A Speech Timed for Market Turmoil

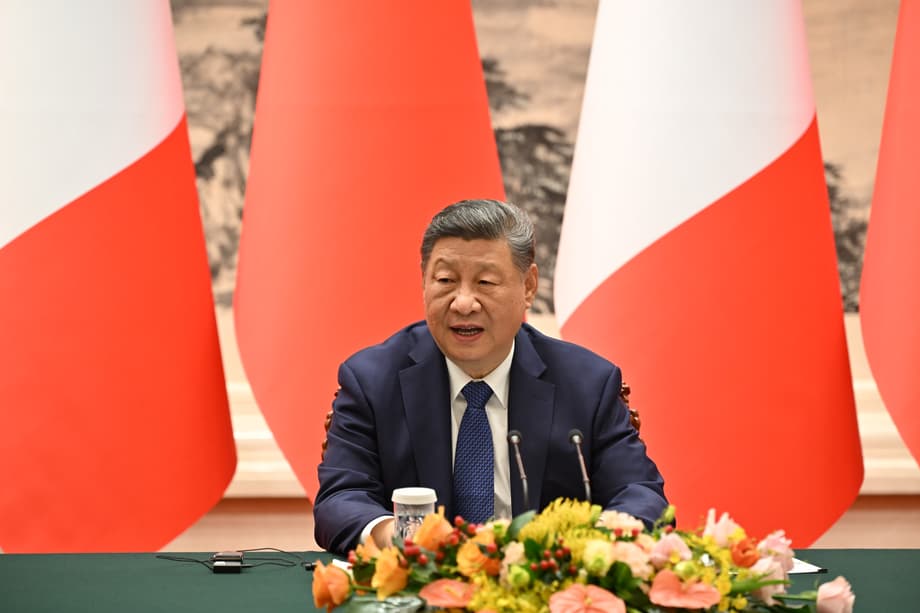

When the flagship ideology journal of the Chinese Communist Party published remarks from President Xi Jinping that were originally delivered in 2024, the timing appeared calculated to capitalize on acute financial instability. The dollar had fallen to four-year lows against a basket of major currencies, driven by erratic trade policies and threats to institutional independence from the Trump administration. Gold prices had surged to record highs above $5,500 an ounce as investors sought havens outside traditional United States assets. The depreciation of the dollar has approached 11 percent against the basket of major trading partners of the United States since the inauguration of Trump, reflecting broad concern about the trajectory of American economic policy. In this climate of what analysts describe as a “Sell America” sentiment, the words of Xi outlined a vision to transform the renminbi from a domestic currency into a global powerhouse.

In the pages of Qiushi, Xi posed a rhetorical question that framed his strategic objective. He asked what constitutes a strong financial nation, then answered that it requires a powerful currency widely used in international trade, investment, and foreign exchange markets, holding the status of a global reserve currency. This definition directly challenges the position the dollar has occupied since the Bretton Woods Agreement established its supremacy more than eight decades ago.

The publication of these comments coincides with a period of unusual vulnerability for American financial hegemony. President Donald Trump’s tariff policies have undermined confidence in United States economic growth, while his decision to nominate Kevin Warsh as the next Federal Reserve chair, following repeated clashes with current chair Jerome Powell, has introduced fresh uncertainty into monetary policy. European Central Bank President Christine Lagarde has openly called for the euro to assume a larger role in global finance, reflecting a broader desire among nations to diversify away from dollar dependence.

China has watched these developments create openings it has sought for over a decade. Since 2010, Beijing has pursued the internationalization of the renminbi, but progress remained limited while the dollar maintained its aura of invincibility. Now, with the dollar share of global foreign exchange reserves declining from 71 percent in 2000 to roughly 57 percent today, and with the renminbi climbing to 2.4 percent of reserves, Chinese leaders sense a window to accelerate their campaign.

The Blueprint for Currency Power

The vision of Xi rests on three institutional pillars that would support reserve currency status. First, China requires a powerful central bank capable of implementing effective monetary policy and attracting global capital flows. Second, the nation must develop internationally competitive financial institutions that can operate seamlessly across borders. Third, cities including Shanghai and Shenzhen must evolve into genuine international financial centers capable of influencing global pricing and attracting sustained investment from abroad.

