An Unequal Economic Fallout

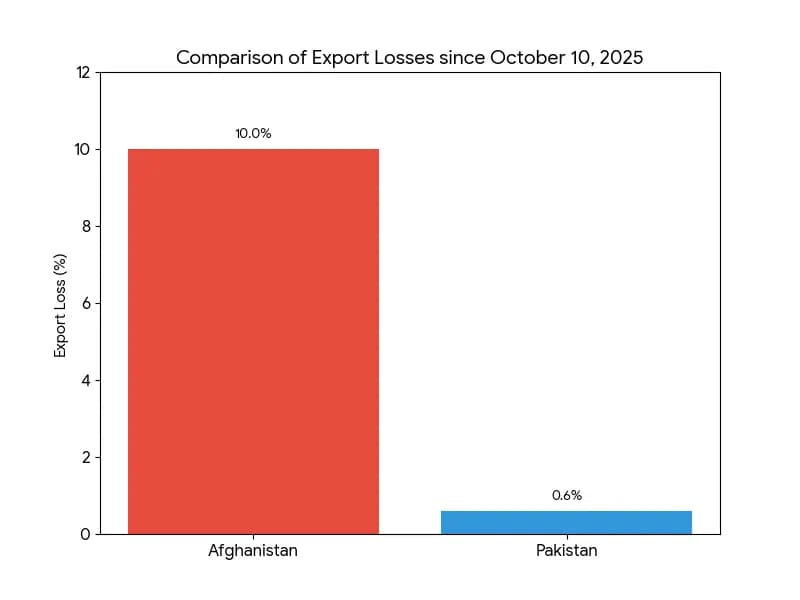

The nearly three-month suspension of bilateral trade between Pakistan and Afghanistan has created a stark economic imbalance, hitting Afghanistan significantly harder than its neighbor. While political tensions in Islamabad focus on security concerns, the economic data reveals a disproportionate burden falling on Kabul. Trade analysis indicates that export losses for Afghanistan have reached approximately 10 percent since the crackdown began on October 10. In contrast, Pakistan has seen a decline of only about 0.6 percent in its total exports during the same period.

This disparity highlights the critical reliance of the Afghan economy on access to Pakistani markets. Afghanistan sends nearly 46 percent of its total exports to Pakistan, including a substantial volume that moves onward to India via the Wagah border. Pakistan serves as a vital lifeline, a reality that makes the prolonged disruption particularly damaging for Kabul. Conversely, Afghanistan accounts for only around 3.46 percent of Pakistan’s global exports, giving Islamabad far more resilience to weather the economic standoff. The suspension of trade flows followed a series of border clashes and failed diplomatic talks involving mediation by Turkiye and Qatar, culminating in Pakistan declaring negotiations effectively over in early November.

Market Volatility and Stranded Cargo

The immediate consequences of the border closure are visible in markets on both sides of the frontier. In Pakistan, the sudden halt has disrupted supply chains for perishable goods, leading to sharp price fluctuations. Poultry prices in the Punjab and Khyber Pakhtunkhwa provinces have witnessed a steep decline due to a surplus of supply that can no longer be exported. Live chicken prices have dropped significantly, while simultaneously, the cost of vegetables and fruits has skyrocketed because imports from Afghanistan have ceased.

Abdul Basit, who heads the Poultry Wholesalers Association, noted that the volatility in essential commodity prices is a direct result of the severing of demand and supply in the border region. Traders report that prices for staples like potatoes, onions, garlic, and ginger have surged in Pakistani markets. This situation is exacerbated by recent floods that wasted local crops, forcing a reliance on Afghan imports that are no longer available.

In Afghanistan, the pain is acute but different. The Afghanistan Chamber of Commerce and Investment reports that more than 11,500 trucks carrying food and non-food goods are currently stranded at border crossings. This gridlock causes daily losses estimated at around $2 million for traders. Prices inside Afghanistan for essential goods have risen, with a 50-kilogram sack of rice now costing 3,400 afghanis and flour reaching 1,600 afghanis. Fuel prices have also climbed, adding pressure to households already struggling with poverty.

The Critical Transit Dilemma

Beyond direct bilateral trade, the suspension threatens the broader framework of transit commerce that is essential for Afghanistan’s survival. Transit trade represents about 40 percent of Afghanistan’s total imports. The value of Afghan imports transiting through Pakistan had already declined sharply due to tightening controls on smuggling-prone items. The current suspension threatens to push that figure below the $1 billion mark, deepening the shift in Afghanistan’s import routes.

Pakistan’s own ambitions for regional connectivity are also stalling. Islamabad had signed transit trade agreements with several Central Asian States, hoping to use Afghanistan as a corridor to access those markets. However, the current disruption has left containers carrying cotton and other goods from Central Asia stranded on the Afghan side. Similarly, Pakistani transit cargo intended for Central markets is piling up within Afghanistan.

