Why this five year plan matters now

China is preparing a new five year blueprint for 2026 to 2030 that puts manufacturing strength and technological self reliance at the top of the national agenda. The outline released after the Communist Party’s Fourth Plenum sets a clear priority order. Build a modern industrial system anchored in advanced manufacturing, accelerate breakthroughs in strategic technologies, and use innovation to create what leaders call new quality productive forces. Expanding domestic demand and improving livelihoods remain on the list, yet the emphasis tilts toward factory floors, research labs, and supply chain security.

- Why this five year plan matters now

- What Beijing says it will prioritize

- Security, self reliance and strategic endurance

- Manufacturing first, consumption later

- Sectors to watch

- Global trade and the next phase of competition

- Political signals from the Fourth Plenum

- Risks, constraints and the debt question

- What to watch next

- Key Points

New quality productive forces is the policy label for faster productivity growth driven by science based advances, smarter production, and digital infrastructure. In practice, this means heavy focus on semiconductors, industrial machinery, high end instruments, advanced materials, artificial intelligence, data platforms, and energy technologies. The leadership is betting that deeper capability in these areas will deliver faster growth, greater national resilience, and leverage in a tougher external environment. This approach comes as major trading partners raise tariffs, tighten export controls, and seek to rebuild their own industrial bases.

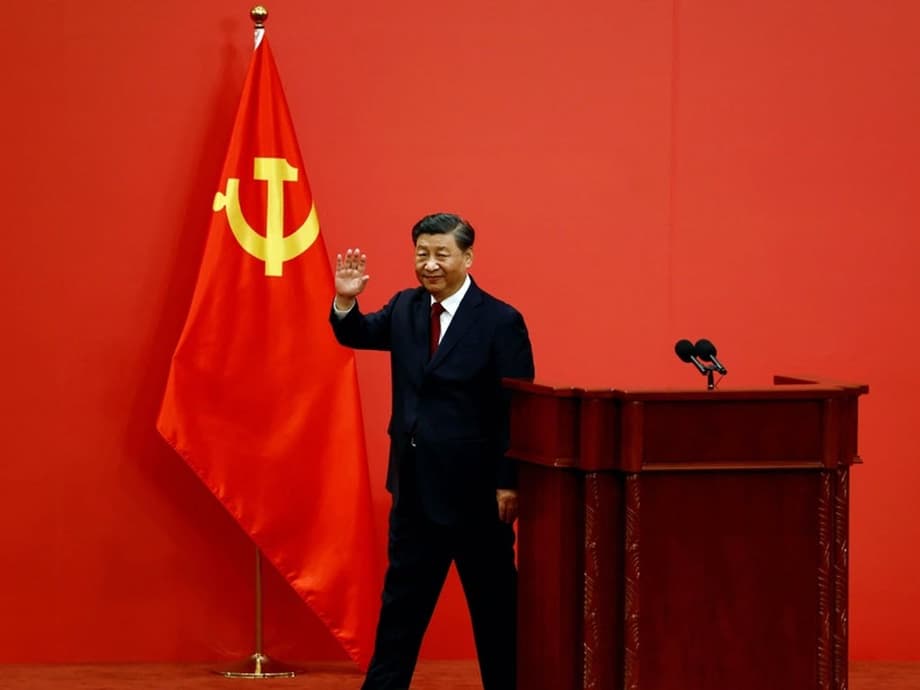

The plenum also signaled political continuity. A large reshuffle and anti corruption actions reaffirmed the authority of the top leadership, a sign that policy directives will face fewer internal obstacles. While the core message is self reliance, the government said it will continue to open parts of the economy, especially services and high value sectors, to foreign participation. The full plan will be finalized and adopted at the national legislature in early 2026.

For other economies, the stakes are high. China already dominates many global supply chains and controls key inputs like rare earth minerals used in electronics, energy, and defense systems. A renewed push into advanced industry will likely keep exports strong even as domestic demand remains uneven, forcing competitors to accelerate their own investment and policy responses.

What Beijing says it will prioritize

Senior officials laid out four main directions for science and technology in 2026 to 2030. First, strengthen original innovation and pursue decisive breakthroughs in core technologies in key fields. Second, deepen the integration of scientific advances with industrial application, so that lab discoveries reach factory floors faster. Third, align education, science and technology, and talent training to support these goals. Fourth, accelerate the Digital China program, with stronger data infrastructure and rules that enable the digital and real economies to work together.

The policy blueprint names integrated circuits, industrial machinery, and high end instruments as focus areas for national level resource mobilization. It calls for better intellectual property protection, more support for high tech companies and smaller science based firms, and an increase in the super deduction for corporate research and development expenses. A higher super deduction lowers a company’s tax burden when it spends on research, a tool designed to nudge firms to invest in long horizon innovation.

On the digital side, the government plans an open, shared, and secure national data market. This means common standards for data quality, circulation, and protection, along with cross region data exchange platforms. It also means more computing power, better algorithms, and richer datasets to train artificial intelligence. Officials highlight AI Plus, a program to weave AI through manufacturing, logistics, services, public administration, and social programs. The number of AI firms has already climbed into the thousands, and the plan signals more support for high end AI chips, foundation models, and robotics.

