Vietnam’s Historic Digital Cash Payout: A National Celebration and a Digital Leap

In a move that blends national celebration with digital transformation, the Vietnamese government is distributing approximately 11 trillion dong (about US$430 million) in state-funded cash gifts to every citizen—over 106 million people. Each person will receive 100,000 dong (roughly US$4), either in cash or via electronic transfer through bank accounts linked to VNeID, the country’s official digital identification platform. This unprecedented initiative, timed to mark the 80th anniversary of the August Revolution and National Day, is more than a festive gesture: it is a strategic push to accelerate Vietnam’s digital transformation and financial inclusion agenda.

- Vietnam’s Historic Digital Cash Payout: A National Celebration and a Digital Leap

- What Is VNeID and Why Is It Central to Vietnam’s Digital Future?

- Financial Inclusion: Reaching Every Corner of Vietnam

- Vietnam’s Digital Banking Ecosystem: Growth, Challenges, and Opportunities

- VNeID as a Super App: The Next Stage of Digital Governance

- Regional and Global Context: How Does Vietnam Compare?

- Challenges and the Road to Universal Adoption

- In Summary

Prime Minister Pham Minh Chinh has directed that the payout be completed before National Day on September 2, with local banks and government agencies mobilized to guide citizens through the process of linking their bank accounts to VNeID. The campaign is not only a logistical feat but also a bold experiment in using digital incentives to drive adoption of national digital identity infrastructure.

What Is VNeID and Why Is It Central to Vietnam’s Digital Future?

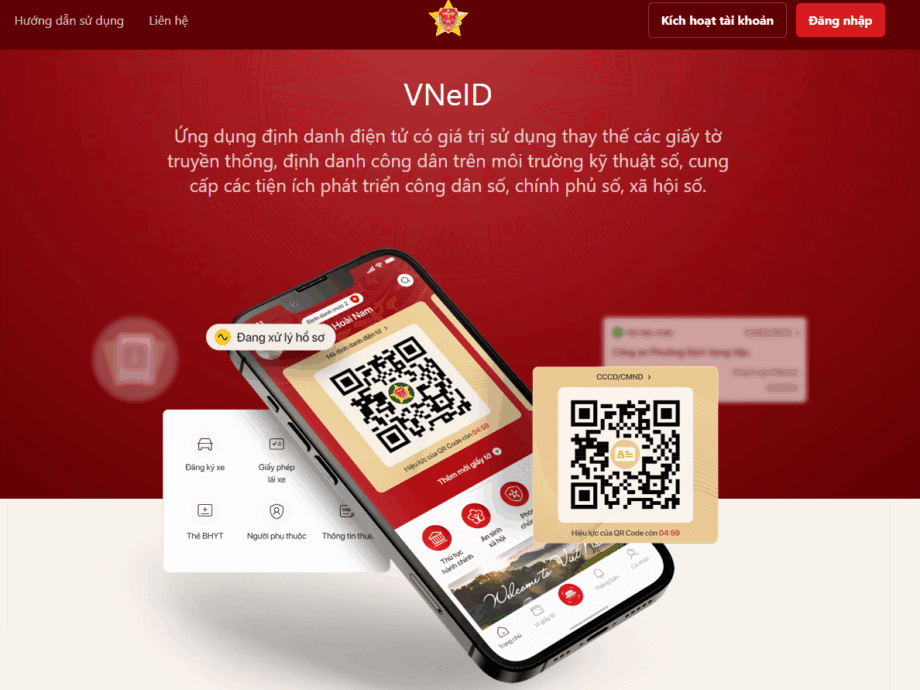

VNeID, operated by the Ministry of Public Security and integrated with the National Population Database, is Vietnam’s official digital identification platform. Originally launched during the Covid-19 pandemic to facilitate movement tracking and public health measures, VNeID has rapidly evolved into a cornerstone of the country’s digital government ecosystem. Today, it offers citizens access to a growing array of public services, from administrative documents and social welfare to digital payments and biometric authentication.

The government’s ambition is to transform VNeID into a “super app”—a single, secure gateway for everything from banking and healthcare to education and e-government. This vision echoes successful models in countries like Estonia, Singapore, and India, where digital ID platforms have become the backbone of digital societies.

