Hungary’s Transformation: From European Periphery to China’s Factory Hub

In recent years, Hungary has rapidly emerged as the leading European destination for Chinese manufacturing investment, outpacing even the continent’s largest economies. Once seen as a peripheral player in the European Union, Hungary now stands at the center of a dramatic shift in global industrial dynamics, driven by a surge of Chinese capital, technology, and ambition. This transformation is reshaping Hungary’s economy, its political landscape, and its relationship with both China and the European Union.

- Hungary’s Transformation: From European Periphery to China’s Factory Hub

- Why Hungary? The Economic and Political Drivers

- The EV and Battery Boom: Flagship Projects and Economic Impact

- Greenfield Investments: What Makes Them Different?

- Local Backlash: Environmental and Social Concerns

- Political Implications: Hungary, China, and the European Union

- Beyond EVs: Diversification and the Future of Chinese Investment

- Challenges and Uncertainties Ahead

- In Summary

At the heart of this story is a confluence of economic opportunity, political strategy, and local resistance. Chinese companies, especially in the electric vehicle (EV) and battery sectors, are pouring billions into new factories and infrastructure. The Hungarian government, led by Prime Minister Viktor Orbán, has actively courted this investment, offering generous subsidies and positioning the country as a gateway to the European market. Yet, as the factories rise, so too do concerns among local communities about environmental risks, social change, and the long-term implications of Hungary’s deepening ties with Beijing.

Why Hungary? The Economic and Political Drivers

Hungary’s ascent as China’s factory hub is no accident. Several factors have converged to make the country uniquely attractive to Chinese investors seeking a European foothold:

- Strategic Location: Situated in the heart of Europe, Hungary offers direct access to the EU’s vast consumer market and established automotive supply chains.

- Competitive Labor Costs: Hungarian wages are significantly lower than those in Western Europe—about one-third of Germany’s average hourly labor cost—making it an appealing site for labor-intensive manufacturing.

- Government Incentives: The Orbán administration has provided substantial subsidies, tax breaks, and direct grants to foreign investors, particularly in high-tech and automotive sectors.

- Political Alignment with China: Hungary’s government has cultivated close diplomatic ties with Beijing, joining China’s Belt and Road Initiative in 2015 and consistently supporting Chinese interests within the EU.

These factors have combined to create a business environment that is both welcoming and profitable for Chinese firms. According to a joint report by the Mercator Institute for China Studies and Rhodium Group, more than 30% of China’s foreign direct investment (FDI) into Europe in 2023—about €3.1 billion—flowed into Hungary, surpassing the combined total for France, Germany, and the United Kingdom.

The EV and Battery Boom: Flagship Projects and Economic Impact

The most visible manifestation of Chinese investment in Hungary is the rapid expansion of the electric vehicle and battery manufacturing sector. Four of China’s five largest active investment projects in Europe are now located in Hungary, with companies like BYD, CATL, EVE Energy, and Semcorp leading the charge.

BYD: Building Europe’s EV Future in Hungary

Chinese electric vehicle giant BYD has made Hungary its European headquarters, with a new center in Budapest and a major factory in Szeged set to begin production in 2025. According to BYD CEO Wang Chuanfu, the new European center will create 2,000 jobs and serve as a hub for sales, after-sales services, testing, and the development of localized vehicle models. BYD’s investment is part of a broader strategy to localize production, reduce shipping costs, and navigate new EU tariffs on Chinese-made vehicles.

CATL: The World’s Largest Battery Plant Outside China

CATL, the world’s leading EV battery producer, is constructing an €8 billion battery plant near Mikepércs in eastern Hungary. The facility, covering 221 hectares, is expected to supply batteries to major automakers like BMW and Mercedes-Benz. The Hungarian government has supported CATL with substantial incentives, including tax allowances and direct grants, although the company maintains that state incentives were only one factor in its decision-making.

Other Major Players: EVE Energy, Semcorp, and ZettaNet

Other Chinese firms are also making significant investments. EVE Energy received roughly €37 million in direct grants for its battery cell plant, while Semcorp is launching a €370 million factory for lithium-ion battery separators. Beyond the automotive sector, Chinese telecommunications giant FiberHome has opened ZettaNet, an optical cable manufacturing base in Kisber, further diversifying Hungary’s industrial landscape.

According to Hungary’s Minister of Foreign Affairs and Trade, Péter Szijjártó, 54 large-scale Chinese investments worth HUF 7,000 billion (about €17.3 billion) have been established in Hungary over the past decade, directly creating more than 30,000 new jobs. The government touts these projects as evidence of Hungary’s emergence as a global leader in the technological transformation of the automotive industry.

Greenfield Investments: What Makes Them Different?

Much of the Chinese investment in Hungary takes the form of greenfield projects—new factories and facilities built from the ground up, rather than acquisitions of existing companies. Greenfield investments allow foreign firms to maintain full control over operations, technology, and supply chains. This approach is particularly attractive for Chinese companies seeking to establish a long-term presence in Europe and avoid the complications of joint ventures or takeovers.

Greenfield FDI also brings significant benefits to host countries, including job creation, technology transfer, and the development of local supply networks. However, it can also raise concerns about dependency on foreign capital, the displacement of local industries, and the environmental impact of large-scale industrialization.

Local Backlash: Environmental and Social Concerns

While the economic benefits of Chinese investment are clear, the rapid industrialization of rural Hungary has sparked a wave of local resistance, particularly around environmental and health issues. The construction of massive battery plants and related facilities has transformed once-quiet villages into industrial hubs, raising fears about pollution, water usage, and the loss of agricultural land.

