Europe broadens its footprint at Taipei’s defence expo

Europe made a more visible appearance at Taiwan’s largest defence exhibition, signaling a cautious but growing willingness to engage the island on security and defence industry cooperation. The Taipei Aerospace and Defence Technology Exhibition drew a larger roster of foreign participants than in previous years, and for the first time in decades several European actors took public steps to show interest. The German Trade Office Taipei hosted a stand, Airbus made its debut with a prominent drone display, and a senior Czech lawmaker met Taiwan’s defence chief on the show floor. The mood suggested a shift from near silence to selective engagement as governments and companies weigh new risks and opportunities in a tense regional environment.

- Europe broadens its footprint at Taipei’s defence expo

- What changed in Europe after Russia’s invasion of Ukraine

- Central and Eastern Europe move first

- Drones and dual-use technology as the bridge

- Europe’s One China policies and the diplomatic dance

- The US still dominates, and how Europe fits

- What deeper cooperation could include

- Risks, red lines, and Beijing’s likely response

- Key Points

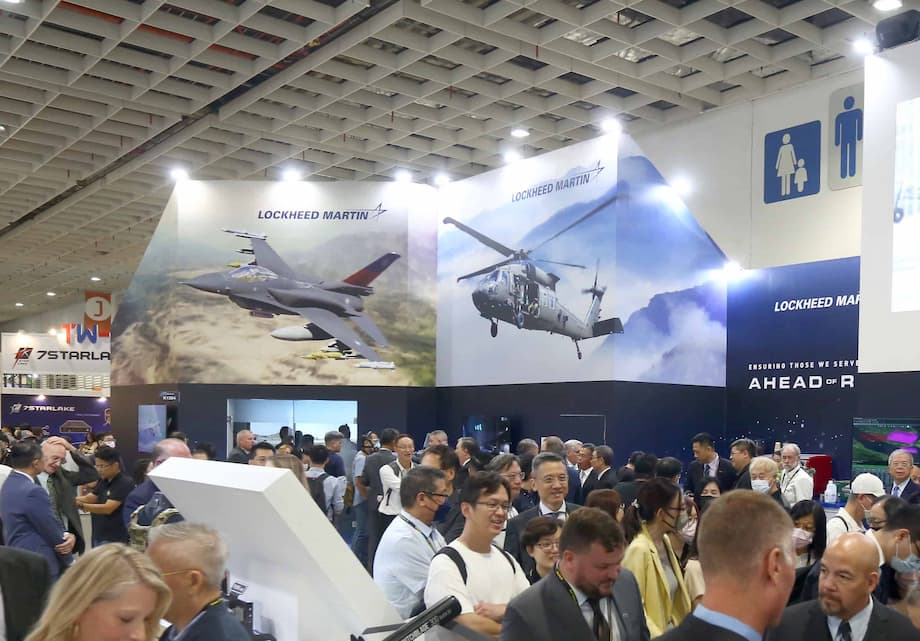

For Taiwan, the attention comes as it faces sustained military pressure from China, which claims the island as its territory. The government is boosting its defence budget and seeking more diverse partnerships. The exhibition featured roughly 490 exhibitors and 1,500 booths, up sharply from 2023. Taiwan has also outlined a path to lift defence spending toward 5 percent of GDP by 2030, a plan that could translate into tens of billions of dollars in procurement this decade. US firms still dominate Taiwan’s arms market, but Europe’s presence, even if modest, carries political weight. It points to a wider debate inside Europe about how to balance relations with Beijing while supporting Taiwan’s resilience.

At the Czech pavilion, Pavel Fischer, chairman of the Czech Senate’s Foreign Affairs, Defence and Security Committee, greeted Taiwan’s Defence Minister Wellington Koo and underscored the value of closer contacts despite political pressure from Beijing. Fischer said the island has partners in Europe and that conversations are growing more practical.

Today in Taiwan we have many partners to work with. We know the complexity of Taiwan in the international arena, because of the active measures by the Communist Party of China.

A Taiwanese executive at a military-use drone manufacturer that works with European partners described a notable change in tone after the war in Ukraine, which sharpened Europe’s focus on supply chains, deterrence, and the cost of inaction.

There is much less caution now. The world has changed because of Ukraine.

What changed in Europe after Russia’s invasion of Ukraine

Russia’s full-scale invasion of Ukraine reset assumptions about security on the continent. Governments accelerated defence spending, updated policies on critical suppliers, and pressed for more reliable partners across key technologies. In that environment, Taiwan’s position as a democracy under pressure, and a technology leader, gained resonance. The Baltic states and parts of Central and Eastern Europe pushed for harder lines on China and friendlier ties with Taipei. In Western Europe, governments became more open to contact with Taiwan on practical matters, including emergency services cooperation, secure communications, and industrial standards for dual-use technologies.

