Malaysian Police Arrest Over 400 in Major Raid on Singapore-Linked Doo Group Amid Scam Crackdown

Authorities target Kuala Lumpur office of Manchester United sponsor as part of nationwide effort to combat financial fraud and online scams.

On August 26, 2025, Malaysian police arrested more than 400 people in Kuala Lumpur after raiding the office of Doo Group, a Singapore-based fintech company and sponsor of English Premier League club Manchester United. The large-scale operation, which unfolded at the company’s five-storey premises in the Bangsar South commercial district, is part of a broader crackdown on scam call centres and online fraud syndicates that have plagued Malaysia in recent years.

- Malaysian Police Arrest Over 400 in Major Raid on Singapore-Linked Doo Group Amid Scam Crackdown

- What Prompted the Raid on Doo Group?

- Doo Group’s Response and Ongoing Investigation

- Understanding Scam Call Centres and Financial Fraud in Malaysia

- The Manchester United Connection

- How the Raid Unfolded: Eyewitness Accounts and Social Media Reaction

- Broader Impact: Malaysia’s Fight Against Financial Crime

- What to Know

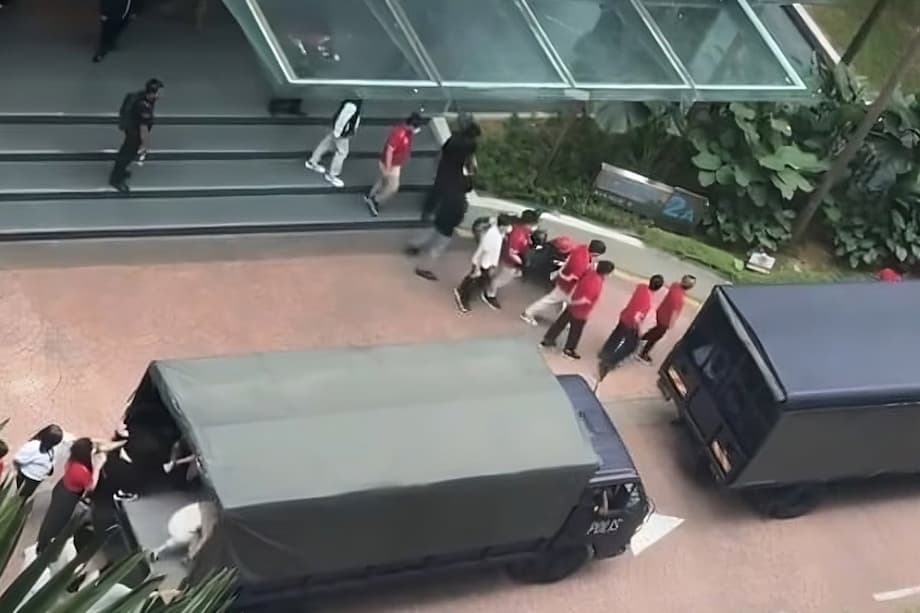

Officers swept through the building, detaining hundreds of suspects and transporting them in a convoy of police vans to the Travers Police Station in Bangsar for processing. The raid quickly drew public attention, with videos and photos circulating on social media showing detainees lined up and escorted into police vehicles, while officers carried out black plastic bags filled with seized items.

Kuala Lumpur police chief Fadil Marsus confirmed the operation and stated that investigations are ongoing due to the scale of the arrests. Authorities have not yet disclosed the nationalities of those detained, and a special press conference is expected soon to provide further details.

What Prompted the Raid on Doo Group?

The raid on Doo Group’s Kuala Lumpur office was part of a nationwide campaign by Malaysian authorities to dismantle illegal call centres and financial scam operations. According to Malaysia’s Home Affairs Minister Datuk Seri Saifuddin Nasution Ismail, police have arrested nearly 12,000 individuals in connection with almost 32,000 fraud cases so far in 2025, with losses estimated at RM1.5 billion (about $355 million).

