US Imposes 93.5% Tariff on Chinese Graphite: A Turning Point for EV Batteries

The United States has taken a dramatic step in its ongoing trade battle with China by imposing a 93.5% tariff on Chinese graphite, a raw material critical to the production of electric vehicle (EV) batteries. This move, announced by the US Commerce Department, is poised to reshape the global EV supply chain, impact car prices, and accelerate efforts to build a domestic battery materials industry. But it also raises questions about the future affordability and adoption of electric vehicles in America.

- US Imposes 93.5% Tariff on Chinese Graphite: A Turning Point for EV Batteries

- Why Did the US Impose Such a Steep Tariff?

- What Does This Mean for the US EV Industry?

- Global Supply Chain Shockwaves

- Will the Tariff Slow Down EV Adoption?

- Industry and Environmental Implications

- What’s Next for Automakers, Battery Makers, and Consumers?

- In Summary

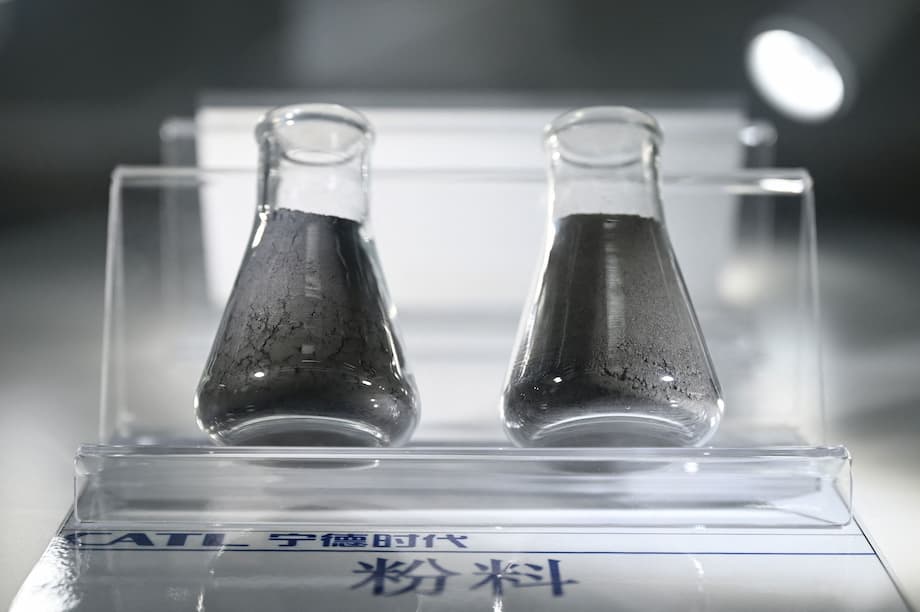

Graphite is the unsung hero of the EV revolution. Every lithium-ion battery—the heart of an electric car—relies on graphite for its anode, the part of the battery that stores and releases energy. China currently dominates the global graphite market, supplying about 75% of the world’s refined graphite and nearly two-thirds of US imports. The new tariff, combined with existing duties, could push the total levy on some Chinese graphite products to as much as 160%.

Why Did the US Impose Such a Steep Tariff?

The Commerce Department’s decision follows an investigation into allegations that Chinese companies were “dumping” graphite in the US market—selling it below fair market value, often with the help of government subsidies. This practice, US officials argue, undercuts American producers and threatens the development of a domestic supply chain for critical minerals.

The American Active Anode Material Producers, a coalition of US and Canadian graphite suppliers, petitioned for the tariffs. They claim that Chinese overproduction and aggressive exports have made it nearly impossible for American companies to compete or scale up. The Commerce Department agreed, issuing a preliminary ruling that Chinese graphite imports were indeed being dumped and unfairly subsidized.

“Dumping is a malicious trade practice used by China to undercut competition and wield geopolitical influence,” the trade group said in a statement applauding the decision.

How the Tariff Works

The 93.5% anti-dumping duty applies to anode-grade graphite with at least 90% carbon purity, whether synthetic, natural, or blended. A parallel investigation into Chinese government subsidies resulted in an additional preliminary countervailing duty of 6.55% for most producers, with much higher rates for a few specific companies. The combined effect could mean some Chinese graphite faces tariffs of about 160% when entering the US.

The order is preliminary, but importers must pay the duties immediately. If the final determination, expected by December 2025, reverses the finding, companies could receive refunds.

What Does This Mean for the US EV Industry?

The tariff comes at a time of major policy shifts in the US EV sector. The Trump administration has moved to eliminate or recall federal loans for EV factories and battery plants and signed a bill ending the $7,500 tax credit for EV buyers. These changes, combined with the new graphite tariff, could significantly raise the cost of building and buying electric vehicles in the US.

Graphite itself is not the most expensive part of a battery—accounting for less than 8% of the total cost, according to Panasonic. However, batteries are the single most expensive component in an EV, and the price of graphite can have a ripple effect. Analysts estimate that doubling the cost of graphite could add $1,000 or more to the price of a battery pack, potentially raising EV sticker prices for consumers.

Automakers and battery manufacturers are already feeling the pressure. Tesla, Ford, Panasonic, and LG Energy Solution all rely heavily on Chinese graphite for their US battery plants. During the tariff investigation, Tesla and other companies argued that American suppliers simply cannot yet produce the high-purity graphite needed for advanced batteries at commercial scale.