Companies also began reassessing supply chains. Europe’s heavy reliance on Chinese-made drones, optics, and other components suddenly looked risky. Taiwan’s emphasis on a non Chinese supply chain for unmanned systems and secure communications appealed to European planners worried about resilience and sanctions exposure in a crisis. That did not erase political red lines in Europe, but it made space for targeted collaboration that can be framed as civilian or public safety support while still boosting deterrence.

From long freeze to selective engagement

Europe’s caution has deep roots. When the Netherlands sold Taiwan two submarines in the 1980s, China’s retaliation was swift and severe, and Dutch authorities later pledged to block further arms sales. France sold six frigates in 1991 and 60 Mirage fighter jets in 1992, then drew back from major deals. Since then, Europe avoided big ticket systems for Taiwan. Cooperation, when it happened, largely stayed out of sight.

That pattern is loosening at the margins. British expertise has helped Taiwan’s indigenous submarine program, a signature effort to raise undersea deterrence with local production and foreign technical support. Support also appears in areas that are less politically charged, such as training, sustainment, and dual-use technologies where civilian missions overlap with defence priorities.

Central and Eastern Europe move first

Much of the energy behind closer ties comes from Central and Eastern Europe. The Czech Republic has emerged as a vocal supporter of engaging Taipei. Lawmakers from Lithuania, Slovakia, and other countries have visited the island, and business chambers have set up channels to explore cooperation. Firms in Poland, the Czech Republic, and the Baltics see opportunities in drones, software, and sensors. They also understand, from Ukraine’s battlefield lessons, how low-cost, scalable systems can change the calculus for a country facing a stronger adversary.

Industry linkages are forming. At a major defence expo in Kielce, Poland, Taiwanese companies and European partners signed memoranda of understanding to work on unmanned aerial vehicle technology, marrying Taiwanese components and electronics to Polish manufacturing strength and, in some cases, Ukrainian wartime research and development experience. The logic is clear: Europe brings demand, practical testing insights, and access to procurement channels; Taiwan brings component depth, electronics, and a drive to build a China-free supply chain.

Early numbers point to traction. Taiwan’s drone exports to Europe rose sharply in the first half of 2025, with Poland accounting for a large share of orders. The amounts are still small by the standards of traditional defence contracts, yet growth suggests a market taking shape where political sensitivity is lower than for fighters or submarines.

Why CEE matters for Taiwan’s defence industry

Central and Eastern Europe is attractive for three reasons. First, many governments in the region are open to new suppliers after seeing the urgency of replacing equipment used in Ukraine and filling critical gaps. Second, CEE industries are often agile, accustomed to bridging NATO standards with varied legacy systems. Third, companies there have fewer entrenched commercial ties to China, which reduces fear of sudden export bans or consumer boycotts. That does not mean risk is absent. Legal constraints, one China policies, and concerns about retaliation still shape decisions. Yet the region offers a practical entry point for Taiwan’s firms to scale production, co-develop components, and standardize certifications with European buyers.

Drones and dual-use technology as the bridge

Unmanned systems are becoming the most realistic avenue for near-term cooperation. Taiwan has invested in a full stack of unmanned platforms, including aerial drones for reconnaissance and strike, and sea drones inspired, in part, by Ukraine’s success against the Russian Navy. Taipei is trying to expand output while excluding Chinese components. That push aligns with Europe’s effort to secure supply chains and reduce exposure to sanctioned or untrusted vendors.

Airbus’s first appearance at the Taipei show underscored this shift. Beyond commercial jets, the company highlighted services and products for public safety, law enforcement, and secure communications. On the floor, a vertical takeoff and landing Flexrotor drone drew steady attention and even carried a sticker that read I heart Taiwan. An Airbus representative explained that the company’s pitch to Taiwan reaches beyond passenger aircraft to capabilities that improve emergency response and communication resilience.

These include helicopter applications for supporting search and rescue missions, emergency services and law enforcement, as well as secure communications services.

Europe’s industrial push also shapes the conversation. The EU’s effort to rebuild its defence base and speed up procurement, often described as Readiness 2030 or ReArm Europe, seeks to boost production capacity and reduce dependency on single suppliers. If European programs allow legal and financial pathways for cooperation with Taiwan on vetted dual-use technologies, joint procurement and financing could help Taiwan scale production and give Europe a clearer alternative to Chinese-made platforms.

Europe’s One China policies and the diplomatic dance

European governments accept that there is only one Chinese government while maintaining their own versions of a one China policy. Those national policies, not Beijing’s one China principle, define how each country engages Taipei in practice. The result is a spectrum. Some states keep contacts low profile and avoid high-ranking visits. Others tolerate ministerial-level travel or formal agreements in science, education, and technology, while maintaining that such moves do not change their recognition policy.

In recent years, European officials have quietly expanded interactions with Taiwan while choosing language that avoids crossing political red lines. For instance, a German cabinet minister visited Taiwan for a science and education cooperation event. Beijing protested, yet there were no major penalties. This is the pattern many in Europe prefer: keep trade and technology ties practical and defensible under existing policies while avoiding overt military deals.

