annual price reductions of at least 10% from component suppliers while simultaneously delaying payments for months. The China Iron and Steel Association published a stark warning that steel companies were struggling with minimal profit margins and mounting liquidity pressure as carmakers requested price cuts exceeding 10% and delayed payments indefinitely. Suppliers became involuntary bankers, with some manufacturers like BYD taking an average of 275 days to pay vendors in 2023, according to financial analysis.

Beijing’s Anti-Involution Campaign

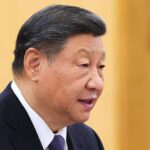

The Chinese government has launched a comprehensive campaign against the destructive competition, with President Xi Jinping personally calling for cracking down on chaotic, cut-throat price wars among companies in a Communist Party magazine article. The Ministry of Industry and Information Technology summoned the chief executives of over a dozen major automakers including BYD, Geely, and Xiaomi to Beijing in mid-2025, delivering a clear message: no selling below cost, no inappropriate price cuts, and fair treatment of suppliers.

The regulatory response has been swift and multifaceted. Beyond the 60-day payment rule, the State Administration for Market Regulation issued final guidelines in February 2026 that effectively ban automakers from selling vehicles below their total cost of production, including administrative, financial and sales overheads. This broad definition closes loopholes that allowed companies to claim they were profitable on a per-unit basis while operating at a loss overall. The regulations also outlaw price-fixing between automakers and suppliers, and prohibit brands from forcing dealerships into money-losing sales through punitive rebate programs.

Wei Jianjun, founder and chairman of Great Wall Motor, issued a dire warning that drew parallels to China’s property sector collapse. He stated publicly that the automotive industry already has its own version of Evergrande, the bankrupt real estate giant that crashed in 2021 with $300 billion in debt, though he declined to name specific companies. BYD responded by threatening legal action against anyone comparing the company to Evergrande, defending its 70% debt ratio as comparable to global manufacturers like Ford and Toyota.

Supplier Relief and Remaining Concerns

For the thousands of small and medium-sized enterprises that comprise China’s automotive supply chain, the payment reforms represent a lifeline. Fourteen of the 17 surveyed companies have introduced additional preferential measures for SME suppliers, with two enterprises now paying entirely in cash rather than using commercial paper, and five allowing financially constrained suppliers to apply for early payment. Several companies have earmarked special funds totaling more than 10 billion yuan to improve supplier payment arrangements.

However, challenges remain. Industry experts note that carmakers can still exploit differences in defining when the 60-day countdown begins, with some using delivery acceptance dates while others wait for centralized reconciliation or invoice confirmation. Yang Hongze, chairman of Autolink, a supplier of intelligent vehicle technologies, welcomed the pledges but requested clarity on whether payments would be made in cash or commercial paper, and what exactly constitutes the starting date for payment terms.

Commercial paper has been a particularly contentious issue. This financial instrument, which promises payment on a future fixed date, has been commonly used in China’s property sector because it is not categorized as interest-bearing debt. Suppliers sometimes sell this paper before maturity at a discount in the secondary market, effectively reducing their actual payment. BAIC and SAIC specifically vowed not to pay suppliers with commercial paper, though it remains unclear how extensively they had previously used this practice.

Industry Consolidation and Casualties

The payment reforms arrive as the Chinese auto market enters what analysts call the knockout rounds of consolidation. Of the roughly 169 automakers operating in China, more than half hold less than 0.1% market share, an unsustainable position. Bank of America analysts expect a bloodbath this year, with CAAM predicting that only five to seven dominant brands will survive the shakeout.

The human cost of this consolidation is already visible. Ji Yue, an electric vehicle startup founded in 2021 as a joint venture between internet giant Baidu and automaker Geely, collapsed within six months of appearing successful. Li Hongxing, who runs a social media ad agency, borrowed money to cover advertising costs for Ji Yue based on the company’s apparent efficiency and deep-pocketed backers, only to find himself saddled with 40 million yuan in debt when the company failed. He described the experience as sheer despair, noting that for a large company backed by two major shareholders to suddenly collapse was simply unforeseeable.

The auto industry’s travails reflect broader economic pressures. With passenger car sales falling 19.5% in January 2026, the fastest pace in almost two years, and new-energy vehicle sales dropping 20%, manufacturers are struggling with weakening domestic demand. The cut in tax exemptions for EV purchases and uncertainty over trade-in subsidies have exacerbated the downturn. At the same time, the industry employs more than 4.8 million people, creating a dilemma for policymakers who want to eliminate overcapacity without triggering mass unemployment and social instability.

Global Repercussions

As domestic competition becomes increasingly untenable, Chinese automakers are accelerating their push into international markets, with 20% of vehicles manufactured in China now destined for export, an 11% increase from the previous year. This flood of low-priced vehicles has prompted defensive measures abroad, including 100% tariffs in Canada, anti-subsidy duties in the European Union, and restrictions in other markets. Even with tariffs of 45%, a BYD Seal that costs 12,500 euros in China would retail for approximately 18,125 euros in Europe, roughly half the price of a comparable Tesla Model 3.

Chinese officials worry that the price war is damaging the reputation of Made in China products globally. State media has warned that cheap cars could hurt Chinese exports, while the government has tightened EV export rules by requiring licenses for carmakers to ship overseas starting in 2026. The goal is to rein in the practice of flooding foreign markets with low-priced vehicles that sometimes suffer from quality compromises forced by excessive cost cutting.

He Xiaopeng, founder and chief executive officer of Xpeng, predicts the industry turmoil will continue for another five years, leaving likely only five major players standing. Chetan Ahya, chief Asia economist at Morgan Stanley, notes that tackling oversupply will be more difficult in the auto sector than in state-dominated industries because of the larger presence of private enterprises, making consolidation more complex. Structural reforms are needed to fundamentally address the overcapacity that lies at the root of the payment and pricing crises.

The Essentials

- Chinese carmakers reduced average supplier payment cycles from approximately 300 days to 54 days, with four companies achieving under 50 days

- Seventeen major manufacturers including BYD, Chery, SAIC, and Xiaomi complied with new government regulations requiring payment within 60 days

- Beijing implemented the rules as part of an anti-involution campaign against disorderly price wars that have cut industry profit margins to below 4%

- New regulations also ban sales below total production cost and prohibit price-fixing between automakers and suppliers

- Industry analysts expect consolidation from roughly 170 brands down to 5-7 survivors, with knock-out rounds lasting approximately five more years

- Chinese auto exports continue rising despite domestic troubles, prompting tariff responses from Europe, North America, and other markets