How Does VNeID Work?

VNeID is a mobile application built on a national identity, residency, and electronic verification database. Citizens can register for an account, verify their identity (including biometric data such as facial recognition and fingerprints), and link their bank accounts and other personal records. The platform supports digital signatures, health records, and is being upgraded to include utility bill payments, pension disbursements, and even stock market transactions.

For the current cash payout, citizens are encouraged to link their bank accounts to VNeID, enabling direct electronic transfers. Local banks, such as Sacombank, have launched features to help customers link or update their accounts within the app, making it easier to receive government benefits and social security payments.

Biometric Authentication: Security and Trust

Vietnam is at the forefront of integrating biometric authentication into its digital ID and banking systems. Starting January 1, 2025, biometric verification—using facial recognition and fingerprints—will be mandatory for certain online banking transactions. This move aims to combat fraud, eliminate anonymous accounts, and enhance customer safety. Already, platforms like VNPT process an average of 600,000 biometric KYC (Know Your Customer) checks daily, serving over 100 financial institutions and digitally identifying more than 40 million people.

Deputy Governor Pham Tien Dung of the State Bank of Vietnam emphasized the importance of biometric authentication, stating, “Implementing biometric authentication to verify account holders against Ministry of Public Security identification records is crucial for eliminating fraudulent accounts and enhancing customer safety.”

Banks are actively assisting customers in updating their biometric data, with millions already complying. Those who do not update by the deadline will face restrictions on online transactions and ATM usage.

Financial Inclusion: Reaching Every Corner of Vietnam

Vietnam’s digital cash payout is not just about technology—it is a powerful tool for financial inclusion. By requiring citizens to link their bank accounts to VNeID, the government is encouraging millions who may have never used digital banking to take their first steps into the formal financial system. This is especially significant in a country where cash remains dominant, particularly among low-income families, rural communities, and street vendors.

According to the State Bank of Vietnam, digital transactions rose by more than 85% year-over-year in 2022, with mobile transactions representing nearly 78% of the total. Yet, cash is still widely used, and many rural residents lack access to banking services. The digital payout, therefore, serves as both an incentive and an educational campaign, familiarizing citizens with digital tools and building trust in the system.

Experts compare Vietnam’s approach to similar schemes in Thailand and China, where digital wallet giveaways and central bank digital currency (CBDC) pilots have been used to promote digital payments. In Vietnam, the initiative is also likened to blockchain “airdrops” and fintech app incentives, which have proven effective in driving user adoption.

Practical Implementation: Linking Bank Accounts and Social Security

Banks like Sacombank have streamlined the process for customers to link their accounts to VNeID, enabling direct receipt of social security payments, pensions, unemployment benefits, and other government transfers. The process is simple: log in to VNeID, select the relevant service, enter your bank account details, and authorize data sharing. This integration not only speeds up benefit delivery but also reduces administrative costs and the risk of fraud.

For those without smartphones or digital literacy, banks and local authorities provide in-person support, ensuring that no one is left behind in the digital transition.

Vietnam’s Digital Banking Ecosystem: Growth, Challenges, and Opportunities

Vietnam is one of Southeast Asia’s fastest-growing markets for mobile banking and digital payments. Smartphone penetration exceeds 80%, and urban youth adoption of mobile banking is near saturation. Major banks such as Techcombank, MB Bank, Vietcombank, VietinBank, and BIDV have invested heavily in mobile apps offering savings, investments, QR code payments, and more. E-wallets like MoMo, ZaloPay, VNPay, and ViettelPay are also key players, with MoMo boasting over 31 million users and 140,000 acceptance points.

Adoption drivers include:

- High smartphone penetration

- Supportive government policy

- Widespread merchant acceptance of QR payments

- Mobile banking’s ability to reach underserved communities

Security is a top concern, with banks employing two-factor authentication, device fingerprinting, behavioral analytics, and end-to-end encryption. Partnerships with global players like Visa and Mastercard have further enhanced standards and interoperability.