Grassroots Activism: The Mothers of Mikepércs

In the village of Mikepércs, near the site of CATL’s new battery plant, local residents have organized to demand greater transparency and environmental safeguards. Eva Kozma, an environmental engineer and mother of three, helped found Mikepércs Mothers for the Environment (Miakö), a group that has joined a national network of grassroots organizations challenging the government’s approach to industrial development.

These activists have staged protests, filed lawsuits, and pressured local authorities to enforce stricter environmental standards. Their concerns are not unfounded: previous investigations into South Korean-funded battery plants in Hungary revealed instances of water contamination, toxic emissions, and workplace safety violations. Chinese firms, including Halms (the Hungarian arm of Zhejiang Huashuo Technology), have also faced fines for environmental infractions.

Health and Property Fears

Some residents, like Vera Csuvarszki, have even tried to relocate, fearing for their children’s health due to potential factory pollutants. However, proximity to industrial sites has depressed property values, making it difficult for families to sell their homes. The sense of powerlessness is compounded by what many see as opaque government decision-making and a lack of meaningful public consultation.

Government and Corporate Responses

In response to mounting criticism, companies like Semcorp have pledged to comply with all environmental, health, and safety standards, and to work with local authorities and stakeholders. The Hungarian government, meanwhile, has launched investigations into some civic organizations, accusing them of using foreign aid to influence elections—a move seen by critics as an attempt to stifle dissent.

Despite these tensions, local activism has achieved some victories. In Alsózsolca, protests halted plans for a battery recycling plant, while in Heves, public outcry led the mayor to cancel a contract with a Chinese chemical company. These examples suggest that civic engagement can influence the trajectory of industrial development, even in the face of powerful economic interests.

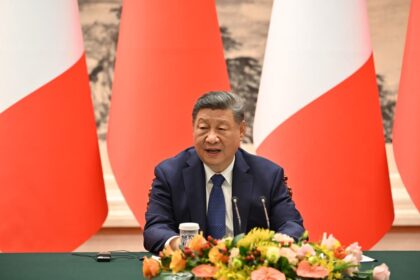

Political Implications: Hungary, China, and the European Union

Hungary’s embrace of Chinese investment has significant political ramifications, both domestically and within the broader EU context. Prime Minister Orbán’s pro-China stance has deepened rifts with Brussels, especially as the EU has hardened its position on China, labeling it a “systemic rival” and imposing new tariffs on Chinese electric vehicles.

During the COVID-19 pandemic, Hungary was the first European country to accept Chinese vaccines, and it has consistently blocked EU criticism of China on issues like Hong Kong and Xinjiang. This alignment has strained Hungary’s relations with other EU members, leading to the freezing of EU recovery funds and increased scrutiny of Budapest’s domestic policies.

At the same time, Hungary’s economic dependence on Chinese capital is becoming a point of contention in national politics. Opposition leaders, such as Peter Magyar of the Tisza party, have warned that true sovereignty requires a strong, independent economy—not one reliant on Chinese loans or Russian influence. With parliamentary elections looming in 2026, the future direction of Hungary’s foreign policy and investment strategy remains uncertain.

Beyond EVs: Diversification and the Future of Chinese Investment

While the EV and battery sectors dominate headlines, Chinese investment in Hungary is increasingly diversified. The opening of ZettaNet’s optical cable factory, backed by FiberHome, signals a move into high-tech manufacturing and telecommunications. The Hungarian government is also seeking to attract Chinese research and development (R&D) and service investments, aiming to accelerate the country’s economic transformation beyond traditional manufacturing.

Budapest has become a major air logistics hub for Chinese exports to Central Europe, with record cargo traffic and direct flights connecting Hungary to multiple Chinese cities. This infrastructure supports not only manufacturing but also e-commerce and technology transfer, further embedding Hungary in China’s global supply chains.

Challenges and Uncertainties Ahead

Despite the economic boom, Hungary’s status as China’s factory hub faces several challenges:

- Environmental and Social Backlash: Local protests and legal challenges could slow or reshape future investments, especially if environmental concerns are not adequately addressed.

- Political Volatility: Changes in government or shifts in public opinion could alter Hungary’s pro-China stance, creating uncertainty for investors.

- EU Policy Shifts: The European Union’s evolving trade and investment policies, including tariffs and regulatory scrutiny, may impact the profitability and feasibility of Chinese projects in Hungary.

- Economic Dependency: Overreliance on foreign capital, particularly from a single country, raises questions about long-term economic resilience and national sovereignty.

Nevertheless, the momentum behind Chinese investment in Hungary appears strong. As industry leaders establish roots, a broader ecosystem of suppliers and service providers is expected to follow, deepening the integration of Chinese and Hungarian economies.

In Summary

- Hungary has become the leading European destination for Chinese manufacturing investment, especially in the electric vehicle and battery sectors.

- Key factors include strategic location, low labor costs, generous government incentives, and close political ties with China.

- Major projects by BYD, CATL, EVE Energy, and others are transforming Hungary’s industrial landscape and creating tens of thousands of jobs.

- Much of the investment is in greenfield projects, giving Chinese firms full control over operations and supply chains.

- Local communities have mounted significant resistance, citing environmental, health, and social concerns, and have achieved some successes in halting or modifying projects.

- Hungary’s pro-China stance has strained relations with the European Union and become a contentious issue in domestic politics.

- Chinese investment is diversifying beyond EVs into high-tech sectors like telecommunications and logistics.

- The future of Hungary as China’s factory hub will depend on balancing economic growth with environmental protection, political stability, and evolving EU-China relations.