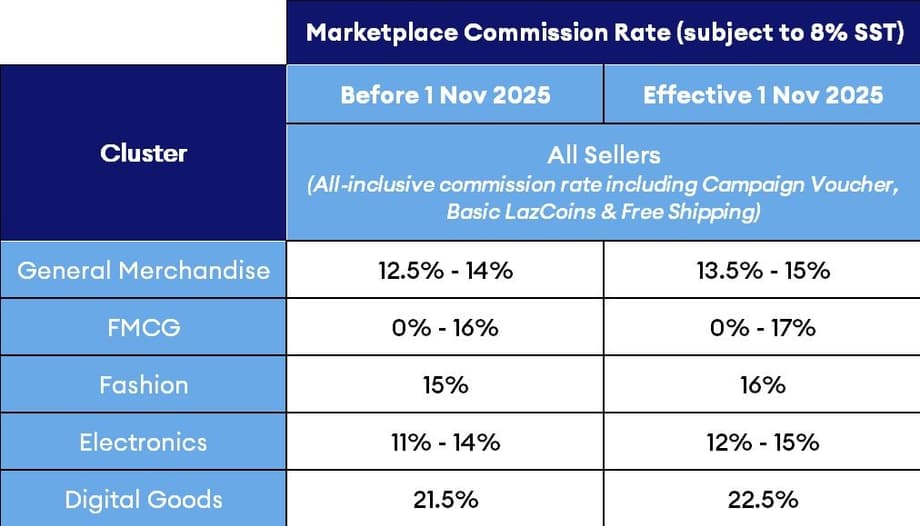

Fee changes on Nov 1 and who is affected

Lazada has raised commission fees for Marketplace sellers in Malaysia, with rates now reaching as high as 22.5 percent in some digital goods categories. The change took effect on Saturday (Nov 1). It applies across five product clusters that cover much of the catalog on the platform, including general merchandise (home decor, automotive, stationery), fast moving consumer goods (food and drinks, household essentials), fashion, electronics, and digital goods (vouchers, event ticketing, gift cards). Although the headline is a single revision, the actual charges still depend on the category and subcategory of each item.

Rates within the same cluster can vary. Within electronics, for example, audio equipment such as headphones carry about 13 percent, while cameras and drones are around 12.5 percent. Digital goods sit at the top end under the new schedule at up to 22.5 percent. LazMall, the channel reserved for brand stores, also saw a smaller revision, with commission moving up by as much as 1 percentage point across clusters. The company frames the change as part of a broader upgrade of the buyer and seller experience, including AI tools, improved delivery options, and more exposure through free campaigns.

How the new fees are calculated

The current model in Malaysia builds on an all in one approach rolled out by Lazada in mid 2025. Instead of separate charges for participation in free shipping or daily campaign vouchers, the platform folds those benefits into the commission. In practice, sellers get automatic access to basic LazCoins discounts, daily platform vouchers, and free shipping to buyers, while paying a single category based commission rate. The commission is only charged on orders that are successfully delivered. If an order fails or a buyer returns an item, the commission is reversed fully or partially.

Calculation uses the item price after seller funded promotions. Platform funded vouchers do not reduce the commission base. Malaysia’s 8 percent Sales and Service Tax (SST) applies to the commission amount. New Marketplace sellers receive a 120 day grace period from store launch, with commission starting on day 121. Sellers can review the detailed matrix by category and subcategory in the Lazada Seller Center FAQ, which is the official reference for current rates and rules. For the latest breakdown, visit the help center page at Seller Center.

Example: making sense of the math

Consider a RM100 item in a category with a 13 percent commission. If a seller funds a RM10 voucher, the commission base is RM90. Commission equals 13 percent of RM90, which is RM11.70. The 8 percent SST applies to the commission, not to the item price, which adds RM0.94 (rounded) for a total commission charge of about RM12.64. If the order is returned and refunded in full, the commission is reversed.

If the category rate is higher, the calculation scales accordingly. A digital category at 21 percent with the same RM100 price and RM10 seller voucher would mean RM90 x 21 percent equals RM18.90 commission, plus 8 percent SST on that commission (about RM1.51), for a total near RM20.41. This kind of example shows why category placement and discount strategy matter to margin planning.

Why Lazada says it raised rates

Lazada says the higher commission is tied to platform upgrades that benefit both sides of the marketplace. The company points to AI tools for sellers, improved delivery options, and greater exposure via free campaigns and voucher programs. The platform has also stepped up investment in creator and brand marketing, which can generate incremental traffic and sales for merchants during big shopping seasons. In May 2025, Lazada announced an annual commitment of about US$100 million to strengthen its affiliate program, with features like curated high commission products, a performance dashboard, and customizable storefronts for creators. In November, it topped up campaign spending for the 11.11 shopping period with about US$25 million to boost brand and creator growth, including AI assisted deal discovery for shoppers and expanded creator incentives. The company’s message is that a single, clearer commission helps fund these initiatives while giving sellers wider access to perks that previously sat behind separate program fees.