Muhammad Ishaq, former president of the Sarhad Chamber of Commerce and Industry, explained the broader impact. He noted that segments of Punjab’s textile industry had begun shifting operations to Uzbekistan, but the current uncertainty has halted that process. Cotton and coal imports from Uzbekistan and Tajikistan, vital for industries in Khyber Pakhtunkhwa and Punjab, have also been affected. The alternative route via Iran is significantly longer and more expensive, reducing the competitiveness of goods.

A Strategic Shift Northward

Faced with this instability, the Taliban administration is actively accelerating a shift toward alternative trade partners. Mullah Abdul Ghani Baradar, the Taliban’s deputy prime minister for economic affairs, issued a directive urging Afghan traders to seek alternatives to Pakistan to avoid delays. He went further, advising traders to source imports from other countries and warning that after three months, the government would not assist traders who continue to rely on Pakistan and encounter problems.

This push for diversification is not merely a reaction to the current crisis but fits a historical pattern. During previous major diplomatic confrontations between 1949 and 1963, Afghanistan consistently turned toward the Soviet Union and Iran to bypass Pakistani routes. History suggests that every major disruption with Pakistan drives Afghanistan to diversify away from its neighbor. The current situation follows this trajectory, with Kabul increasingly looking toward Central Asian states like Uzbekistan and Kazakhstan.

A clear example of this shift is the import of wheat flour. In 2015, Afghanistan imported $320 million of flour from Pakistan. By 2024, that figure had fallen almost to zero. Data for 2025 shows that Afghanistan now imports over 98 percent of its wheat flour from Uzbekistan and Kazakhstan. This demonstrates that while Pakistan remains a key partner, Afghanistan has successfully managed to pivot for critical staple goods when necessary.

Political Rhetoric Clashes with Business Reality

While business communities on both sides suffer, political leaders have struck a defiant tone. Pakistan’s Defense Minister, Khawaja Asif, claimed that the halt in trade would eventually benefit the Pakistani people. However, this view contrasts sharply with the assessments from the ground. The Ministry of Commerce has sought detailed data on financial losses from the Chaman Chamber of Commerce and Industry, acknowledging the severe repercussions on exporters and the rising unemployment in border communities.

Traders in Peshawar, which once bustled with Afghan-owned shops, report that business has been cut in half. Hameed Ullah Ayaz, an Afghan owner of multiple bakeries in Peshawar, described the climate of fear, noting that Afghans are afraid to go outside. The informal sector and close-knit communities that rely on cross-border movement are being ripped apart by the political standoff.

Khan Jan Alokozai, President of the Afghanistan-Pakistan Joint Chamber of Commerce, emphasized that traders on both sides are losing. He pointed out that Afghan importers are already shifting orders for cement and pharmaceuticals to Iran, Uzbekistan, and Tajikistan. This structural change in supply chains poses a long-term threat to Pakistani exporters. Once these markets are lost to competitors, regaining a foothold becomes incredibly difficult.

Afghan importers have already begun shifting orders away from Pakistan in response to the prolonged suspension of trade, particularly in key sectors such as cement and pharmaceuticals, said Alokozai.

The Long-Term Regional Consequences

The extended trade suspension carries risks that extend beyond immediate balance sheets. Major regional infrastructure projects like CASA-1000 and the Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipeline depend heavily on stable transit arrangements through Pakistan. Without cooperation between Islamabad and Kabul, these projects face further delays and potential failure.

The Taliban is also leveraging anti-Pakistan sentiment to bolster domestic legitimacy. By refusing to submit to border closures, the leadership presents itself as a defender of national sovereignty. This political theater complicates any diplomatic resolution, as economic concessions are now viewed through the lens of capitulation.

Economists warn that a prolonged border closure will have severe consequences. For Pakistan, the losses extend beyond the immediate $150 million to $170 million estimated for a three-month suspension. The interconnected labor, transport, and industrial economies of Khyber Pakhtunkhwa are under threat. For Afghanistan, the isolation deepens poverty and could accelerate the search for alternative routes that permanently bypass Pakistan, fundamentally altering the region’s economic geography.

The Essentials

- Afghanistan has lost approximately 10 percent of its export value since October 10, compared to a 0.6 percent loss for Pakistan.

- Over 11,500 trucks carrying goods are stranded at border crossings, causing daily losses of $2 million for traders.

- Afghanistan has successfully shifted its wheat flour imports from Pakistan to Uzbekistan and Kazakhstan, signaling a potential broader trade diversion.

- Pakistan faces price hikes for fruits and vegetables due to halted imports, while poultry prices have crashed due to a lack of export markets.

- The Taliban leadership has issued a three-month ultimatum for traders to find alternatives to Pakistani supply routes.

- Historical precedents suggest that prolonged border closures lead to permanent shifts in Afghan trade patterns toward northern and western routes.

- Major infrastructure projects like CASA-1000 and TAPI are at risk due to the instability in Pakistan-Afghanistan relations.