A fragile truce in a high stakes tech race

After months of tariff hikes, export restrictions, and tense rhetoric, Washington and Beijing are easing toward a limited truce. The pause offers a clear view of what has changed. China has moved from fast follower to full spectrum technology power. The United States still leads in foundational science and many frontier capabilities. The rivalry now runs through factories, research labs, data centers, and shipping lanes. It touches how countries source energy, store data, and design the rules that govern the digital world.

- A fragile truce in a high stakes tech race

- How China built speed and scale

- AI with Chinese characteristics

- Where the United States still leads

- The costs of sharp decoupling

- What the United States can learn and do now

- Areas where cooperation still makes sense

- What it means for the rest of the world

- Key Points

China’s rise did not happen by accident. The country spent two decades building unrivaled hardware capacity, from smartphones and telecom gear to solar panels, batteries, and electric vehicles. It combined long term industrial planning with fierce market competition at home. The result is speed, scale, and a dense network of suppliers that can turn ideas into mass production quickly. That momentum is visible in the dominance of Chinese solar modules and battery cells, the rapid climb of Chinese electric car makers, and a growing presence in industrial robots and high speed rail.

The United States has responded with export controls, investment screening, and new subsidies for strategic industries. Those tools slowed some transfers of cutting edge chips and manufacturing tools. They also pushed companies to diversify supply chains. Yet policy alone does not determine who wins the next phase. The real contest is about who can convert science into production, deploy trustworthy infrastructure at scale, and set standards that others adopt.

In a party statement outlining the next five year plan, Chinese leader Xi Jinping framed the moment as a sprint for advantage in strategic technologies. He signaled a determination to press ahead on advanced manufacturing and to use state tools to secure critical inputs.

China must seize the window of opportunity to consolidate and expand strengths, break past bottlenecks, and gain the strategic initiative. The government will adopt extraordinary measures to pursue breakthroughs in key technologies and will improve export control and security review mechanisms.

The message captures Beijing’s model: align funding, regulation, and logistics behind clear goals, then scale production fast. It also points to sharper use of export rules and mineral stockpiles. That is a reminder that technology power is inseparable from control over materials, energy, and ports.

How China built speed and scale

China combined national strategy with a ground level ecosystem that prizes fast iteration. The country’s manufacturing hubs concentrate suppliers, skilled labor, and logistics in tight clusters. That density lets companies move from design to tooling to assembly with little friction. It also reduces costs and shortens time to market.

Manufacturing muscle and supply chains

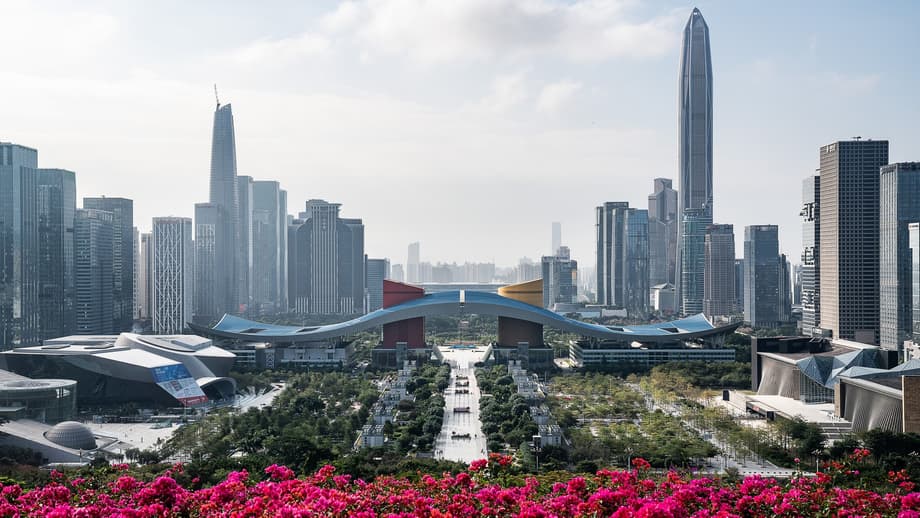

Shenzhen is the emblem of this model. What began as a small fishing town now anchors a hardware ecosystem that stretches from circuit board shops to precision tooling and final assembly. The Huaqiangbei district, once famous for copycat gadgets, now functions as a marketplace for components, prototypes, and new ideas. Entrepreneurs can source parts, test designs, and place small batch orders in days. Companies like Huawei and DJI grew in this environment, learning to iterate quickly and to scale production with confidence.

Chinese suppliers dominate the stages of clean energy manufacturing. Their share of global solar panel production sits well above any other country. Battery cell, module, and pack production is concentrated in Chinese plants. The same pattern is emerging in wind turbine components and power electronics. Scale brings experience, and experience reinforces scale. Factories refine processes, cut defects, and squeeze costs. Buyers around the world then select the lowest price and most available option, which often arrives from Chinese ports.