Tesla attorney Matt Nicely told officials, “Lithium-ion battery producers demand graphite with a 99.9 percent carbon purity level, meaning extremely low metallic impurities. Not a single US producer is able to produce graphite to these exacting specifications. Domestic producers cannot blame imports when they are not yet able to produce the product the market demands.”

Even US graphite producers admit it will take time to catch up. Mike O’Kronley, CEO of Novonix, a Chattanooga-based graphite manufacturer, said, “This material takes a long time to develop and qualify to be used in batteries. So it’s not very easy to switch or change supply. Tariffs will not have an immediate effect with changing supply. But we will see changes over time and the development of a US industry is going to happen now, or it’s going to be accelerated.”

Global Supply Chain Shockwaves

The US is not alone in feeling the impact of the new tariffs. Korean battery makers, who supply US automakers and rely on Chinese graphite, are bracing for higher costs. Companies like LG and Samsung SDI are exploring alternative suppliers and considering how to absorb or pass on the increased expenses. The situation highlights the vulnerability of global supply chains and the challenges of shifting away from Chinese dominance in battery materials.

Meanwhile, the tariff announcement sent shockwaves through financial markets. Shares of non-Chinese graphite producers, such as Australia’s Syrah Resources and Canada’s Nouveau Monde Graphite, soared as investors bet on a surge in demand for alternative sources. US-based Westwater Resources, which is building a graphite plant in Alabama, saw its stock jump 15% and announced plans to expand production capacity to 50,000 tons annually by 2028.

Yet, the global graphite market remains highly concentrated. Nearly 180,000 metric tons of graphite products were imported into the US last year, with about two-thirds coming from China. The International Energy Agency has warned that graphite is one of the most supply-risk-exposed battery materials, making diversification an urgent priority for countries seeking energy security and clean technology leadership.

Will the Tariff Slow Down EV Adoption?

One of the biggest questions is whether the new tariff will slow the transition to electric vehicles in the US. EV adoption has been growing steadily, with 1.2 million Americans buying electric cars in 2023 (about 7.6% of the vehicle market). But affordability remains a major hurdle: the average EV sold for $52,345 in late 2023, compared to $48,247 for all vehicles. The loss of the federal tax credit and higher battery costs could make it even harder for EVs to reach price parity with gasoline cars.

Some analysts believe the overall impact on EV pricing will be limited in the short term, since graphite is a relatively small part of the battery cost and automakers may absorb some of the increase. Others warn that any added expense could slow adoption, especially for lower-priced models that appeal to mainstream buyers.

There’s also a strategic calculation at play. By raising tariffs, the US government hopes to buy time for domestic automakers and battery suppliers to catch up with Chinese competitors, who are ahead in both technology and supply chain integration. The tariffs are intended to prevent China from flooding the US market with cheap batteries and cars, which could undermine American manufacturing jobs and national security.

Industry and Environmental Implications

The graphite tariff is just one piece of a broader effort to secure the US supply chain for critical minerals and clean energy technologies. In recent years, both the Trump and Biden administrations have taken steps to encourage domestic mining, processing, and manufacturing of battery materials, including lithium, nickel, cobalt, and rare earth elements.

However, building a robust domestic graphite industry will not happen overnight. It requires significant investment, technical expertise, and time to develop the ultra-high-purity graphite needed for advanced batteries. Companies like Westwater Resources and Novonix are ramping up production, but experts say it could take years before US suppliers can meet the full demand of the EV industry.

In the meantime, the tariff could have unintended consequences for the clean energy transition. Higher battery costs may slow the rollout of renewable energy storage projects, which rely on the same lithium-ion technology as EVs. Supply chain risks and price volatility could also deter investment in new manufacturing plants and infrastructure.

China’s Response and the Geopolitical Chessboard

China has not yet announced retaliatory measures, but the move is likely to further strain US-China relations. Beijing has already imposed export controls on some critical minerals and battery technologies, raising the specter of a broader trade war over clean energy. The US and its allies are racing to diversify supply chains and reduce dependence on Chinese materials, but the process is complex and fraught with challenges.

What’s Next for Automakers, Battery Makers, and Consumers?

For now, US automakers and battery manufacturers will have to pay more for the graphite they need, unless they can quickly find alternative suppliers. Some may try to pass the cost on to consumers, while others may absorb it to stay competitive. The tariff provides a strong incentive for investment in domestic graphite production, but the transition will take time.

Consumers considering an electric vehicle may face higher prices and fewer incentives in the near term. However, the long-term goal is to build a more resilient, secure, and competitive US battery industry—one that can support the growth of clean transportation and renewable energy for decades to come.

In Summary

- The US imposed a 93.5% tariff on Chinese graphite, a key material for EV batteries, citing unfair trade practices and dumping.

- The tariff, combined with existing duties, could raise the total levy on some Chinese graphite products to 160%.

- China supplies about 75% of the world’s graphite and nearly two-thirds of US imports, making the US EV industry highly dependent on Chinese materials.

- Automakers and battery makers warn that US suppliers cannot yet produce enough high-purity graphite to meet demand, so costs will rise in the short term.

- The move is part of a broader effort to build a domestic supply chain for critical minerals and protect American manufacturing jobs.

- Higher battery costs and the loss of federal tax credits could slow EV adoption and make electric cars less affordable for US consumers.

- The tariff has sent shockwaves through global supply chains and financial markets, benefiting non-Chinese graphite producers.

- Building a robust US graphite industry will take years, but the tariff provides a strong incentive for investment and innovation.

- The decision escalates trade tensions with China and could have far-reaching implications for the global clean energy transition.