A sharp climb driven by new routes and visa free policies

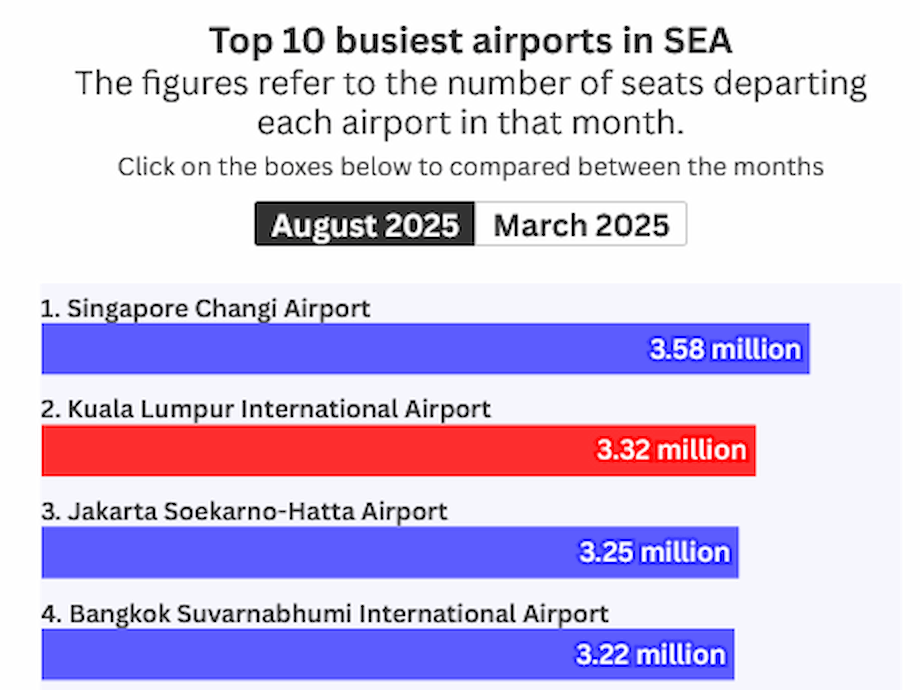

Kuala Lumpur International Airport has jumped to second place among Southeast Asia’s busiest airports after a sustained surge in scheduled capacity. Between March and August, departing seats at KLIA rose by 10 percent, climbing from 3.02 million in March to 3.32 million in August. Singapore Changi stayed in first place with 3.58 million departing seats, but Kuala Lumpur’s pace of growth moved it ahead of other regional rivals for the first time since travel returned at scale after the pandemic. The shift reflects a mix of new airlines, fresh routes, and Malaysia’s temporary visa waivers for visitors from China and India.

- A sharp climb driven by new routes and visa free policies

- How KLIA moved up the rankings

- China and India policies give a lift

- A broader recovery in Malaysia and ASEAN

- KLIA as a transit hub, who uses it and why

- Infrastructure upgrades passengers will notice in 2025

- Competitive outlook in Southeast Asia

- Challenges that could slow momentum

- What it means for travelers and airlines

- Key Points

KLIA’s connectivity has broadened at the same time. The airport now links to 117 international destinations, up from 105 a year ago, and hosts 66 airlines compared with 59 previously. Terminal 1 serves 52 airlines while Terminal 2, home to many low cost carriers, serves 14. Added capacity from foreign airlines and network expansion by Malaysia Airlines, AirAsia, and Batik Air Malaysia helped fill seats through the northern summer and sharpened KLIA’s role as a regional transit point.

Policy shifts also mattered. Visa free entry for tourists from China and India, currently in place until the end of next year, has supported demand on high growth routes and stimulated transfer traffic beyond Malaysia. KLIA also ranked fourth for year on year capacity growth among the region’s top airports in August with a 7.5 percent rise in departing seats. Most international seats from Southeast Asian airports serve Asia Pacific destinations, and capacity to Africa is growing from a small base.

How KLIA moved up the rankings

The rebound in capacity is tied to airlines adding Kuala Lumpur back to their networks and launching services to secondary cities in large markets. British Airways resumed flights in April. Chinese carriers expanded options to and from key cities. Local operators added frequencies and adjusted schedules to create more reliable connections. The result is more choice for travelers and stronger feeder flows into long haul flights.

Monthly traffic data also show a rising trend. In July, KLIA’s international passenger count reached 3.9 million, up from 3.6 million in June, a 10.3 percent month on month increase reported by Malaysia Airports. One catalyst was Loong Air’s service to Xi’an, which operates three times weekly and adds depth to the China network beyond the giants of Guangzhou, Shanghai, Xiamen, and Beijing.