Scam call centres have become a persistent issue in Malaysia, often operating out of luxury condominiums and commercial towers in Kuala Lumpur. These centres typically employ both local and foreign nationals and run a variety of fraudulent schemes, including investment scams, impersonation of government officials, and online gambling operations. Many of these scams target victims both within Malaysia and overseas, particularly in China and the wider Asia-Pacific region.

The Doo Group call centre in Malaysia reportedly serviced clients in China and across the Far East, supporting the group’s offshore brokerage arm, D Prime (formerly Doo Prime). The company also operates licensed businesses in Cyprus and the UK, and is controlled by Chinese national Junjie Chen.

While police have not publicly linked Doo Group to specific fraudulent activities, the scale of the raid and the number of arrests highlight the authorities’ determination to disrupt large-scale scam operations. The incident has also sparked online speculation, with some social media users claiming that Malaysian employees at Doo Group were among those arrested, despite being unaware of any alleged wrongdoing.

Doo Group’s Response and Ongoing Investigation

In the aftermath of the raid, Doo Group issued statements to reassure clients, partners, and stakeholders that its operations remain fully compliant with regulatory requirements. The company confirmed that its office in Bangsar South was visited by police as part of the nationwide crackdown and emphasized that it is cooperating transparently with authorities by providing all requested information and documents.

A spokesperson for Doo Group stated:

As part of a broader nationwide campaign against illegal call centres, Malaysian authorities recently conducted inspections at several business premises, including ours. We would like to reassure our clients, partners, and stakeholders that our operations remain fully compliant, and we are working transparently and constructively with the authorities by providing all the information required. Compliance, integrity, and accountability are fundamental to the way we operate. We are confident that our strong governance standards will ensure this matter is clarified and resolved swiftly.

The company also highlighted that its Malaysian office is primarily involved in client servicing operations and that the inspection was routine within the wider sweep against illegal call centres. Doo Group’s business, according to its statements, continues as normal, and the firm maintains that it has not engaged in any wrongdoing.

Despite these assurances, the investigation remains active, and authorities have not ruled out further action. Malaysian police have warned building owners and landlords that they could face conspiracy charges if they knowingly host scam call centres on their premises.

Understanding Scam Call Centres and Financial Fraud in Malaysia

Scam call centres are organized operations that use phone calls, emails, and online platforms to defraud individuals and businesses. In Malaysia, these centres have become increasingly sophisticated, often masquerading as legitimate businesses or financial service providers. Common scams include:

- Investment fraud: Promising high returns through fake investment schemes, often involving forex or cryptocurrency trading.

- Impersonation scams: Posing as government officials, police officers, or bank representatives to trick victims into revealing personal information or transferring money.

- Online gambling: Running illegal betting operations targeting both local and international clients.

Authorities have noted that many of these operations are staffed by foreign nationals and target victims in other countries, especially China. The syndicates use advanced technology, including artificial intelligence, to automate calls and evade detection. The scale of the problem is significant, with nearly 12,000 arrests and RM1.5 billion in losses reported in 2025 alone.

Malaysia’s crackdown on scam call centres is part of a broader regional effort to combat cybercrime and financial fraud. Similar raids have taken place in other countries, including Singapore, Hong Kong, and Cyprus, often targeting unlicensed forex brokers and online trading platforms.

Regulatory Scrutiny of Online Brokers and Trading Platforms

The raid on Doo Group comes amid growing scrutiny of online brokers and trading platforms across Asia. Regulators have raised concerns about aggressive offshore marketing, unlicensed operations, and the blurring of lines between legitimate back-office functions and illegal solicitation.

Doo Group operates several licensed subsidiaries, including Doo Clearing Limited (FCA-authorized in the UK) and Doo Financial Cyprus Limited (licensed by CySEC in the EU). Its offshore brokerage arm, D Prime, is domiciled in Mauritius and Vanuatu and primarily targets traders in China and the Asia-Pacific region. The group also holds licenses in Hong Kong and has expanded its presence globally through partnerships and sponsorships, most notably with Manchester United.

