The Critical Shift in Power Bottlenecks

Johor has reached a critical point in its transformation into Southeast Asia’s digital infrastructure hub. Industry watchers confirm that the region’s primary obstacle has shifted dramatically from power generation capacity to grid delivery infrastructure, creating a time to power crisis that determines which projects advance and which falter. According to a report by Area Market Intelligence, Johor rejected up to 30 percent of new data center applications in 2024, a striking figure that signals a fundamental change in market dynamics.

- The Critical Shift in Power Bottlenecks

- Global Demand Outpaces Infrastructure Reality

- Singapore Constraints Fuel Johor Expansion

- Technical Constraints Behind Connection Delays

- Water Resources and Community Resistance

- Geopolitical Pressures Complicate Development

- Alternative Power Strategies Emerge

- The Bottom Line

The consequences of this bottleneck extend far beyond administrative delays. Projects are now being determined not by investment capital or land availability, but by connection timelines to an electrical grid struggling to match the explosive pace of digital infrastructure deployment. The rejections stem from misaligned utility timelines, unclear responsibility for substation infrastructure, and planning issues identified only in late stages of development. For an industry accustomed to rapid scaling, this represents a structural barrier that threatens to constrain the region’s growth trajectory.

Global Demand Outpaces Infrastructure Reality

Johor’s struggles reflect a worldwide pattern as artificial intelligence and cloud computing drive unprecedented demand for computational capacity. In the first half of 2025 alone, the Asia-Pacific region saw nearly 13 gigawatts of new project announcements, representing a 160 percent increase over the previous year, according to Knight Frank research. This surge reflects over $180 billion in required investment, cementing the region’s role as the world’s fastest-growing hub for digital infrastructure.

Yet committed supply, defined as projects with secured land, power, and planning permissions, has grown more than sixfold since 2019 while actual construction activity has failed to keep pace. DC Byte, a market intelligence firm, notes that under construction capacity is no longer tracking upward at the same rate as announcements. This divergence between planned and operational capacity creates a structural constraint affecting markets worldwide.

The market is not cooling. It is overcommitted and underdelivered. In the US especially, we are seeing a real tension between intent and execution. Projects are being leased before construction starts, but grid delays and permitting hold-ups are pushing delivery further out. This is not a demand problem. It is a development bottleneck.

Colby Cox, Managing Director for the Americas at DC Byte, stresses that operators who can bring capacity online, not merely announce it, will determine market leadership. This observation holds equally true for Johor, where the ability to secure timely grid connections now separates viable projects from stalled investments.

Singapore Constraints Fuel Johor Expansion

Johor’s emergence as a data center magnet stems largely from restrictions imposed on its neighbor. Singapore, historically the region’s primary digital hub, imposed a three-year moratorium on new data center builds until January 2022 due to severe power and water constraints. Though the city-state subsequently launched a Green Data Centre Roadmap and approved 300 megawatts of additional capacity, growth there remains tempered by strict sustainability requirements and limited physical space.

This regulatory environment triggered a massive spillover effect. Johor, located just across the Strait of Johor, offered cheap land, abundant resources compared to Singapore’s island constraints, and proximity to the financial hub’s fiber connectivity. The numbers reveal the scale of this shift. According to Knight Frank, Johor currently hosts approximately 580 megawatts of operational data center capacity, yet its total planned capacity, including early-stage projects, reaches nearly 10 times that amount at 5.8 gigawatts. As of the second quarter of 2025, the state had approved 42 projects worth 164.45 billion ringgit ($39.08 billion), contributing 78.6 percent of Malaysia’s operational IT capacity.

However, this rapid growth has created intense pressure on local infrastructure. Kenanga Investment Bank Berhad projects that electricity consumption from Malaysia’s data centers will equate to 20 percent of the country’s total energy-generating capacity by 2035. While the Malaysian government plans to add 6 to 8 gigawatts of gas-fired power generation, the challenge lies not in producing this electricity but in delivering it through transmission and distribution networks that require years of lead time to upgrade.

Technical Constraints Behind Connection Delays

The distinction between power generation and grid delivery is crucial for understanding Johor’s current predicament. While Malaysia can build power plants relatively quickly, the substations, transformers, and transmission lines that connect these facilities to individual data center campuses require extensive planning, permitting, and construction timelines. Boston Consulting Group analysis indicates that while a typical greenfield data center requires two to three years to develop, associated interconnection studies and infrastructure upgrades typically span four to eight years.

This mismatch creates what industry professionals call the time to power gap. In Johor specifically, the Area Market Intelligence report identifies three critical failure points: utility timelines that do not align with developer construction schedules, ambiguous responsibility for substation infrastructure investments, and planning constraints that emerge only after projects have advanced through initial approval stages. When developers assume grid capacity exists based on regional generation statistics, they often discover that local transmission infrastructure cannot support their specific load requirements.

The technical complexity extends to power quality and reliability. Data centers require not just megawatts of capacity, but highly stable, redundant electrical supply with specific voltage and frequency characteristics. Upgrading existing grid infrastructure to meet these specifications involves coordination between multiple stakeholders including Tenaga Nasional Berhad, the national utility, local regulators, and private developers. Without clear frameworks governing who bears the cost and responsibility for these upgrades, projects stall in administrative uncertainty.

Water Resources and Community Resistance

Electricity is not the only resource under strain. Data centers consume enormous quantities of water for cooling, with a single 100-megawatt facility using approximately 4.2 million liters per day, equivalent to the supply needs of thousands of residents. Johor, which already relies on neighboring Singapore for a significant portion of its treated water and has experienced several supply disruptions, faces a dual resource crunch that is prompting local resistance.