New and returning carriers include:

- British Airways, resuming London flights to Kuala Lumpur

- Juneyao Air, adding capacity from China

- Jiangxi Airlines, launching Nanchang to Kuala Lumpur as its first Southeast Asian route

- Lucky Air, growing presence on China to Malaysia markets

- FitsAir, expanding links with Colombo

- Hainan Airlines, reinforcing China connectivity

- Loong Air, opening the Xi’an to Kuala Lumpur link

These additions are part of a broader strategy by Malaysia Airports Holdings to attract new carriers, increase frequencies, and support upgauging to larger aircraft where demand warrants. The emphasis is on balanced growth that helps both point to point traffic and transfer flows through Kuala Lumpur.

China and India policies give a lift

Malaysia’s visa policy shift has been a tailwind. A 30 day visa exemption for tourists from China and India, now extended through next year, has supported a faster return of international demand. That is visible beyond Kuala Lumpur. Across the country, the Civil Aviation Authority of Malaysia said total monthly passengers reached 9.3 million in July, edging closer to pre pandemic levels. International traffic rose faster than domestic as carriers restored capacity into and beyond Malaysia.

At KLIA, the move has reinforced network expansion. Additional services to China, plus steady demand from India, have flowed into long haul connections to Australia, the Middle East, and Europe. Malaysia Airports’ data highlight how new links to second tier Chinese cities are diversifying inbound travel and supporting trade ties that ride on better air connectivity.

Malaysia Airports managing director Dato’ Mohd Izani Ghani framed the China focus as both an aviation and an economic play. He said new routes bring visitors and also open doors for commerce.

“Strategic growth in Chinese connectivity is a key driver of Malaysia’s broader economic expansion and reinforces KLIA’s position as Southeast Asia’s preferred aviation hub. Direct air links with emerging cities like Xi’an not only increase passenger traffic but also facilitate greater trade and investment opportunities.”

Traffic gains at KLIA also reflect how airlines are using Kuala Lumpur to supplement capacity constraints or higher costs at rival hubs. A richer set of options for China and India feeds connections to ASEAN neighbors and onward sectors to the Pacific and Europe.

A broader recovery in Malaysia and ASEAN

Malaysia’s air travel market continued to heal in mid 2025. CAAM reported that from January through July total passenger traffic reached 61.2 million. July traffic of 9.3 million was up 3.9 percent month on month and 5.3 percent year on year, while international traffic reached 98.7 percent of July 2019 levels. That improvement has been aided by added seats, visa policies, and a wave of new routes across the country, including services from Kuala Lumpur, Subang, and Kota Kinabalu.

Across Southeast Asia, the ranking remains tight at the top. Singapore Changi recorded 3.59 million passengers in May 2025, the highest in the region. Kuala Lumpur followed with roughly 3.23 million. Jakarta Soekarno Hatta and Bangkok Suvarnabhumi each moved above 3 million as Indonesia and Thailand also benefited from tourism and regional business travel. Data compiled by industry outlets such as Travel And Tour World and seasia.co point to a region wide recovery built on a mix of national carriers and low cost operators.

Most international seats in Southeast Asia continue to serve Asia Pacific markets like Northeast Asia, South Asia, and Australia. Capacity to Africa is the fastest growing regional flow, but from a small base. The next phase of growth will depend on aircraft deliveries, staffing, and how fast airlines can restore widebody networks for long haul services.

KLIA as a transit hub, who uses it and why

Kuala Lumpur’s role as a transfer point has grown with each new spoke added to the network. Malaysia Airlines connects KLIA to Australia, South Asia, and select European destinations. AirAsia and Batik Air Malaysia feed regional traffic from across ASEAN and beyond, including large flows from Indonesia, Thailand, Vietnam, and the Philippines. The mix of a full service flag carrier and a powerful low cost group gives Kuala Lumpur both premium and budget options for travelers building itineraries through the hub.

Terminal 1 handles most full service carriers, alliance partners, and long haul flights. Terminal 2 caters to low cost carriers and is designed for fast turns and high utilization. Together, the two terminals support growing transfer traffic. Travelers often cite value for money, expanding schedules, and straightforward connections as reasons to choose KLIA for itineraries that cross the region.

A note on the figures often used: departing seats measure scheduled capacity, not the number of passengers who actually fly. That metric is useful for comparing airports because it shows how much supply airlines plan to offer in a given period. When paired with traffic data, it gives a clearer sense of how full flights are and where airlines expect demand to materialize.

Infrastructure upgrades passengers will notice in 2025

KLIA is making a visible push on the customer experience. Upgrades include additional seating, new baggage trolleys, more family parking bays, improved signage, curated cultural showcases in public areas, and a new playground to ease travel for families. These changes aim to make dwell time more comfortable and to help first time visitors navigate the terminal with less stress.

Technology trials are underway. An Open Belt bag drop system is being tested to let travelers check bags more flexibly, which can reduce queues and speed up the start of a journey. The system is designed to allow airlines to share drop points, smoothing peaks that usually occur when many flights depart in tight waves.