Analysts note that achieving these objectives would require fundamental changes to the financial architecture of China. The country would need to allow the renminbi to float freely according to market forces rather than daily fixing by the central bank, and permit capital to flow across borders without government approval. Such liberalization would undermine the command and control approach that shapes economic management by the Communist Party, creating a paradox at the heart of the currency ambitions.

This framework represents more than symbolic ambition. It signals a shift from the previous reticence of Beijing about openly challenging dollar dominance. For years, China benefited enormously from the existing global system while quietly chafing at Washington’s ability to weaponize financial infrastructure through sanctions. The freezing of Russian foreign exchange reserves in 2022 demonstrated the vulnerability of dollar-dependent economies, accelerating the push of China for alternatives that can function independently of American-controlled systems.

However, the gap between ambition and reality remains substantial. According to data from the International Monetary Fund, the renminbi accounts for approximately 1.93 percent of global foreign exchange reserves, compared with the dollar at 57 percent and the euro at 20 percent. In global trade finance, the yuan briefly overtook the euro last year to become the second-most-used currency, but its 5.8 percent market share pales beside the 82 percent dominance of the dollar.

Building Alternative Financial Infrastructure

Digital Currency and Cross-Border Systems

China has constructed a parallel financial architecture designed to reduce reliance on systems based on the dollar. At the center stands the Cross-Border Interbank Payment System (CIPS), which offers an alternative to the SWIFT messaging network that dominates international banking. In recent months, CIPS has expanded to offshore centers across Africa, the Middle East, and Central Asia. Standard Bank, the largest lender in Africa by assets, became the first on that continent to link directly into CIPS, allowing businesses to settle payments with China in renminbi without converting through dollars.

Complementing CIPS is the digital yuan, known as the Digital Currency Electronic Payment (DCEP). The People’s Bank of China has pioneered large-scale trials of this central bank digital currency, which operates on a two tiered structure allowing commercial banks to distribute digital wallets to end users. The system enables transactions without internet connections using near-field communication, and has been made interoperable with existing payment platforms including Alipay and WeChat Pay.

Currency swap agreements form another component of this strategy. Beijing has signed such arrangements with approximately 50 countries, enabling central banks to exchange local currencies for yuan on demand. These swaps provide critical liquidity for nations facing sanctions from the United States, such as Russia and Iran, while also supporting trade partners including Argentina, Pakistan, and Turkey. The mechanism allows bilateral trade to bypass dollar conversion entirely, settling instead in local currencies or renminbi.

Trade Settlement Gains

The most tangible progress in renminbi internationalization has occurred in trade settlement. Nearly one-third of the $6.2 trillion in global trade of China is now settled in yuan, up from 20 percent in 2022. When counting all cross border payments including bond purchases and foreign investment, the yuan share jumps to 53 percent, having overtaken the dollar for the first time in 2023 within the trade sphere of China.

Bilateral arrangements have proliferated across the Global South. Brazil and China now settle soy bean sales using the real and yuan. The United Arab Emirates and China trade liquefied natural gas in yuan. India and Russia have increased use of rupees and roubles for bilateral commerce. Energy trade between Russia and China now occurs predominantly in renminbi, a necessity born of Western sanctions that has nonetheless advanced the currency goals of Beijing.

Outbound lending from China has also shifted toward yuan denomination. External yuan holdings by Chinese banks have quadrupled to $480 billion in five years, representing a growing slice of the roughly $1 trillion Belt and Road Initiative lending portfolio. Countries including Kenya, Angola, and Ethiopia have converted existing dollar debts into yuan obligations to take advantage of interest rates that sit 200 to 300 basis points below dollar levels.

The Constraints of Control

Despite these advances, structural limitations prevent the renminbi from achieving genuine reserve currency status. China maintains strict capital controls that limit the free flow of money across its borders. Cross border transactions require government approval, and the exchange rate is managed daily by the People’s Bank of China within narrow trading bands. This closed capital account contradicts the requirements of a reserve currency, which must be fully convertible and freely floating to attract global investors seeking liquidity and stability.