However, challenges remain. Rural penetration is hindered by connectivity and literacy issues, and the market is fragmented with many competing apps. Regulatory complexity, especially with the introduction of VNeID and new biometric requirements, adds to the burden. Consumer protection and cybersecurity are ongoing concerns, particularly as digital banking expands beyond urban centers.

Regulatory and Technological Innovations

The Vietnamese government is actively modernizing legal frameworks, upgrading payment systems, and fostering partnerships for skill development. The State Bank of Vietnam has introduced new regulations requiring biometric authentication for large transactions, and a database of suspicious accounts is being developed to combat fraud. The Ministry of Finance is also working on legal frameworks for virtual assets and services.

These efforts are supported by public awareness campaigns, educational programs, and international cooperation, making Vietnam one of Southeast Asia’s most ambitious digital transformation stories.

VNeID as a Super App: The Next Stage of Digital Governance

The vision for VNeID extends far beyond identity verification. The government aims to make it a super app that provides seamless access to almost every public service and financial product. Recent upgrades have added digital signatures, health records, and integration with banking transactions for biometric authentication. Plans are underway to include utility bill payments, stock market transactions, and more.

This approach mirrors trends across Asia, where digital wallets are evolving into multifaceted platforms that combine payments, identity, and access to government services. India’s Aadhaar, Singapore’s Singpass, and China’s Alipay are leading examples. In Vietnam, VNeID is positioned to unify digital identity and payments, supporting the country’s goal of becoming an upper-middle-income nation by 2030.

Data as a Strategic Resource

Vietnam’s National Data Strategy recognizes data as a key resource for digital transformation. The information collected through VNeID and related campaigns is seen as a valuable asset, enabling better policy-making, targeted social programs, and economic transparency. By integrating data across government agencies and financial institutions, Vietnam hopes to build a smarter, more efficient public sector and foster innovation in the private sector.

Regional and Global Context: How Does Vietnam Compare?

Vietnam’s digital transformation is part of a broader regional trend. Across Asia, governments are leveraging digital identity and payments to drive financial inclusion, improve security, and streamline public services. Digital wallets now have 4.8 billion users globally, with over 60% in Asia-Pacific. Countries like India, Indonesia, and the Philippines are integrating digital ID with payment systems, enhancing security and access while building trust in digital ecosystems.

Vietnam’s approach stands out for its scale and ambition. The nationwide cash payout, combined with mandatory biometric authentication and the push to make VNeID a super app, positions the country as a regional leader in digital government innovation. The integration of identity and payments is reshaping economic participation and digital security, with implications for everything from social welfare to e-commerce.

Lessons from Other Countries

India’s Aadhaar infrastructure connects millions of bank accounts and improves benefit delivery, while China’s Alipay and WeChat Pay have integrated digital ID for secure transactions. Singapore’s Singpass now includes payment services, and Indonesia’s Digital Population Identity aims to unify identity and financial transactions. These examples highlight the importance of interoperability, security, and public-private collaboration in building trusted digital ecosystems.

Challenges and the Road to Universal Adoption

Despite impressive progress, Vietnam faces significant challenges on its digital journey. Outdated regulations, infrastructure gaps, cybersecurity threats, and a shortage of digital talent must be addressed. Many rural residents still lack identity credentials or access to smartphones, and concerns about data privacy and consumer protection persist.

The government is responding with updated legal frameworks, investments in digital infrastructure, and public education campaigns. Banks and fintech firms are innovating with new products and services, while partnerships with global players are raising standards and interoperability. The success of the digital cash payout and VNeID adoption will depend on continued collaboration between government, industry, and civil society.

In Summary

- Vietnam is distributing 11 trillion dong in cash gifts to all citizens, using the VNeID digital ID platform to promote financial inclusion and digital adoption.

- VNeID is evolving into a super app, integrating identity verification, banking, social security, and public services.

- Biometric authentication will become mandatory for certain banking transactions from 2025, enhancing security and combating fraud.

- The initiative is part of a broader digital transformation strategy, aiming to build a digital economy and society by 2030.

- Vietnam’s approach mirrors successful models in Asia, positioning the country as a leader in digital government innovation.

- Challenges remain, including rural access, cybersecurity, and regulatory complexity, but ongoing reforms and investments are paving the way for universal adoption.