A new routine at the teller window

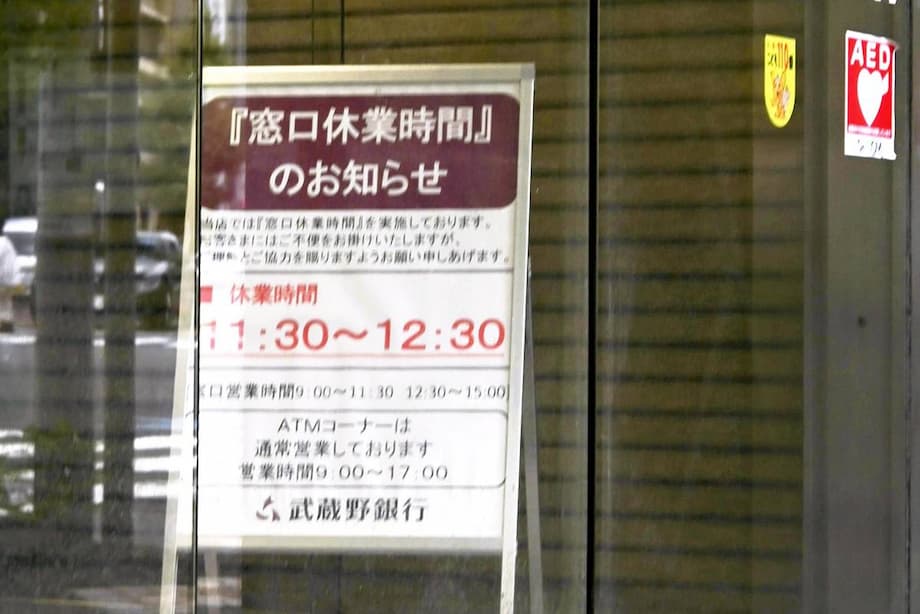

Across Japan, a growing number of bank branches now switch off their teller counters for a one hour lunch break in the middle of the day. The move, led by regional lenders and now tested by two of the three megabanks, is a direct response to a tight labor market and sharply lower in person visits. Mizuho Bank has started the practice at selected locations, while MUFG Bank has rolled out closures in Kyushu with plans to expand. During the pause, typically from 11:30 a.m. to 12:30 p.m., ATM services continue and digital channels remain available. The change alters a long standing routine at Japanese branches, which traditionally operated from 9:00 a.m. to 3:00 p.m., uninterrupted. A 2016 update to banking rules gave lenders room to adjust hours as long as customers are not left at a disadvantage, and many banks now see a midday break as a workable way to match staffing levels with demand.

- A new routine at the teller window

- Which branches are closing and when

- What the rules say

- Why labor strains push banks to change hours

- Customer experience and the digital gap

- Regional banks and local communities

- Other sectors face similar strains

- Will banks roll this out wider

- What regulators and consumer groups will watch

- Key Points

Iyo Bank in Ehime Prefecture was the first to test the idea in 2017. Since then, adoption has spread quickly across the country. About 90 percent of the 61 members of the Regional Banks Association of Japan have put the policy in place. The short closure helps banks cope with fewer tellers on the floor, a reality shaped by retirements of workers hired during the bubble era and a long shift to online banking that has drained branch traffic. For many locations, the hour serves as a planned pause so employees can take meal breaks and back office work can be completed without leaving a thin crew at the counters. Banks say the trade off is preferable to deeper cutbacks, and in some cases it keeps a branch viable for the community.

While the sign in the window is new for many customers, the basic services that matter most remain available. Cash withdrawals, deposits, and balance checks continue at ATMs. Transfers and many changes to account settings can be handled on websites or apps. The lunch break aims to smooth staffing pressure rather than cut customers off from the system.

Which branches are closing and when

At Mizuho Bank, midday closures have been introduced at branches in Yamagata, Matsuyama, and Yamaguchi, as well as at two special branches on remote islands. MUFG Bank has begun with four branches in the Kyushu region and intends to extend the policy to additional locations in Ibaraki, Yamaguchi, Gifu, and Aichi prefectures. At participating branches, counter service stops for one hour starting at 11:30 a.m., then resumes until the regular closing time at 3:00 p.m. ATMs remain accessible during the break.

These pilots and rollouts reflect a pattern that regional lenders have already established. Many branches with lighter lunchtime traffic see little difference in daily throughput, since customers adjust visits to the morning or early afternoon. Where footfall is heavier, banks monitor queues and make changes if congestion builds at 11:30 a.m. or immediately after reopening.

Standard hours in Japan keep branches open for six hours a day. The new approach reshapes that span rather than shorten the day, consolidating staff when demand is highest and providing a defined window for internal tasks and meal breaks.

What the rules say

In 2016, an amendment to banking regulations gave institutions flexibility to set branch hours provided that customers are not inconvenienced. This opened the door for regional banks to adjust schedules in areas with changing demand. The current lunch closures sit within that framework. Banks continue to post operating hours on branch doors and websites and are expected to offer accessible alternatives for essential services, like ATM access and telephone support, during any pause.

For decades, Japanese bank branches kept limited hours compared with many countries. Until relatively recently, ATM operating times often mirrored branch schedules, and some machines even closed at night. Today most ATMs stay available through the lunch period, and many operate all day, which helps reduce the impact of a one hour teller break.

Why labor strains push banks to change hours

Japan faces a shrinking and aging workforce. Banks are no exception. Employees hired in large cohorts during the bubble economy years are reaching retirement age. Hiring and training new tellers takes time, while fewer customers now need in person help. Low interest rates have also squeezed net interest margins, leaving lenders with persistent cost pressure. For a branch manager, the combination can be difficult to balance. A one hour pause lowers staffing needs for the day without closing the branch for good.

