Production Lines Halt Amid Transatlantic Chip Feud

Honda Motor’s assembly lines have fallen silent across North America and parts of Japan, marking the most visible casualty yet of a deepening corporate war within the global semiconductor industry. The automaker was forced to halt output at its Mexico plant and adjust operations in the United States and Canada following a critical shortage of components supplied by Nexperia. This shortage stems from a fierce legal and operational standoff between Nexperia’s Chinese unit and its Dutch parent company, a conflict that has now drawn the attention of governments in Europe, China, and the United States.

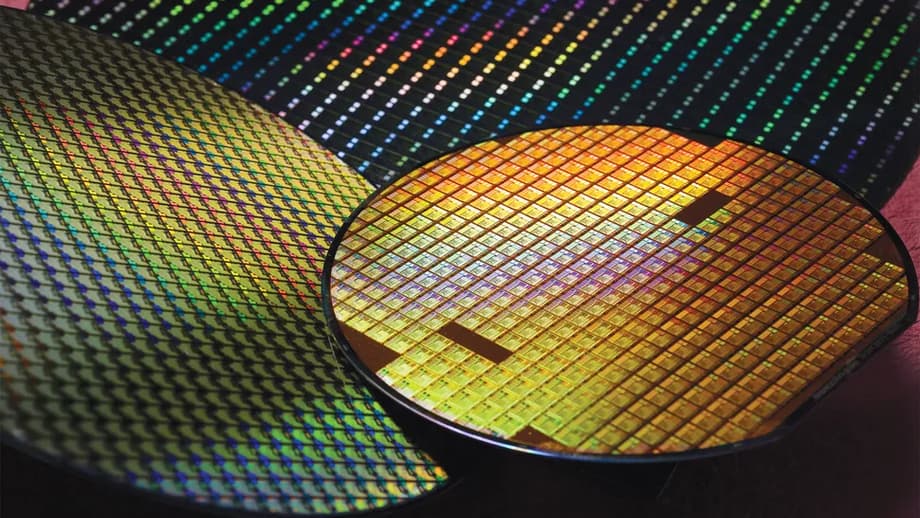

The dispute centers on the Dongguan manufacturing base in Guangdong province, a facility that historically accounted for roughly 70% of Nexperia’s total output. This plant is one of the world’s largest producers of automotive and industrial chips, making the interruption a matter of urgent concern for the global automotive sector. As the rift widens, both sides are digging in, triggering a chain reaction that threatens to reshape legacy chip supply chains and potentially bifurcate the company entirely.

A Corporate Standoff Over Payments and Control

At a shareholder meeting in Shanghai on Friday, December 26, Wingtech Technology, the Chinese owner of Nexperia China, detailed the mechanics of the supply breakdown. The company accused the Netherlands head office in Nijmegen of suspending wafer shipments on October 29 after the Chinese unit refused payment for delivered materials. Wingtech further alleged that the Dutch side had restricted internal fund transfers, exacerbating the operational strain.

The Dutch parent company maintains it was forced to act due to contractual breaches and governance issues. This financial disagreement is not occurring in a vacuum. It follows the Dutch government’s sudden intervention in September, when the Ministry of Economic Affairs invoked the 1952 Goods Availability Act to seize temporary control of the Dutch chipmaker. The government cited national security concerns as the primary driver, barring Nexperia from relocating assets for one year without government approval.

In response to the suspension of shipments, Nexperia China has moved aggressively to secure its own future. The Chinese unit has declared independence from European management and initiated the validation of domestic wafer suppliers. This process is expected to finalize between the first and second quarters of 2026, effectively creating a parallel supply chain that bypasses the Netherlands entirely.

Operational Impact and Automaker Workarounds

Despite what Wingtech described as a “significant gap in wafer supply,” the Dongguan facility has managed to sustain a reduced level of operations. Since mid-October, the plant has produced and delivered more than 11 billion chips to over 800 customers worldwide. While impressive, this output represents a 14% drop relative to Nexperia’s pre-dispute annual production of more than 110 billion devices.

The disruption has already translated into tangible losses for downstream automakers. Honda’s temporary shutdowns in North America are just the beginning. The company has announced additional stoppages at several Japanese plants scheduled for January 5 and 6, with reduced operations expected to persist until January 9. Industry analysts warn that other automakers, including Volkswagen and clients of major suppliers like Bosch and Hella, are also feeling the squeeze.

To mitigate the damage, some automakers and parts suppliers are exploring a complex logistical workaround. Under this arrangement, customers would buy silicon wafers directly from Nexperia’s Hamburg factory in Europe, arrange separate transport to China, and then contract the Dongguan site to perform the final packaging. This approach treats the European and Chinese divisions of Nexperia as separate entities, ensuring each gets paid for its specific contribution.

One Nexperia product distributor described the situation to the press, noting that many companies are currently negotiating this arrangement. Some have already begun buying wafers from Nexperia Europe and providing them to the Chinese unit to secure exclusive production slots. While this patch addresses immediate supply concerns for large clients, it is not a viable solution for smaller automotive suppliers who lack the logistical leverage to coordinate such complex international shipping.