Local competition and the push to go global

Inside China, competition is relentless. The phenomenon often described as involution means firms race to match features, cut prices, and release new models in quick cycles. Local governments act like patient investors. They offer land, tax breaks, and infrastructure to lure factories and research centers. That support can be uneven and sometimes wasteful, yet it helps companies survive the toughest stretch of scaling up. The outcome is a market where only the fastest and leanest endure. Winners then look outward for growth, entering Southeast Asia, the Middle East, Europe, and Latin America with affordable products and strong after sales support.

Electric vehicles show how this formula works. Domestic demand in China is large, supported by charging networks and consumer acceptance of software rich cars. Chinese makers pushed into smaller cities and built strong service networks. With volume at home, they took competitive models abroad. Global rivals now face a competitor that controls batteries, drives down costs, and updates vehicles with frequent software improvements.

AI with Chinese characteristics

Artificial intelligence sits at the center of the next phase of competition. The United States leads in frontier model research and private investment. China is advancing through scale, energy planning, and a focus on practical deployment. Both paths shape how AI will reach factories, hospitals, city services, and farms.

Energy and infrastructure design

AI demands electricity for training and inference, and for cooling the racks that run nonstop. In the United States, energy pricing is market driven with large regional differences. Data center developers negotiate for supply, often via long term contracts. Grid constraints are real. A failure in a surge protection system took down a cluster of data centers in Northern Virginia in 2024, a sign of how tight the margins can be when clusters grow fast.

China’s approach pairs industrial policy with grid planning. The Eastern Data, Western Computing program steers hyperscale data centers to regions with abundant hydro and wind power. The placement reduces strain in the east and brings investment to inland provinces. Provincial planners align power upgrades, fiber links, and water access for cooling. The result is a system built to scale in step with AI adoption.

Open source and model access

China’s AI community has embraced open source practices. Companies and labs share model weights, training recipes, and optimization methods for inference on limited hardware. That openness accelerates practical solutions such as AI customer service, industrial quality inspection, education tools, and on device assistants. The release of large language models like DeepSeek in early 2025 drew global developers into Chinese projects. Open model access lets small firms and universities fine tune systems without massive budgets.

Open source also carries tradeoffs. Wider access spreads capabilities across borders and lowers entry costs for less resourced actors. Policymakers in many capitals are weighing how to encourage innovation while protecting security and privacy. A balanced regime would separate truly sensitive technologies from routine research and would avoid blanket restrictions that slow progress.

Chips and a shifting export control landscape

Semiconductors remain the most contentious arena. United States controls still target high performance chips and the tools needed to make them. Yet Chinese producers are closing some gaps. Huawei’s Ascend 910 class accelerators now approach the capabilities of earlier generation United States chips and ship with attractive software stacks. If Chinese firms raise yields and keep prices low, buyers outside elite AI labs may choose them for training and inference clusters.

Washington has recalibrated how it tries to slow AI proliferation. Rather than attempting to seal off entire markets, it is moving toward managing where advanced systems go and how they are used. That shift reflects industry pressure and the reality that third countries can now choose between Chinese and United States supply. Policy consistency will matter. If rules swing from strict to permissive and back again, global firms will hedge by building parallel stacks.

Where the United States still leads

The United States retains strengths that matter for the long run. Research universities, national labs, and deep capital markets form a pipeline that turns ideas into companies. Top platform companies train the most capable general purpose AI models. Software talent, chip architecture expertise, and open research communities remain world class.

Frontier research and private capital

Private investment in AI in the United States outpaces China by a wide margin. That capital funds chip design, cloud services, and specialized models for science and defense. Startups target new materials, biotech, and fusion using AI for discovery. These frontier areas play to United States strengths in interdisciplinary research and high risk funding.

Allied standard setting and values

Coalitions are another advantage. When the United States aligns policies with partners in Europe and Asia, it helps shape standards for security, privacy, and safety. Open digital environments support innovation and honest debate. They can also create vulnerabilities, such as exposure to disinformation or data theft. Democratic governments that coordinate export controls, supply chain security, and privacy rules can protect citizens while keeping markets dynamic.

The costs of sharp decoupling

Some separation between the two systems is already underway. Both countries screen investments and block specific technologies that carry security risks. Targeted controls can make sense. A general unraveling of trade and tech ties carries heavy costs for both sides and for the rest of the world.

Security tradeoffs

Blocking equipment from networks or banning specific apps reduces certain risks. It also creates real expenses for smaller carriers and companies that relied on low cost gear. Replacing installed base hardware is slow and costly. Reciprocal measures are likely. If Beijing responds by limiting market access or by tightening its own export rules, global firms get caught between legal regimes.