Operational tech and inter terminal transfer

Malaysia Airports is also planning an air side transfer solution between Terminal 1 and Terminal 2. Seamless transfer of passengers and baggage between the two terminals will support the hub’s mix of full service and low cost operators. The goal is to reduce minimum connection times and make it easier for airlines to sell through itineraries across terminals.

Longer term planning is underway as well. Malaysia Airports has signaled that it is reviewing the need for a third terminal while it continues to enhance services at the existing terminals. Across Asia Pacific, many hubs are adding runways and terminals to prepare for the next wave of demand. Changi is advancing Terminal 5, Bangkok is expanding its airfield and terminal complex, and Hong Kong is scaling up around its third runway. KLIA’s incremental approach aims to match capacity growth with passenger experience and operational reliability.

Competitive outlook in Southeast Asia

Competition among regional hubs is intense. Changi is building massive new capacity with Terminal 5. Bangkok plans a larger terminal complex and more runway capacity. Hong Kong is adding terminal facilities around its new runway and remains strong for China flows and global finance. These investments aim to capture long haul transfers that link Asia with Europe, North America, and the Middle East.

KLIA’s recipe is different. It leans on a strong low cost ecosystem, a resurgent national carrier, and growing connectivity to China, India, and Australia. Lower operating costs for some carriers, ample slots compared with congested hubs, and improving transfer processes are attractive to airlines looking for a balanced Southeast Asia strategy. Continued gains will depend on punctuality, efficient security screening, and consistently fast baggage handling during peak periods.

Challenges that could slow momentum

Experts point to the need for faster check in and security clearance during busy hours, along with smarter queue management. More self service options, biometrics, and better wayfinding can trim minutes from each step. These tweaks are not headline grabbing, but they compound into a smoother experience that keeps connections tight.

Surface access and schedule integrity matter too. Airport rail and highway links are vital in peak travel seasons. Consistent on time performance, supported by enough gates and resilient staffing, will be necessary as more airlines add Kuala Lumpur to their schedules. Weather events and regional air traffic constraints can strain operations, so buffers and contingency planning are part of sustainable growth.

Cargo is another lever. KLIA already hosts several large handlers and five major cargo terminal operators. As airlines increase frequencies, belly cargo capacity rises, feeding trade in small parcels, perishables, electronics, and components. That freight supports airline economics and helps justify added flights, especially on widebody routes.

What it means for travelers and airlines

Travelers now have more nonstop and one stop choices through Kuala Lumpur, especially across China, India, ASEAN, and Australia. Fares can be more competitive when more seats are offered, and schedules are more flexible when there are multiple daily options. A refreshed terminal experience, clearer signage, and family friendly facilities should make long connections less taxing.

Airlines benefit from a hub that can absorb added capacity without long wait times for gates or scarce slots. Kuala Lumpur’s combination of a full service and a low cost platform enables partnerships, interlines, and codeshares that broaden networks without requiring every carrier to fly every route. As the network deepens, secondary cities feed into trunk routes, which strengthens the case for more long haul flights over time.

Key Points

- KLIA has risen to second place in Southeast Asia by departing seats after a 10 percent capacity jump between March and August.

- August scheduled capacity at KLIA reached about 3.32 million departing seats, up from 3.02 million in March.

- Changi remains first in the region with 3.58 million departing seats.

- KLIA now connects to 117 international destinations and hosts 66 airlines, up from 105 destinations and 59 airlines a year ago.

- British Airways returned in April, while Chinese carriers and others including Juneyao Air, Jiangxi Airlines, Lucky Air, FitsAir, Hainan Airlines, and Loong Air added services.

- International passengers at KLIA reached 3.9 million in July, a 10.3 percent rise from June, supported by new China routes.

- Visa free entry for visitors from China and India, extended through next year, is lifting demand for Malaysia and for transfers via Kuala Lumpur.

- KLIA ranked fourth for year on year capacity growth among the top ASEAN airports, up 7.5 percent in August.

- Malaysia’s monthly air traffic reached 9.3 million in July as the market nears pre pandemic levels, according to CAAM.

- Terminal upgrades at KLIA include new seating, trolleys, family parking bays, better signage, cultural showcases, a new playground, and an Open Belt bag drop trial.

- Planned air side transfer between Terminal 1 and Terminal 2 aims to simplify connections and baggage transfers.

- Regional competition is heating up as Changi, Bangkok, and Hong Kong expand, while KLIA targets growth through network depth and operational efficiency.

Sources: Malaysia Airports and its public statements on July traffic and route expansion, The Star and Asia News Network coverage of KLIA’s ranking and capacity data, CAAM updates on national passenger traffic, industry reports from Routesonline and Aviation Week on new routes, and regional rankings compiled by Travel And Tour World and seasia.co. For official updates from Malaysia Airports, see the group’s media releases at this link, and for the interactive ranking narrative see The Star.