Commerce Minister Wang Wentao said the opening agenda will continue even as the country doubles down on technology. He described a more selective opening that aims to draw investment into areas that match domestic development needs and consumer demand.

China will take the initiative to open more broadly in the next five years.

Wang framed future investment as a way to build markets inside China rather than a race to win at any cost.

Moving forward, whether it is about opening up or attracting investment, we will not engage in zero sum games that will serve no one’s interest.

Security, self reliance and strategic endurance

The new plan shifts from a growth at all costs mindset to strategic endurance. Leaders speak of integrating a security pattern with the development pattern. The goal is a resilient economy that can sustain steady growth, around the mid single digits, while withstanding external shocks such as export controls or sudden drops in global demand. That is why autonomy in critical technologies sits beside traditional industrial targets. It is also why policy guidance is leaning toward long term capability building rather than short spurts of stimulus.

In practice, officials are likely to channel more state support into semiconductors, AI, aerospace, advanced energy, and key industrial equipment, while trying to keep other sectors stable. Financial risk control remains a priority, which points to targeted monetary and credit tools rather than a broad credit surge. This two tier approach seeks to protect employment and prevent stagnation in the wider economy while concentrating resources in technology heavy fields that the leadership sees as vital for national strength.

Military Civil Fusion, a policy that integrates civilian innovation with defense needs, is set to deepen. Civilian companies and universities already provide much of the AI software, sensing, and robotics that can be adapted for military use. The closer this coupling becomes, the shorter the lag between commercial breakthroughs and military adoption. China has also used export controls and licensing in areas such as rare earth minerals to align civilian resource management with strategic goals. For rivals, this means more of the civilian tech stack can carry military relevance, a dynamic that complicates export control strategies.

Manufacturing first, consumption later

The party readout mentions boosting domestic demand and improving people’s livelihoods, yet places greater weight on advanced manufacturing and technology self reliance. That balance reflects China’s current economic structure. Domestic demand has been fragile, the property market remains weak, and private confidence is uneven. Meanwhile, factories continue to drive growth through exports, even in the face of higher tariffs in key markets.

There is an unresolved tension between long term rebalancing toward consumption and the near term push to expand industrial capacity. Low wages in parts of the manufacturing base, a modest social safety net, and high precautionary savings have limited household spending for years. Heavy investment in tradable sectors encourages producers to sell abroad, which can keep domestic prices low and depress profits. The result is periodic overcapacity and deflation pressure. Trading partners increasingly respond with tariffs, quotas, and anti dumping cases.

Officials have signaled steps to invest more in people, including possible improvements in medical insurance and rural pensions, and more support for families with children and eldercare. The plan’s logic, however, treats strong consumption as an outcome of a more productive economy. Better products, more reliable services, and higher quality jobs are expected to raise household spending over time, rather than relying first on large scale welfare transfers.

What this means for households

Job creation is set to tilt toward higher skill roles in equipment, software, materials, and services that support industry. That requires more training, curriculum changes, and partnerships between universities, vocational schools, and firms. The plan’s emphasis on aligning education, science and technology, and talent seeks to match graduates with the skills demanded by advanced factories and research driven companies.

Sectors to watch

The outline and official briefings point to a dense map of priorities. Several areas are likely to receive the most policy support, financing, and regulatory attention.

- Semiconductors and advanced equipment: Expect sustained funding for chip design, materials, and equipment, along with alternatives to foreign lithography and inspection tools. Industrial machinery, precision tools, and robotics are central to upgrading factory lines.

- Artificial intelligence and AI Plus: National computing clusters, higher quality datasets, and support for high end AI chips and models will feed applications in manufacturing, logistics, healthcare, finance, and public services. Work on humanoid robots and embodied intelligence seeks to put AI into physical systems.

- Digital infrastructure and data: A unified, secure data market aims to standardize how data is collected, traded, and protected, making it easier to build services while guarding privacy and security.

- Energy and green technology: New energy industries, including hydrogen, grid scale storage, and nuclear fusion research, are likely to attract more state backed projects. Upgraded power equipment and materials will be needed to integrate intermittent renewables.

- Quantum and advanced communications: Efforts in quantum information and next generation mobile standards, often called sixth generation networks, aim to lock in advantages in secure communications and industrial internet applications.

- Biotechnology and biomanufacturing: From synthetic biology to advanced diagnostics and medical devices, the plan treats biotech as both a health priority and a growth engine.

- Aerospace and the low altitude economy: Satellites, launch services, avionics, and an expanding drone ecosystem create industrial and service opportunities in mapping, agriculture, logistics, and urban mobility.

- Traditional industrial upgrades: Chemicals, machinery, and shipbuilding will be organized into advanced manufacturing clusters, with an emphasis on process automation and digital control systems.

Electric vehicles once sat at the center of industrial policy. The official summaries of new strategic and future industries focus more on energy, materials, data, and next generation technologies. Automobiles appear mainly in a consumption context. That suggests a recalibration after rapid capacity buildouts and intense price competition, with policy attention moving to the next wave of innovation.

