Why this plenum matters now

China has closed a consequential political gathering in Beijing, the Fourth Plenum of the Communist Party’s current Central Committee. The meeting approved the outline for the next five year plan that will steer policy from 2026 to 2030, while also confirming major personnel moves amid a widening anti corruption campaign in the military. Decisions taken at this session set the tone for how the world’s second largest economy intends to grow, compete, and manage risk under a crowded agenda that stretches from advanced technology to birth policy and party discipline.

- Why this plenum matters now

- Blueprint for the 15th five year plan

- Tech self reliance takes center stage

- How Beijing frames rivalry with the United States

- From baby bust to silver economy

- Tackling involution and weak demand

- Personnel shock and a deepening military purge

- What this means for businesses and investors

- Implementation timeline and what to watch

- Key Points

A plenum brings together the full and alternate members of the Central Committee to debate strategy and adopt proposals. In the past, fourth plenums often focused on party governance. This one placed economic work and long range planning at the center, signaling that leadership wants clarity on growth, security, and innovation before the full plan is written and passed next spring. The session also offered a window into elite politics, with unprecedented turnover in committee seats and new faces in the top military command.

The headline themes are clear. Beijing is elevating domestic innovation and new quality productive forces, it is signaling dialogue with the United States rather than a clean break, it is preparing a new push to counter a deepening baby bust and grow a silver economy, it is promising action against bruising price wars and fragmented local protectionism, and it is extending an anti corruption drive inside the People’s Liberation Army with uncommon intensity.

Blueprint for the 15th five year plan

Party leaders announced that the plenum adopted the Recommendations for the 15th Five Year Plan for Economic and Social Development. According to senior officials, the document contains 15 sections and 61 articles arranged in three parts. The first part sets guiding principles. The second lists strategic tasks and measures across sectors. The third focuses on strengthening centralized leadership, governance, and rule of law. These recommendations now move to government agencies and localities that will translate them into a full plan for submission to the national legislature in March.

Officials highlighted a broad consultation process behind the draft. An online portal open for one month collected several million comments from the public. After circulation to provinces and ministries, thousands of revision suggestions were logged and hundreds were accepted. The message is that the plan blends top level priorities with feedback from a wide range of offices and organizations, then binds them into a program that will guide budgets, projects, and performance reviews across the system.

Jiang Jinquan, director of the Policy Research Office of the Communist Party Central Committee, underscored how Beijing sees planning as a strategic asset in an era of rivalry. Before describing the structure of the recommendations, he framed why this process matters to the leadership.

“Scientifically formulating and continuously implementing the five year plan is a key political advantage of socialism with Chinese characteristics, and essential for gaining strategic initiative amid intense international competition.”

The proposals will be refined by ministries into sector road maps and key projects. The final plan, expected to be approved by the National People’s Congress in the spring, will anchor growth targets, investment priorities, and policy tools for the next half decade.

Tech self reliance takes center stage

Innovation moves from aspiration to operating system in this planning cycle. Leaders want domestic research, talent, and capital to power what they call new quality productive forces that lift productivity and reduce exposure to external choke points. In plain terms, that means bigger funding for core science, more support for strategic supply chains, and faster translation of lab work into commercial products.

The plan outline leans into artificial intelligence, clean energy, advanced manufacturing, robotics, biomedicine, quantum science, and next generation communications. China already counts thousands of firms working on AI, with officials citing roughly 4,500 companies in the sector. The space program is singled out as a priority. Beijing seeks to become a leading spacefaring nation, using advances in launch, satellites, deep space exploration, and dual use applications to drive civilian industries. The recommendations also nod to frontier bets like nuclear fusion, hydrogen energy, and brain computer interfaces, areas where breakthrough timelines are uncertain but potential payoffs are large.

This agenda is not only about new sectors. It is also about renewing and digitizing traditional industries, where most jobs sit. The leadership’s view is that upgrading steel, chemicals, autos, and machinery with sensors, software, and greener processes can sustain employment while improving energy efficiency and product quality. That approach keeps manufacturing at the heart of development strategy and positions Chinese firms to expand in electric vehicles, batteries, solar equipment, and industrial automation.

How Beijing frames rivalry with the United States

Officials described a complex external environment but chose the language of engagement rather than separation. The message is that China seeks dialogue, expanded areas of cooperation, and high level opening up, while quietly preparing for a long contest in technology and national security. Export controls, investment screening, and tariff risks are all part of the backdrop, yet the leadership is signaling that policy will focus on resilience and competitiveness rather than pulling up the drawbridge.

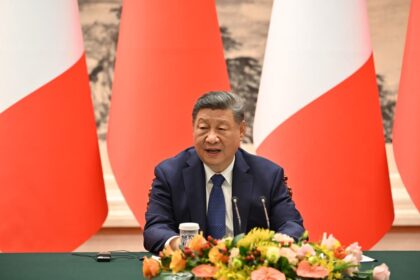

Against that backdrop, a meeting between Xi Jinping and Donald Trump is expected on the sidelines of a regional summit, with tariffs likely to feature. Beijing has been building leverage in supply chains that matter to advanced industries, from rare earths and critical minerals to components for clean energy. At the same time, Chinese planners know the economy still relies on international markets, imported tools, and foreign capital in certain niches. This creates an incentive to stabilize ties even as both sides harden their positions.

The plan’s emphasis on self reliance, product quality, and a modern industrial system reads as a play for long term advantage. The leadership appears confident that steady execution, scale, and an integrated home market can carry the economy through policy shocks and cyclical turbulence.

From baby bust to silver economy

Demographics weigh on growth prospects, and the recommendations reflect that concern. Births have fallen to modern lows despite the end of the one child policy and the introduction of a three child framework. Families cite high costs for housing, childcare, and education, as well as work pressures. The new plan seeks to build what officials call a birth friendly society by cutting those costs and expanding services.

