Why China is moving now

China has escalated a pressure campaign on United States semiconductor firms, accusing Nvidia of violating anti monopoly rules and opening a wide anti dumping case into a class of American made chips that power cars, factories, and consumer electronics. The twin moves land during sensitive trade talks between senior American and Chinese officials in Madrid and only days after Washington added 23 Chinese companies to its Entity List for national security reasons. The timing underscores how technology and trade policy have fused into a single contest over supply chains and national resilience.

- Why China is moving now

- What the antitrust case against Nvidia is about

- The anti dumping claims and which chips are targeted

- How subsidies and the Chips Act factor into the fight

- The state of China chipmaking and why mature chips matter

- Market reaction and potential penalties

- What negotiators are discussing and the timing

- Expert views on strategy and risk

- What to watch for companies and supply chains

- Key Points

China’s State Administration for Market Regulation said a preliminary investigation found Nvidia failed to honor commitments linked to its 2020 acquisition of Mellanox Technologies, the Israeli networking specialist whose hardware connects the graphics processors that train artificial intelligence models. The regulator said it would continue the probe. In a parallel track, the Ministry of Commerce opened a full anti dumping investigation into commodity interface integrated circuits and gate driver chips from Texas Instruments, Analog Devices, Broadcom, and ON Semiconductor. Those parts are not the cutting edge processors at the center of earlier sanctions, yet they are vital to modern electronics and are sold in very large volumes.

Industry data submitted to Beijing asserts that from 2022 to 2024 imports of the targeted chips into China rose by 37 percent, while average prices fell by 52 percent. The complaint alleges dumping margins as high as 300 percent and says chips of United States origin have captured 41 percent of the domestic market. If those numbers hold through the formal investigation, the case could justify steep tariffs or other restraints on American suppliers for years.

The cross fire arrives as both governments test the boundaries of trade law to advance strategic aims. Washington has tightened controls on advanced semiconductors and manufacturing tools destined for China. Beijing is now signaling it will use antitrust and trade remedies to police foreign suppliers it views as undercutting domestic producers or as failing to meet earlier promises.

What the antitrust case against Nvidia is about

When China cleared Nvidia’s purchase of Mellanox in 2020, approval came with conditions that aimed to preserve competition and ensure reliable access for Chinese buyers. The current finding asserts Nvidia violated elements of those commitments. Mellanox sells InfiniBand and Ethernet networking gear and software that tie together thousands of accelerators inside data centers. Since the acquisition, Nvidia has positioned this stack, from chips to interconnects to software, as a tightly integrated platform for artificial intelligence customers.

Chinese regulators opened their probe in December and now say the matter remains under investigation. The menu of remedies ranges from fines to required changes in business practices. In past cases involving global tech deals, China has pressed for non discrimination in supply, transparent pricing, and contractual commitments that prevent bundling that locks out competitors. The regulator has not said what specific measures it is weighing for Nvidia, or whether it might seek structural changes to how the networking business is offered and supported inside China.

Nvidia’s dependence on China has already shifted after United States rules curbed exports of the most powerful accelerators. The company created variants that comply with those rules, including H20 chips that Washington recently allowed to ship, but Chinese agencies have raised security concerns and urged some local buyers to favor domestic options. That push and the new antitrust scrutiny add a further layer of uncertainty to Nvidia’s sales plans in the country.

The anti dumping claims and which chips are targeted

China’s anti dumping case focuses on mature node analog and mixed signal components rather than leading edge processors. The complaint filed by the Jiangsu Semiconductor Industry Association argues that United States suppliers have shipped large quantities of commodity interface chips and gate driver integrated circuits at sharply reduced prices that do not reflect fair value. The Ministry of Commerce says it has begun a full investigation into sales by Texas Instruments, Analog Devices, Broadcom, and ON Semiconductor.

Analog chips regulate power, sense temperature and pressure, control motors, and manage signals between the physical world and digital systems. Gate drivers control power transistors in electric vehicles, industrial equipment, and consumer devices. These are foundational parts for cars, factory automation, appliances, battery management, display panels, and energy systems. A large swing in prices for such components can ripple across many sectors.

In trade law, dumping means selling below a normal value, typically the price in the home market or a constructed cost, in a way that causes injury to a domestic industry. The investigated margin describes the gap between the export price and that benchmark. If authorities confirm large margins, they can impose duties that offset the difference. Under Chinese practice that mirrors World Trade Organization rules, provisional measures can follow a preliminary finding, and final duties typically last five years and can be extended. Companies sometimes seek price undertakings to avoid or reduce duties, but those require regulator consent and strict monitoring.

Beijing’s notice suggests it will scrutinize patterns of shipments and pricing from 2022 onward and test claims that subsidized production in the United States, or aggressive discounting to gain share, distorted the Chinese market. The government says the review responds to protests from local industry, a common threshold for launching such cases.