Geopolitical Tensions and Security Concerns

The corporate malaise has quickly escalated into a geopolitical flashpoint. Following the Dutch government’s intervention, China’s Ministry of Commerce issued export control measures that restricted Nexperia China and its subcontractors from exporting specific finished components and subassemblies. Although both governments relaxed these measures last month, the underlying tensions remain unresolved.

On October 7, an emergency hearing at the Dutch Enterprise Chamber resulted in the removal of Nexperia CEO Zhang Xuezheng, who is also the founder of Wingtech. The court placed all Wingtech-held voting rights under the supervision of an independent administrator. Nexperia subsequently appointed CFO Stefan Tilger as interim CEO, but the legal battle is far from over. Wingtech has indicated that a court hearing on the broader dispute will be held in the Netherlands in January.

Across the Atlantic, the United States is watching the situation with growing apprehension. Congressman Raja Krishnamoorthi, Ranking Member of the House Select Committee on the Strategic Competition Between the United States and the Chinese Communist Party, has pressed the Commerce Department for answers. In a letter to Commerce Secretary Howard Lutnick, Krishnamoorthi warned that the crisis exposes deep vulnerabilities in legacy semiconductor sourcing.

The Congressman highlighted a specific risk associated with Nexperia China’s pivot to domestic suppliers. He stated that these chips are widely used across the automotive sectors of America’s closest allies, and any shift to unvetted suppliers would raise significant concerns regarding safety certification, quality control, and reliability. He urged the administration to assess the potential impact of Chinese-controlled supply disruptions on automotive safety and recall risks.

China’s Pivot to Domestic Suppliers

Central to the long-term resolution of this dispute is Nexperia China’s rapid transition to a localized supply chain. According to a document seen by Reuters, the Chinese unit has locked in supplies of silicon wafers from local firms to cover its entire 2026 production of key products. The focus is on Insulated-Gate Bipolar Transistor (IGBT) power chips and modules, which act as switches to regulate current in electric vehicles and industrial equipment.

Wingtech is accelerating the verification of wafers from its own foundry, Wingsky Semi, to ensure what the company termed “abundant supply.” Wingsky Semi is set to supply 12-inch automotive-grade IGBT wafers, with its Shanghai production base currently boasting a capacity of 30,000 wafers per month. In addition to Wingsky Semi, Nexperia China has secured supplies of 8-inch IGBT wafers from Shanghai GAT Semiconductor and United Nova Technology Co, a fabrication plant linked to Semiconductor Manufacturing International Corp (SMIC).

However, these domestic suppliers are precisely the ones raising eyebrows in Washington. Congressman Krishnamoorthi’s letter specifically called for formal investigations into Wuxi NCE Power, Hangzhou Silan Microelectronics, Yangjie Technology, and Wingsky Semi. The goal is to determine whether these entities pose risks related to ownership, state direction, or the circumvention of export controls.

For Chinese automakers, the shift is a necessary survival strategy. A person familiar with the matter noted that low wafer inventory at the Dongguan factory has started causing shortages for domestic carmakers, particularly for logic devices, transistors, and diodes. These are Nexperia’s most popular products, and the scarcity is driving the industry toward a new normal where Chinese production relies increasingly on Chinese materials.

Legal Repercussions and the Future of the Supply Chain

The financial stakes of this divorce are astronomical. A representative for Wingtech told state-backed Shanghai Securities News that the Dutch government’s intervention may violate a 2001 bilateral investment protection agreement. The company warned that it could pursue international arbitration with claims of up to $8 billion if the issue is not resolved within six months.

Such a sum would represent one of the largest damages claims in recent corporate history, underscoring how valuable the Chinese operations are to the global Nexperia ecosystem. The legal proceedings in January will likely determine whether the company can be reintegrated or if a permanent split is inevitable.

Looking beyond the immediate crisis, the industry is already adapting to a fractured landscape. Nexperia’s European arm is exploring plans to expand packaging operations in Malaysia and the Philippines, effectively diversifying away from its reliance on Dongguan. Conversely, the Chinese unit is cementing its relationships with local fabs like Wingsky Semi and Shanghai GAT.

A Dutch delegation is due to travel to China in early January to attempt a diplomatic resolution. Economic affairs minister Vincent Karremans noted that he welcomed China’s decision to ease export restrictions but remained cautious about the long-term outlook. Despite these diplomatic efforts, the structural changes in the supply chain may prove difficult to reverse. The “workarounds” being used by automakers today could easily become the standard operating procedures of tomorrow, leaving the global automotive industry with two distinct and separate pools of components.

The Bottom Line

- Nexperia China is validating new domestic suppliers like Wingsky Semi and Shanghai GAT to replace wafers from the Dutch parent company, aiming to secure supply by mid-2026.

- The dispute caused a 14% drop in Nexperia China’s output, leading to production stoppages at Honda plants in Mexico, the US, Canada, and Japan.

- The Dutch government seized control of Nexperia in September citing national security, while China responded with export controls on finished chips.

- Automakers are using a workaround where they buy wafers from Nexperia’s European plant and ship them to China for packaging to bypass the internal blockade.

- US officials have raised concerns about “unvetted” Chinese suppliers entering the automotive supply chain, warning of potential safety and quality risks.

- Wingtech has threatened up to $8 billion in international arbitration claims against the Dutch government, alleging a violation of bilateral investment treaties.