Despite its regulatory footprint, Doo Group has faced complaints from users in Malaysia and elsewhere, particularly regarding difficulties withdrawing funds and concerns about unlicensed investment schemes. In 2021, Bank Negara Malaysia flagged the Doo Prime Malaysia Berhad Investment Scheme in its Financial Consumer Alert update, warning the public about potential risks.

The Manchester United Connection

Doo Group’s sponsorship of Manchester United has brought additional attention to the case. The fintech firm became an official online financial trading partner of the football club in 2023 and extended the partnership into a third season in 2025. The collaboration includes co-branded merchandise, exclusive events, and special discounts for fans and clients.

Through its partnership, Doo Group aims to boost brand awareness and align itself with Manchester United’s values of discipline, teamwork, and determination. The company has distributed thousands of branded items across its offices and offers employees a 10% discount at the United Direct Store. Manchester United previously stated that it was impressed by Doo Group’s focus on technology and strong brand values when selecting it as a partner.

The high-profile sponsorship has, however, also made the company a target for scrutiny, especially in light of the recent police raid and ongoing investigation. Manchester United has not commented publicly on the incident, but the association has fueled public interest and media coverage of the case.

How the Raid Unfolded: Eyewitness Accounts and Social Media Reaction

The raid on Doo Group’s office in Bangsar South was a dramatic event that played out in full view of the public. Eyewitnesses described seeing large groups of men and women being led out of the building and loaded into police vans. Officers were observed carrying out bags of evidence, and the operation continued into the evening as more police trucks arrived to transport additional detainees.

Footage of the raid quickly went viral on social media, with bystanders sharing videos and photos of the scene. Some job seekers who had applied for positions at Doo Group, such as Data Engineer and Senior Data Analyst, expressed shock at the news, while others who were not hired felt relieved after learning about the police investigation.

Online speculation also linked the raid to complaints about Doo Prime, the group’s brokerage arm, which had reportedly faced user complaints about fund withdrawals and was not licensed by Bank Negara Malaysia. The incident has sparked debate about the risks associated with working for or investing in companies operating in the online trading and fintech sectors.

Broader Impact: Malaysia’s Fight Against Financial Crime

The raid on Doo Group is part of a larger effort by Malaysian authorities to tackle financial crime and protect consumers from scams. Police have intensified their focus on call centres and online fraud syndicates, using new technologies and intelligence-sharing to identify and dismantle criminal networks.

Home Affairs Minister Saifuddin Nasution Ismail has emphasized the need for law enforcement to improve their skills and adopt advanced tools, including artificial intelligence, to combat cybercrime. Authorities have also warned that building owners and landlords could face legal consequences if they knowingly allow scam operations to operate on their premises.

Regulators across Asia are also stepping up oversight of online brokers and trading platforms, with several countries taking action against unlicensed operators and fraudulent investment schemes. The crackdown reflects growing concerns about the risks posed by financial scams, particularly those that exploit new technologies and target vulnerable individuals.

What to Know

- Malaysian police arrested over 400 people in a raid on Doo Group’s Kuala Lumpur office on August 26, 2025, as part of a nationwide crackdown on scam call centres and financial fraud.

- Doo Group is a Singapore-based fintech company and sponsor of Manchester United, with operations across Asia, Europe, and the Middle East.

- The company has confirmed it is cooperating with authorities and maintains that its operations are fully compliant with regulations.

- Authorities have not disclosed the nationalities of those detained, and investigations are ongoing, with a press conference expected soon.

- Scam call centres and online fraud syndicates have caused significant financial losses in Malaysia, prompting a major law enforcement response.

- Regulators and police across Asia are increasing scrutiny of online brokers and trading platforms amid rising concerns about financial crime.