The aversion of the Chinese Communist Party to financial risk creates a fundamental tension. Full liberalization would expose the domestic financial system to speculative attacks and reduce the ability of Beijing to direct credit flows within the economy. Banks owned by the state currently channel capital according to political priorities, a mechanism the party is unwilling to surrender. Without transparent legal systems, deep and liquid financial markets, and full convertibility, the renminbi cannot function as a true store of value for central banks worldwide.

Analysts suggest Beijing prefers this controlled approach. By maintaining tight supervision while expanding trade settlement, China gains the benefits of reduced dollar exposure without the volatility of open capital markets. The strategy prioritizes transactional utility for commerce over the financial market depth required for reserve status.

Geopolitical Strategy and the Slow Decline

The approach of China appears designed not to overthrow the dollar immediately, but to prepare for a prolonged period of fragmentation. By embedding the renminbi in trade with sanctioned nations and developing economies, Beijing creates a network of bilateral relationships that can survive potential future decoupling from Western financial systems. This represents insurance against scenarios where China itself might face coordinated sanctions, particularly regarding Taiwan or other flashpoints.

The decline of the dollar, meanwhile, follows what some analysts describe as a slow burn trajectory rather than sudden collapse. Central banks have doubled gold purchases since 2022, diversifying away from dollar assets while China has reduced its Treasury holdings to their lowest levels since 2008, now below $731 billion. These moves reflect declining trust in American political stability and fiscal management, with the national debt of the United States exceeding $38 trillion and nearly half requiring refinancing within two years.

President Trump’s recent comments welcoming dollar weakness, stating that depreciation makes United States exports more competitive, have further alarmed foreign investors. Though Treasury Secretary Scott Bessent subsequently reaffirmed commitment to a strong dollar policy, the contradiction highlights policy unpredictability that drives diversification.

Future Scenarios and Persistent Barriers

The nomination of Kevin Warsh to lead the Federal Reserve introduces additional variables. Warsh previously established a reputation as an inflation hawk during his earlier service at the Fed, though he has recently moderated positions to align with demands for lower interest rates. His potential leadership coincides with speculation about the Mar-a-Lago Accord, a theoretical framework for controlled depreciation of the dollar authored by Trump economic adviser Stephen Miran. Such managed decline might achieve competitiveness goals, but risks igniting capital flight from United States markets at a precarious moment for government financing.

For China, the immediate objective remains incremental expansion rather than dollar replacement. The renminbi has grown from 1.9 percent to 8.4 percent of global trade payments since 2020, and its use in bilateral trade continues climbing. Yet without the institutional foundations of open capital markets and legal transparency, it serves primarily as a settlement currency for commerce rather than a reserve asset for investment.

The BRICS nations continue exploring shared payment systems and potential digital currencies that could bypass both dollars and SWIFT. China and Russia promote these alternatives, though Trump has threatened 100 percent tariffs against any BRICS currency initiative. Such tensions suggest the global financial system is entering a phase of contested multipolarity, where the dollar maintains dominance but faces erosion at the margins by regional alternatives.

Key Points

- Xi Jinping’s 2024 speech published in Qiushi journal outlines ambitions for the renminbi to achieve global reserve currency status with a strong currency widely used in international trade.

- The dollar has fallen to four-year lows amid concerns over Trump administration trade policies and Federal Reserve leadership changes, creating an opening for renminbi promotion.

- Nearly 33 percent of the $6.2 trillion trade of China is now settled in yuan, with cross border payments reaching 53 percent, though the currency comprises only 2.4 percent of global reserves.

- China has expanded the Cross-Border Interbank Payment System (CIPS) to Africa and the Middle East, and advanced the digital yuan (DCEP) to reduce reliance on SWIFT and dollar systems.

- Strict capital controls, managed exchange rates, and closed capital accounts prevent the renminbi from achieving full convertibility required for true reserve currency status.

- Central banks worldwide are diversifying into gold and reducing dollar exposure, with China cutting Treasury holdings to below $731 billion, the lowest since 2008.