Diplomatic traffic has increased. Taiwan’s foreign minister recently visited Prague, Rome, and Vienna, and European delegations have been more visible at events in Taipei. These steps signal that Europe is more comfortable engaging Taiwan on security-adjacent issues, including maritime awareness, crisis response, and cyber resilience.

Why words and symbols matter

Titles of offices, wording in communiques, and protocol decisions can trigger harsh reactions from Beijing, which tries to narrow the space for international engagement with Taipei. European governments tread carefully. They aim to support stability in the Taiwan Strait, express concern about coercion, and deepen practical ties, while reiterating that they do not recognize Taiwan as a state. That balancing act shapes how far defence-related cooperation can go in public.

The US still dominates, and how Europe fits

US companies still anchor Taiwan’s external procurement. The F-16 remains the mainstay of Taiwan’s air force. At the expo, the US presence was large, and Taiwan showcased joint work with North American partners, including projects in missiles, anti-drone rockets, and underwater surveillance drones. Taipei expects the bulk of international defence orders to flow to US suppliers, helped by the predictability of the US Foreign Military Sales system and the depth of US logistics.

That leaves an opening for Europe to play complementary roles. European firms can contribute training, sustainment, maritime domain awareness, secure communications, airspace management, radar upgrades, electronic warfare support, and helicopters for search and rescue and law enforcement. In these areas, dual-use framing is straightforward, and the political cost is lower than for combat aircraft or large warships. Over time, targeted co-production with European partners in CEE could support Taiwan’s goal of building a resilient, China-free supply chain for unmanned systems.

Complement rather than replace

Europe is unlikely to supplant Washington as Taiwan’s primary defence partner. The opportunity is to fill urgent gaps, improve resilience, and reduce single points of failure in supply chains. Selective cooperation can raise Taiwan’s costs of being coerced while reinforcing European security goals.

What deeper cooperation could include

Several low-risk, high-impact steps are on the table. First, co-production of drones and components in Central and Eastern Europe would blend Taiwanese electronics and software with European assembly and testing. Second, certification regimes could verify China-free supply chains, giving European buyers confidence that systems meet security standards. Third, joint trials and training in Taiwan’s Asia UAV AI Innovation Application R&D Center in Chiayi can turn memoranda into purchase orders by showing performance in realistic conditions.

Maritime cooperation is another pathway. Taiwan and European partners can expand work on underwater surveillance, anti-mine solutions, unmanned surface vessels for coastal defense and reconnaissance, and data sharing that improves maritime situational awareness. Helicopter fleets for law enforcement and search and rescue, paired with secure communications suites, provide immediate public safety benefits while enhancing readiness.

Practical steps in the next year

Governments could launch pilot procurements with Poland and other willing partners, integrate Taiwanese testbeds into European trials for drones and sensors, and open financing windows that support dual-use projects with strict end-use and transparency clauses. Industry-to-industry pacts can set standards, from cyber hardening to component provenance, which is essential if buyers want supply chains free of Chinese parts.

Risks, red lines, and Beijing’s likely response

Every European move toward Taiwan draws scrutiny from China. The threat of trade retaliation, informal boycotts, or diplomatic freezes remains a central constraint, especially for firms with significant business in China. Governments will continue to calibrate how far and how fast they move, and many prefer small, cumulative steps over headline-making contracts.

Export controls and licensing add further complexity. EU member states apply national laws inside a common framework for arms exports, with criteria on regional stability, human rights, and end-use. Even when an item is dual-use, approvals can take time, and political sensitivities vary widely across capitals. These differences all but ensure that Europe’s engagement with Taiwan will progress unevenly.

The picture that emerges is cautious but real movement. More European officials are visiting, more companies are showing up, and more deals point to practical cooperation in drones, secure communications, and maritime awareness. The United States will remain the heavy lifter for Taiwan’s defence, yet Europe’s targeted involvement can strengthen deterrence and resilience in ways that align with both European security and Taiwan’s needs.

Key Points

- European participation at Taiwan’s largest defence expo increased, with first-time stands from the German Trade Office Taipei and Airbus.

- The Czech delegation met Taiwan’s defence minister, signaling greater comfort with public engagement despite pressure from Beijing.

- Taiwan is raising defence spending toward 5 percent of GDP by 2030, drawing more foreign firms to compete for contracts.

- US suppliers still dominate Taiwan’s market, while Europe is exploring complementary roles in dual-use and support capabilities.

- Historic caution remains: after submarine and frigate sales decades ago, Europe avoided major weapon sales to Taiwan.

- Central and Eastern Europe is leading engagement, including new MOUs on drones and growing orders, especially in Poland.

- Drones and secure communications are the most promising areas for near-term Europe–Taiwan cooperation.

- Europe’s one China policies allow practical ties with Taipei without changing recognition, but language and protocol are carefully managed.

- Export controls, licensing, and fear of Chinese retaliation still limit the scope and pace of cooperation.

- Targeted co-production, supply chain certification, and joint testing could expand cooperation while keeping risk manageable.