Teller operations require concentration and multiple layers of verification. Cash handling often uses dual checks. Supervisors must be available to approve transactions that exceed thresholds. When teams get too small, wait times rise and controls can suffer. A planned lunch break gives every teller a chance to rest, completes required tasks in the back office, and keeps the counter adequately staffed at peak times. The approach is simple, but it can make a real difference for thinly staffed locations.

Customer experience and the digital gap

Customers who usually run errands at midday may find the new policy inconvenient. Office workers often step out between noon and one, and those were popular hours for quick visits. The impact varies by branch. In neighborhoods where most customers already use ATMs or mobile apps for routine tasks, the pause attracts little notice. In places with older populations, demand for face to face help is higher, and a midday closure can squeeze the window for a visit.

There are workarounds. Banks encourage customers to use ATMs for cash and passbook updates, and to shift paperwork heavy tasks to morning or early afternoon. Some processes still require an in person visit, such as identity verification for new accounts or complex changes to mortgages. Planning ahead helps to avoid queuing near the break. Checking a branch page before leaving, bringing required documents, and arriving before 11:30 a.m. or after 12:30 p.m. keeps the process smoother.

What to do if you need a teller

Simple steps can reduce hassle at branches that pause for lunch:

- Check the branch website or posted notice for the exact break time.

- Arrive early in the morning or plan for mid afternoon, when counters are open and less crowded.

- Use online banking for transfers, account changes, and statements whenever possible.

- Bring identification and required forms to avoid repeat visits.

- If you need help with complex transactions, consider calling the branch in advance to confirm documents and timing.

What still works during the lunch break

Core self service tools continue operating while counters are closed:

- ATM withdrawals, deposits, and balance checks.

- Passbook updates at machines where available.

- Online and mobile banking for transfers and many account services.

- Customer support through call centers, depending on the bank and service.

Regional banks and local communities

Regional lenders have adopted midday closures faster than the megabanks. These institutions serve areas where foot traffic has fallen the most. They also have smaller teams per branch. Iyo Bank in Ehime Prefecture set an early example in 2017. Since then, a large majority of regional banks have followed. The policy reduces strain on staff and can keep low volume branches open that might otherwise face deeper cuts.

In remote communities and on islands, maintaining a physical presence still matters. The two special branches that Mizuho operates on remote islands now pause for lunch, but they remain important hubs for cash services and local businesses. Careful scheduling and clear public notices are essential so residents can plan visits, especially when travel to the branch is time consuming.

Other sectors face similar strains

Staff shortages are not confined to finance. Hospitality has been grappling with the same problem. In hot spring towns such as Kusatsu in Gunma Prefecture, more inns now skip dinner service and encourage guests to eat at nearby restaurants. Local operators report that doing so cuts staffing needs and lets them accept more bookings, which in turn supports higher occupancy and profits. In Kusatsu, roughly 30 of about 110 inns offer breakfast only or no meals, and the town saw a record 3.7 million visitors in fiscal 2023. Industry groups say many inns and hotels still lack enough workers, and some properties cannot open all rooms because kitchen and serving staff are scarce.

The comparison is not perfect, but the logic is similar. Businesses adjust service models to fit the workforce they have, while trying to preserve customer satisfaction. For banks, a one hour lunchtime pause is a modest change that can help sustain in person service during regular hours.

Will banks roll this out wider

Two of the top lenders, Mizuho Bank and MUFG Bank, have already moved beyond small tests. MUFG began in Kyushu and plans to add branches in Ibaraki, Yamaguchi, Gifu, and Aichi. Mizuho has selected branches in Yamagata, Matsuyama, and Yamaguchi, along with two island offices. The trend suggests more pilots are likely where staff shortages are sharp and lunch hour demand is light.

Banks say they aim to avoid inconveniencing customers. Consistent hours and clear signage help. So does ensuring enough ATMs and staff right before and after the break, when many customers now coincide their visits. If congestion becomes an issue, adjustment is straightforward, either by shifting the time window or by adding staff for the surrounding half hours.

What regulators and consumer groups will watch

While the policy fits within existing rules, consumer expectations still matter. Regulators and customer advocates will focus on a few simple measures that determine whether a lunch break feels seamless or frustrating.

- Timely notices at branch entrances and on websites, with the exact break times.

- Reliable ATM access during the pause, with enough machines and cash replenishment.

- Stable online and mobile banking for routine tasks.

- Helpful guidance from in branch staff to schedule visits and prepare documents.

- Monitoring of queues, especially in older neighborhoods, and tweaks where crowding persists.

Key Points

- Many Japanese banks now pause teller service for one hour at lunch, usually 11:30 a.m. to 12:30 p.m., while ATMs remain available.

- Mizuho Bank and MUFG Bank have begun adopting the policy at selected branches, joining a trend led by regional lenders.

- Iyo Bank pioneered the approach in 2017, and about 90 percent of regional banks have adopted some form of midday closure.

- A 2016 rule change allows flexible branch hours as long as customers are not inconvenienced.

- Staff shortages, retirements of bubble era hires, and fewer in person visits are driving the change.

- The pause helps branches operate with fewer workers while keeping counters adequately staffed at peak times.

- Customers can plan visits around the break and use ATMs and online banking for most routine services.

- Labor shortages across other sectors, such as inns in hot spring towns, show similar adjustments to services.