Supply chain and market effects

Semiconductor supply chains are the clearest pain point. If controls motivate China to invest even more in domestic tools and materials, the long term effect could be faster development of competing supply. Foreign producers might then lose share in what remains the largest end market for electronics. Fragmented standards and duplicated ecosystems lower efficiency and can reduce global growth. Countries that would prefer to buy the best product for the job may find that their choices are narrowed by rules from two capitals.

What the United States can learn and do now

China’s ascent highlights practical lessons that fit United States strengths. The goal is not to copy China’s system. It is to tighten the loop from lab to factory, secure inputs, and make innovation tangible in everyday industries.

Hardware know how and factory speed

Product leadership often depends on how fast teams can iterate on physical designs. That means reviving hands on engineering skills, scaling advanced packaging and assembly, and shortening the distance between designers and shop floors. Public support for industrial apprenticeships, regional prototyping hubs, and small batch manufacturing can help ideas reach customers faster.

Power for the AI era

AI growth will be constrained by electricity as much as by model architecture. The United States can expand clean generation, streamline interconnects for data center clusters, and pair new capacity with grid upgrades. Long term power contracts, energy storage, and waste heat reuse can stabilize operations and cut costs. Planning should tie data infrastructure, fiber, and water use to local conditions.

Open source and practical AI

Open ecosystems speed learning. Agencies and companies can support responsible open source models, tools, and data sets that small developers can adapt. Procurement can prioritize AI that solves concrete problems in health, education, and public services. That approach rewards efficiency and real world value, not only benchmark scores.

More resilient chip supply

Diversifying fabrication, packaging, and materials across allied economies will reduce the risk of single points of failure. Clear, narrow export rules that focus on the most sensitive capabilities will be more effective than broad bans. Coordination with partners on screening and licensing can close loopholes without choking off routine industrial collaboration.

- Invest in regional prototyping centers that link designers to suppliers and contract manufacturers.

- Expand skilled immigration and streamline visas for engineers, researchers, and technicians.

- Adopt common standards with allies on privacy, safety, and security that align with open markets.

- Use government demand to catalyze new industries, from secure cloud services to domestic battery plants.

Areas where cooperation still makes sense

Rivalry does not erase shared interests. There are domains where cooperation or at least coordination serves both sides and the wider world. Climate technology sits at the top of that list. Joint work on grid stability, carbon measurement, and methane reduction would deliver benefits regardless of broader tensions. Scientific exchanges with clear guardrails can advance health research and disaster response. International standards bodies need broad participation to keep networks interoperable and secure.

China’s plan to tighten export control and build reserves of strategic minerals signals tougher competition over inputs. The United States and partners can stabilize markets by supporting mining, refining, and recycling in diverse locations. Licensing arrangements, technology sharing with safeguards, and joint inspections in sensitive supply chains can reduce mistrust.

What it means for the rest of the world

Third countries face a hard calculus. Many firms need access to both ecosystems. They want affordable hardware, reliable software, and predictable rules. Chinese offerings often win on price and delivery timelines. United States platforms often win on performance and developer tools. As Chinese chip makers improve and as Washington revises controls, more buyers will be able to choose from both catalogs, sometimes within the same project. That choice brings leverage but also legal risk.

Beijing has begun pairing its technology drive with new legal tools, warning of penalties for firms that follow foreign restrictions in ways that undermine Chinese interests. United States authorities, for their part, stress enforcement of export rules and sanctions. Companies that sit between the two will seek clarity. They will also build compliance teams in both jurisdictions and will demand contracts that spell out which laws apply in each phase of a project.

Key Points

- China has turned hardware scale, state planning, and fierce domestic competition into global strength in EVs, solar, batteries, and robotics.

- Beijing’s new five year plan doubles down on advanced manufacturing and strategic technologies, paired with tighter export controls and mineral reserves.

- The United States still leads at the frontier of AI and in private investment, and can leverage coalitions to shape standards and protect an open digital environment.

- AI expansion depends on electricity and infrastructure. China integrates energy planning with data centers, while the United States must expand capacity and grid resilience.

- Open source AI in China broadens access and speeds adoption. The United States can encourage responsible openness and focus on practical deployment.

- Semiconductor competition is intensifying. Controls are shifting from blanket bans to more targeted management of where advanced capabilities flow.

- Sharp decoupling carries heavy costs. Targeted, coordinated rules reduce risk with fewer side effects on supply chains and innovation.

- Action for Washington: rebuild hardware skills, speed prototyping, secure chip supply with allies, and align power planning with AI growth.

- Selective cooperation on climate, health, and standards can reduce friction and deliver global benefits even as rivalry continues.