How subsidies and the Chips Act factor into the fight

Chinese officials have also indicated they will examine whether grants and tax credits from the United States Chips and Science Act, along with state level incentives, gave American analog chipmakers an unfair cost advantage. The argument runs that government support at home can spill over into export pricing, which in turn harms Chinese competitors. Such claims fall into the territory of countervailing measures, which are distinct from, though often linked to, anti dumping investigations.

The Chips Act directs tens of billions of dollars toward American semiconductor manufacturing, research, and workforce programs. Washington frames the policy as a response to supply shocks and national security concerns, given the concentration of advanced chipmaking in East Asia. Beijing argues those measures, paired with export controls, skew the playing field. Whether China seeks countervailing duties in addition to anti dumping duties remains to be seen, but the signals suggest regulators want broad latitude to respond to pricing shifts they view as artificial.

The state of China chipmaking and why mature chips matter

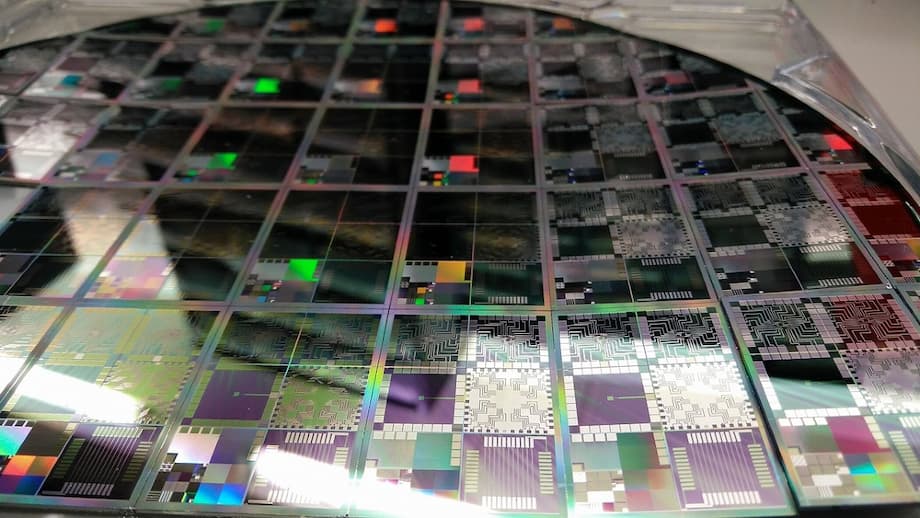

Semiconductor nodes describe the rough size of features etched onto chips. Mature nodes start at about 28 nanometers and above. High end nodes today include 5 nanometers and below. Chinese foundries such as SMIC are experienced in the 14 to 28 nanometer band and have limited capacity at about 7 nanometers. That leaves a gap in the most advanced processors, the kind used for top tier artificial intelligence training, but it also means mature chips are central to local production and a large share of demand inside China.

While export controls block the most powerful data center accelerators, the Chinese market still buys very large volumes of analog, power management, microcontrollers, and sensor chips. These parts sit in everything from automobiles and telecom base stations to industrial robots and household appliances. The anti dumping case aims directly at that layer of the market, where price sensitivity is high and where American brands have deep catalogs built over decades.

Chinese policy is pushing harder for self sufficiency. Officials have encouraged public sector computing projects to favor domestically sourced chips, and some guidance calls for local products to reach a majority share in public data centers. Chinese firms are developing their own accelerators and networking hardware. Fabrication capacity is expanding at mature nodes through producers such as SMIC and Hua Hong, though scaling analog portfolios to match the breadth and reliability of long established United States suppliers will take time.

Chinese device makers and chip design houses have also taken steps to buffer supply risk. Shanghai Fudan Microelectronics, which faces new United States restrictions, has said it increased reserves of wafers and critical materials and diversified supplier relationships to improve resilience. Measures like that are now common across the sector as companies hedge against regulatory swings.

Market reaction and potential penalties

Shares of Nvidia, Texas Instruments, and Analog Devices slipped after Beijing’s announcements. Texas Instruments and Analog Devices were among the weakest names in early trading, and Nvidia eased as investors weighed the risk of fines or behavioral remedies in China alongside ongoing limits on high power chip exports from the United States. Broader semiconductor indexes gave back recent gains as traders marked up the chance of new tariffs and pricing friction inside China.

For the antitrust case, SAMR has the authority to order changes to business practices and to levy financial penalties. In past actions, the regulator has imposed fines up to 5 percent of a company’s prior year sales inside China and required non discriminatory supply commitments. For the trade case, anti dumping duties can match the calculated margin and stay in effect for five years. If provisional measures are applied, they can hit importers within weeks of a preliminary finding, which would raise costs for Chinese buyers in segments such as automotive and industrial electronics.

Asked about the antitrust ruling, Nvidia said it will work with regulators. The company signaled a desire to keep selling compliant products in China despite a complex policy backdrop.

Nvidia spokesperson: “We comply with the law in all respects.”