Measures include more affordable childcare, support for early education, and incentives for local governments to supply public services for young families. The outline also highlights improving elderly care and medical coverage and gradually lifting the retirement age. That shift would bring more people into the workforce for longer and expand a silver economy focused on health services, assistive devices, age friendly housing, tourism, and financial products designed for older consumers. If executed well, this can relieve pressure on pensions and broaden domestic demand.

Tackling involution and weak demand

Party leaders used a term that has entered everyday speech in China: involution. In economic life, it refers to cutthroat internal competition that drives down prices, hurts profits, and leaves firms racing to the bottom. Oversupply in sectors like consumer electronics, solar panels, and some AI services has created price wars that sap investment and wages. The recommendations call for a more unified national market to reduce local protectionism, set fair competition rules, and improve product standards. The goal is to let productive firms scale across provinces while curbing wasteful duplication.

At the same time, the economy still leans heavily on investment and exports. Wages have lagged, household confidence is fragile, and property markets are still adjusting after a long boom. Local governments carry large debts through financing vehicles, which can limit spending on social services that would support consumption. The plan attempts to square this circle by keeping advanced manufacturing and infrastructure at the forefront while pledging more spending on public goods and targeted support for household consumption.

Whether that balance restores demand will depend on concrete measures that protect private property rights, lift disposable incomes, and channel more fiscal resources to health, pensions, and education. Without those steps, deflationary pressure and financial risks may persist even if headline output meets targets.

Personnel shock and a deepening military purge

Beyond policy, the plenum delivered a stark personnel message. The Central Committee removed or replaced 11 members, the highest turnover at a single meeting since 2017. The biggest shock came from the military. Eight generals were expelled from the Party on graft charges, an unusually public culling that included He Weidong, once the second ranked vice chair of the Central Military Commission and a member of the Politburo. The top command body chaired by Xi has now lost several members in a string of investigations since 2023.

Veteran disciplinarian Zhang Shengmin was elevated to second ranked vice chair of the Central Military Commission. He leads the military’s discipline inspection arm and also serves in the national anti graft commission on the civilian side. His promotion signals that the clean up of procurement and logistics in the armed forces will continue with force, and that loyalty and discipline remain paramount criteria for advancement.

Attendance by military delegates was visibly pared back compared with past sessions. The timing and scale of the purge send a clear signal to the ranks: discipline violations carry real consequences, and political control of the gun remains a top priority even as the leadership stresses modernization of combat capabilities.

James Char, an assistant professor focused on the People’s Liberation Army, cautioned that announcements timed with the plenum can have internal side effects if they go too far, too fast. He argued that detailed revelations about ongoing investigations could distract from the policy agenda and unsettle the force.

“Announcing more of these amidst the Plenum will distract from the Plenum itself, and cause further damage to PLA morale.”

What this means for businesses and investors

For companies, the plan signals policy continuity. Manufacturing stays in the driver’s seat, with digital upgrades and green standards running through sector playbooks. Technology substitution will shape procurement and licensing, especially in areas sensitive to export controls or national security. Firms tied to AI, industrial software, power equipment, batteries, and semiconductors can expect contracts and subsidies, along with sharper scrutiny and performance targets.

Foreign investors will see more pilots to expand market access in advanced services, but national treatment is likely to come with conditions around data, security reviews, and local partnerships. Overcapacity is a real risk in several industries. Trade partners may respond with anti dumping probes and local content pushes. Companies selling into China’s market need to plan for intensified domestic competition and price pressure, while those sourcing from China must hedge against policy shifts and logistical bottlenecks.

Consumption upgrades in health, elder services, sports, culture, and tourism could open niches for consumer firms. The key will be follow through on social spending, labor mobility, and fair competition rules. Clearer property rights and predictable regulation for private firms would lift confidence more than slogans, and would help translate the innovation drive into steady earnings growth.

Implementation timeline and what to watch

The recommendations adopted at the plenum flow into a dense work plan. Ministries and provinces will draft detailed programs and submit them for review. The full five year plan is expected to be finalized and approved by the National People’s Congress in the spring, then unpacked into sector plans, budget lines, and performance metrics. Legislators and senior officials have already begun study sessions to align legal frameworks and administrative work with the new goals, including support for a more unified national market and high quality development.

Watch for early signals in the months ahead: pilot programs to stimulate household consumption, measures to handle local government debt, new incentives for childcare and elder care, and procurement lists that favor domestic technology in critical systems. The anti corruption campaign is likely to continue in both civilian and military spheres, and further personnel changes may follow as investigations conclude. All of this underscores tight central control over planning, with a clear emphasis on innovation, security, and disciplined execution.

Key Points

- Fourth Plenum adopted recommendations that will frame China’s 15th Five Year Plan for 2026 to 2030.

- The recommendations span 15 sections and 61 articles covering strategy, sector tasks, and governance.

- Leadership doubled down on innovation and new quality productive forces to drive growth and reduce external exposure.

- High priority sectors include AI, clean energy, advanced manufacturing, biomedicine, quantum, and space.

- Officials signaled dialogue with the United States while preparing for a long technology and security contest.

- Demographic measures target a birth friendly society, better childcare, improved elderly care, and a gradual rise in retirement age.

- The plan aims to unify the national market and curb price wars and oversupply described as involution.

- Eleven Central Committee members were replaced, including eight generals expelled for graft, in the biggest military purge in years.

- Zhang Shengmin was promoted to second ranked vice chair of the Central Military Commission to reinforce discipline.

- The full five year plan is expected to be approved in the spring, followed by detailed sector plans and budgets.