How Malaysia compares with the region

Lazada’s revision in Malaysia lands during a period of higher platform fees across Southeast Asia. In Vietnam, the biggest marketplaces have reworked their fee structures since early 2025. Shopee and TikTok Shop increased commissions across a number of categories and tied free shipping to new terms. Authorities in Vietnam have been watching the changes to ensure transparency and compliance with consumer protection rules. Seller groups there say that rising platform costs make pricing more challenging and could push businesses to raise retail prices, especially where margins are thin. In the Philippines, both Shopee and Lazada announced a small order processing fee per transaction in late August 2025, which spurred pushback from seller communities who already pay percentage based fees and tax.

Officials in Vietnam have cautioned that platforms should publish clear fee policies and provide sufficient notice. Hoang Ninh, deputy director of the Vietnam e Commerce and Digital Economy Agency under the Ministry of Industry and Trade, explained the risk to consumer prices if fee hikes are steep.

Hoang Ninh said: “If fees rise significantly, sellers may increase product prices to offset costs, directly impacting consumer purchasing power. The increase in commission fees must be based on transparent information and applied consistently across all sellers, including domestic and international businesses.”

Fee schedules and taxes differ by country. Malaysia applies 8 percent SST on the commission charge. Singapore applies goods and services tax, and some markets have separate fixed processing fees. The shared pattern is a shift toward folding shipping benefits and campaign vouchers into the core commission while promoting AI and affiliate tools to drive sales.

Seller strategies to stay profitable

Higher commission does not have to erase margins, but it does require more deliberate planning. At a minimum, sellers should map their catalog to the new category table, compute item level margins under the updated rate, and weigh the trade off between discount depth and conversion lift. It also helps to quantify the value of bundled benefits. For many stores, daily platform vouchers, basic LazCoins, and free shipping were previously optional and fee based. Now they sit inside the commission and can raise conversion if priced and promoted correctly.

- Rework pricing for top SKUs. Model price points with and without seller vouchers, then layer the commission and SST to set a floor for acceptable margin.

- Lean into exposure that is already paid for. Daily vouchers, free shipping, and basic LazCoins are included. Use campaign placements, storewide vouchers, and stackable discounts to win traffic without extra line items.

- Use AI tools in Seller Center. AI product titles, descriptions, and campaign recommendations can lift click through and conversion rates, which helps offset fee increases.

- Track finance data weekly. In Seller Center, monitor the commission line, voucher redemption, and shipping subsidies to maintain a running view of net proceeds by item.

- Test creator partnerships. With the affiliate program expanding, creators can drive incremental sales on a pay for performance basis.

Category planning and margin math

Digital goods now sit at the upper end of the commission table. Thin margin items in this cluster may require price adjustments or a pivot toward bundles that increase basket size. In electronics, the spread between subcategories matters. Audio gear at around 13 percent and cameras around 12.5 percent call for different pricing and voucher strategies. Items with higher average order value can sometimes absorb a higher commission if returns are low and shipping is efficient. Fast moving consumer goods usually run on slim margins and high repeat rates, so careful orchestration of seller funded discounts is critical.

New sellers and grace period

The 120 day commission free period for new Marketplace sellers is designed to help stores ramp without immediate pressure on margins. Use that window to build ratings and reviews, test pricing and product titles, and lock in a repeat base. Plan for day 121 by simulating the new commission on current price points so there is no surprise when the grace period ends. Stores that graduate into LazMall should also review the separate LazMall commission table, since brand channels have their own rates and rules.

What it means for shoppers

Shoppers are likely to see a mix of outcomes. Some sellers will raise list prices to account for higher fees, especially in digital goods and selected fast moving consumer goods. At the same time, the platform is increasing the visibility of vouchers and stackable discounts. The AI shopping assistant highlights savings by combining seller vouchers with LazRewards and platform deals, and free shipping is more consistently available. Delivery upgrades and priority options can shorten fulfillment times, which buyers value during peak season. Expect heavy promotions around 11.11 and 12.12, when creator content and live streams drive deal discovery.

What to watch in the months ahead

Category rate tables can evolve, so sellers should bookmark the help center page and check for updates before each peak campaign. Keep an eye on any changes to charges outside commission, such as payment processing or order level fees, which vary by market. Cross border sellers should note that rules for LazGlobal can differ from local Marketplace stores. Regulators in some countries are examining fee transparency and notice periods. Sellers can minimize risk by aligning store policies with the platform’s latest rules, documenting rate changes, and raising discrepancies with Partner Support promptly. As the affiliate and creator ecosystem expands, measure results with campaign level tracking to confirm that the added exposure translates into profitable orders.

Key Points

- Lazada’s new Marketplace commission in Malaysia is live from Nov 1, with some digital goods categories reaching up to 22.5 percent.

- Rates vary by cluster, category, and subcategory; electronics examples include about 13 percent for headphones and 12.5 percent for cameras and drones.

- LazMall commission increased by up to 1 percentage point across clusters.

- Malaysia applies 8 percent SST to the commission amount; commission is charged only on successful deliveries and is reversed on returns.

- The all in one model bundles benefits like daily platform vouchers, basic LazCoins, and free shipping into the commission.

- New Marketplace sellers receive a 120 day commission free period; fees start on day 121.

- Lazada is investing in AI tools, delivery upgrades, and creator programs, including a US$100 million annual affiliate commitment and 11.11 campaign support.

- Across Southeast Asia, major platforms have been raising fees, with authorities in some markets urging transparency and advance notice.