What negotiators are discussing and the timing

United States Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng are meeting in Madrid for talks that cover tariffs, technology controls, and security related to digital platforms. Prior rounds in London, Geneva, and Stockholm produced temporary pauses on tariff increases, but they did not resolve deeper disputes over access to advanced technology and data. The new tension over Nvidia and analog chips injects fresh political risk into the agenda.

Senior American officials have publicly questioned the timing of Beijing’s announcements. They say the moves complicate an already crowded set of issues, including a decision timetable for the social media platform TikTok and potential tariff expirations.

United States Treasury Secretary Scott Bessent: “We discussed the poor timing of the Nvidia investigation the day of these talks.”

Recent weeks also saw Washington permit shipments of certain Nvidia H20 accelerators that meet export rules, while Chinese agencies flagged security risks with those parts. That back and forth illustrates how trade and security review can pull in opposite directions. Companies continue to lobby for narrow permissions that allow limited business, even as both capitals reserve the right to tighten controls at short notice.

Expert views on strategy and risk

Legal and industry experts say China’s measures are designed to create leverage during negotiations and to channel demand toward local suppliers. Some view the antitrust action as a way to push Nvidia to formalize supply and pricing commitments to Chinese buyers, while the anti dumping case could raise the cost of American analog chips and encourage substitution in cars and factories.

Market strategists are divided on the likely impact. Some call the announcements a bargaining tool, not a structural change in the near term. Others warn duties could meaningfully shift share in segments where domestic alternatives exist or where European and Japanese suppliers can step in.

Jordan Klein, trading desk analyst at Mizuho Securities: “Total noise and pure posturing.”

Antitrust lawyers note that China has become more willing to open cases involving foreign technology firms and to keep them open for long periods. This can steer procurement behavior even without a final penalty, since local buyers risk scrutiny if they concentrate spending with a company under investigation. One veteran practitioner who advises multinationals in Beijing said Chinese officials are now explicit about using the full array of regulatory tools to shape outcomes in strategic industries.

Lester Ross, partner in charge of the Beijing office of Wilmer Hale: “This is part of a broader effort by the Chinese government to use the regulatory weapons at its disposal, and diplomatic negotiations, to increase China’s access to advanced semiconductors as well as to surpass foreign competitors, ultimately reducing their dependence.”

What to watch for companies and supply chains

If China imposes provisional anti dumping duties on commodity interface chips and gate drivers, automotive and industrial manufacturers in China will need to reassess sourcing. The near term effect would likely be higher input costs and more orders directed to domestic designs or to non United States suppliers in Europe and Japan. That shift could accelerate ongoing efforts by Chinese firms to qualify local parts in vehicles, power systems, and factory equipment.

For Nvidia, the central question is whether SAMR seeks only a fine and behavioral remedies or also pushes for changes that would alter how networking and accelerator bundles are offered in China. Remedies that force standalone access to Mellanox hardware on standard terms, and strict non discrimination in support, would give Chinese server makers greater flexibility. A broader penalty, such as limits on exclusive software features tied to Nvidia interconnects, could add friction to new data center builds and tilt buyers toward domestic accelerators where feasible.

There is also the risk of escalation. Washington could respond with new restrictions on chip design software, advanced packaging tools, or services connected to high end computing. Beijing could widen its trade cases to other classes of components or bring countervailing duty petitions that target alleged subsidy benefits. The path that negotiators choose in Madrid will set the tone for whether these cases stay discrete or become part of a larger volley of actions that directly raise prices and reshape sourcing on both sides.

Companies can prepare by mapping exposure to the specific tariff codes under review, lining up second sources for analog parts, and refreshing contract language that allows for duty pass through. Manufacturers should expect periods of tight supply for certain gate drivers and interface chips if importers pause orders until duties are clearer. The broader the duties and the longer the antitrust case remains open, the more likely Chinese buyers are to lock in domestic parts and reduce reliance on United States suppliers.

Key Points

- China said Nvidia violated anti monopoly law tied to its 2020 Mellanox acquisition and extended the investigation.

- China opened an anti dumping probe into commodity interface integrated circuits and gate driver chips from Texas Instruments, Analog Devices, Broadcom, and ON Semiconductor.

- From 2022 to 2024, imports of the targeted chips into China rose by 37 percent while average prices fell by 52 percent, with alleged dumping margins up to 300 percent.

- United States origin chips are said to hold 41 percent of China’s market for the products under investigation.

- The moves follow Washington’s addition of 23 Chinese firms to the Entity List and coincide with trade talks in Madrid.

- SAMR could order changes to Nvidia’s business practices and impose fines, while the Commerce Ministry can levy anti dumping duties that last five years.

- Market reaction was negative for Nvidia, Texas Instruments, and Analog Devices as investors priced in regulatory risk.

- Analysts see the actions as leverage in negotiations, with potential to push Chinese buyers toward domestic alternatives in automotive and industrial electronics.