In a notable development, Johor residents staged protests outside a data center construction site, alleging dust pollution and raising alarms about potential water shortages. This represents the first significant public demonstration against the industry in Malaysia, signaling eroding social license as the sector expands. Universiti Teknologi Malaysia property economics expert Assoc Prof Dr Muhammad Najib Razali notes that regulators are now signaling that water and energy allocations must be carefully managed to protect residential and essential industrial users.

Treated water and grid power are no longer assumed to be available on demand. They are becoming conditional inputs, subject to caps, efficiency requirements and policy scrutiny.

Dr Najib explains that land demonstrating utility readiness, through access to alternative water sources, reclaimed water systems, or enhanced energy efficiency, commands premium value and faces fewer delays. Conversely, sites relying entirely on municipal water or standard grid connections face greater uncertainty regardless of location quality. This shift transforms water and energy from background infrastructure considerations into primary determinants of land value and investment risk.

In response to these pressures, Johor is reportedly constructing three new reservoirs and water treatment plants, while the government has imposed higher water tariffs on data centers and pushed for the industry to shift to recycled wastewater. Some newer facilities are adopting air-cooled designs that eliminate water use entirely, though these technologies require additional energy input and are less efficient in Johor’s tropical climate.

Geopolitical Pressures Complicate Development

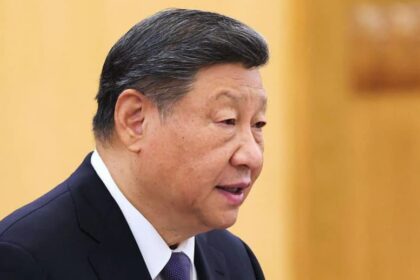

The technical bottlenecks intersect with complex international trade dynamics. Malaysia’s decision to slow data center expansion carries consequences for China’s efforts to secure access to advanced artificial intelligence chips subject to United States export controls. Chinese firms including Tencent, Huawei, and Alibaba have established significant presences in Johor, drawn by the same advantages as their American counterparts. However, Washington has raised concerns that data centers outside China could purchase restricted Nvidia chips for training AI models that support Chinese military applications.

In July 2025, Malaysia announced it would require permits for all exports, trans-shipments, and transits of US-made high performance chips. While regulatory loopholes technically allow Chinese data centers to import chips for in-country use, scrutiny on these projects is intensifying as Kuala Lumpur seeks to finalize trade agreements with Washington. This creates a delicate balancing act for Malaysian policymakers, who must weigh Chinese investment against American strategic concerns.

Lee Ting Han, Johor state’s data center development coordination vice chair, suggests that Chinese firms’ corporate restructuring, including DayOne’s separation from parent company GDS Holdings, likely aims at diversifying client bases in anticipation of shifting trade tensions. The situation illustrates how infrastructure constraints and geopolitical pressures are converging to reshape the competitive landscape, with some projects facing dual headwinds of technical delays and regulatory uncertainty.

Alternative Power Strategies Emerge

Faced with grid delays, operators are exploring diverse strategies to accelerate their time to power. Microsoft has resorted to gas generators at its Queretaro, Mexico facility due to similar grid delays, demonstrating that even the largest technology firms are willing to embrace temporary fossil fuel solutions to maintain operational continuity. Vantage Data Centers has partnered with VoltaGrid to deploy more than one gigawatt of natural gas microgrid capacity across North America, designed for installation within months rather than years.

Google has pursued a different approach in Malaysia, signing a 21-year power purchase agreement with TotalEnergies to secure one terawatt-hour of certified renewable electricity from the Citra Energies solar plant. This arrangement, structured under Malaysia’s Corporate Green Power Programme, demonstrates how hyperscalers are moving beyond traditional utility supply models to secure long-term, dedicated generation capacity that aligns with their sustainability targets while bypassing some grid constraints.

Resources located behind the meter, including solar arrays, battery storage, and on site generation, are gaining attention as temporary fixes. However, these solutions face limitations. Data centers require exceptionally high reliability levels that independent systems struggle to guarantee, and scaling such resources to support facilities operating at gigawatt scale presents significant technical and financial challenges. As Boston Consulting Group notes, grid-connected data centers will likely remain the favored choice, but facilitating these connections will require regulatory reforms in interconnection processes and contractual innovations to de-risk utility investments.

Malaysia’s government plans to launch a Sustainable Data Centre Framework by October 2025, aiming to establish clearer guidelines for resource use and potentially streamline the approval processes that have created current bottlenecks. The framework may address the ambiguity around substation responsibility that has delayed numerous projects, though specific details remain pending.

The Bottom Line

- Johor rejected up to 30 percent of data center applications in 2024 due to grid delivery constraints rather than power generation shortages.

- The state hosts 5.8 gigawatts of planned capacity against 580 megawatts currently operational, creating severe infrastructure strain.

- Global demand for data center capacity increased 30 percent in 2024, but construction cannot match announcements due to power and permitting delays worldwide.

- Water consumption concerns have sparked local protests and prompted regulators to treat utility access as a conditional resource rather than guaranteed infrastructure.

- Geopolitical tensions over AI chip access are complicating Malaysia’s data center strategy, particularly regarding Chinese firm investments.

- Industry solutions include on site gas generation, long-term renewable power purchase agreements, and development of secondary markets with available grid capacity.