Global trade and the next phase of competition

The stakes for global commerce are rising. China plans to defend and expand its share in advanced manufacturing even as the United States and Europe pursue reindustrialization, higher tariffs, and tighter screening of inbound and outbound investment. Tariffs on Chinese goods in the US are already elevated, and export controls target high end chips and manufacturing tools. China, for its part, has refined its own export control regime and is building reserves of strategic minerals to reduce vulnerability to supply disruptions.

At the same time, Beijing says it will broaden opening in services and modern sectors. Officials have floated pilot openings in value added telecommunications, biotechnology, and foreign owned hospitals, as well as greater openness in education and culture. Plans to expand free trade zones, boost trade in intermediate goods, and enable cross border digital trade are meant to draw higher quality foreign investment even as technology self reliance advances.

Rare earth elements illustrate the strategic overlap. These minerals are essential for electric motors, wind turbines, and guidance systems. China dominates mining and processing. The plan’s security lens encourages careful management of these resources, including export licensing and domestic stockpiles, to support industrial goals while navigating foreign controls.

Political signals from the Fourth Plenum

The plenum brought the largest reshuffle of Central Committee members in years, alongside continued anti corruption actions that reached into the military. Personnel changes and the elevation of senior officers to key posts point to tighter control over the security apparatus and the party bureaucracy. This consolidation supports a whole of nation approach, where central directives on technology and industry can be executed more uniformly across ministries and provinces.

Policy continuity is the intended outcome. With authority concentrated and priorities narrowed, the leadership can direct capital markets, bank credit, and local government investment toward chosen sectors. That strengthens the push for technology sovereignty but also raises the stakes if resources are misallocated.

Risks, constraints and the debt question

China’s growth model carries known stresses. Years of heavy investment have pushed total debt to several times the size of the economy. Low inflation paired with high leverage makes growth more fragile, since nominal income grows slowly while interest burdens persist. Local government finances are strained after a long real estate cycle, which limits enthusiasm for a large nationwide stimulus. Policymakers appear to prefer targeted support and gradual debt workouts.

Industrial overcapacity is another challenge. The global market cannot absorb unlimited exports of mid range goods, and even advanced products face trade remedies when supply surges. More countries, including emerging economies building their own factories, are moving to diversify supply chains and protect domestic industry. Export driven growth in cutting edge sectors will likely meet more rules, reviews, and taxes at the border.

There are execution risks in innovation policy. Breakthroughs cannot be scheduled, and picking winners can misallocate capital. That is why intellectual property protection, research evaluation that rewards real results, and governance for data and AI matter. The plan references improving laws, standards, and ethics for AI, which is essential for safe deployment in transportation, healthcare, and public services.

Climate policy will also evolve. The next plan is expected to move from energy consumption control to carbon emissions control, with clearer targets for emissions, renewable energy, and energy use. Heavier monitoring of carbon intensity, product carbon standards, and incentives for clean technology could change cost curves in steel, cement, chemicals, and power generation, with spillovers through supply chains worldwide.

What to watch next

Near term signposts include the Central Economic Work Conference in December, where fiscal and monetary settings for the coming year are discussed, and the Two Sessions in March 2026, when the full five year plan is expected to be adopted. Watch for budget allocations to basic research, the scale of national semiconductor and AI funds, tax policy on research and equipment, and blueprints for computing infrastructure and data markets. Also watch export control lists, approvals for foreign owned service ventures, and standards that govern data flows and AI safety.

For companies, the message is clear. Supply chains that serve China will need more local content in critical technology, tighter compliance with data rules, and closer coordination with domestic partners. For investors, sectors tied to advanced manufacturing, AI, energy systems, and industrial upgrades are likely to remain in policy favor. For trading partners, industrial capacity expansions in China will shape prices and competition, even as more countries pursue their own industrial strategies. For Chinese households, the most tangible changes will come through jobs, training, and any progress on social programs that support spending.

Key Points

- Party leaders set advanced manufacturing and technology self reliance as the top priorities for 2026 to 2030.

- Officials outlined four science and technology directions: original innovation, science industry integration, education and talent alignment, and Digital China.

- Focus fields include chips, industrial machinery, high end instruments, AI, advanced materials, and energy technologies.

- AI Plus aims to embed artificial intelligence across industry, services, and public administration, backed by more computing power and data.

- Opening will continue in selected services, with pilots in telecom value added services, biotechnology, and foreign owned hospitals.

- Security and development are integrated, with a push for resilience against export controls and supply disruptions.

- Consumption support is on the agenda, but policy weight favors productivity gains and industrial upgrading.

- Industrial overcapacity, high debt with low inflation, and global trade pushback are key risks.

- Future industries named by officials include quantum technology, biomanufacturing, hydrogen energy, fusion energy, brain computer interfaces, embodied intelligence, and sixth generation communications.

- Final plan details are expected at the national legislature in March 2026, with more signals at the year end policy conference.