Why heavy rare earths became a choke point

Magnets sit at the heart of electric and hybrid vehicle motors. The strongest commercial magnets are neodymium iron boron magnets. These deliver high torque in compact motors. There is a catch. Neodymium magnets begin to lose their strength at elevated temperatures. To fight heat, makers traditionally add small amounts of heavy rare earth elements, mainly dysprosium and terbium. Both elements boost coercivity, the resistance to demagnetization, so magnets hold their field when a traction motor runs hot.

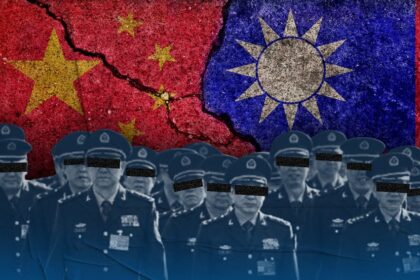

Heavy rare earth supply is concentrated. China mines a large share of the world’s rare earth ores, refines the majority of oxides and metals, and produces about 90 percent of the magnets that go into cars and electronics, according to industry surveys and recent reporting. When export curbs tighten, supply chains feel it fast. In recent months, automakers scrambled for backup supplies of magnet materials. Suzuki Motor temporarily idled some assembly lines after a shortfall of inputs, and suppliers warned of a possible crunch reminiscent of the chip shortage. Reuters described automakers and parts makers in full panic over rare earth bottlenecks.

What Japan’s new magnets promise

Japanese materials specialists are moving to break the link between motor performance and heavy rare earth metals. Proterial, formerly Hitachi Metals, says it has developed neodymium magnets for traction motors that maintain performance without any heavy rare earths. By tightening control of impurities and the microstructure during processing, the company reports magnet grades strong enough for electric vehicles and hybrids.

Technical details published by industry sources describe two new sintered neodymium grades that avoid dysprosium and terbium. One grade targets driving motors, electric power steering and compressors, with residual magnetic flux density B_r of about 1.40 tesla and intrinsic coercivity H_cJ of at least 1671 kiloampere per meter. A second grade aimed at higher torque applications raises B_r to about 1.42 tesla with H_cJ at or above 1830 kiloampere per meter. In simple terms, B_r indicates how much magnetic flux a magnet can deliver, and H_cJ indicates how hard it is to demagnetize at high temperature.

Proterial says sample quantities from a mass production line are already available for the first grade, and that a higher heat variant will reach sample readiness by April 2026. The company holds hundreds of patents related to neodymium sintered magnets and has also highlighted work on a high flux soft magnetic alloy, which could trim weight and losses in certain motor cores. For traction motors, the headline is the removal of heavy rare earths while hitting key thresholds for torque and temperature.

The company is preparing domestic production in Kumagaya in Saitama Prefecture and Yabu in Hyogo Prefecture. If contracts follow, this would create a home based source of traction motor magnets at a time when auto companies seek supply that is less exposed to policy shifts in Beijing.

Daido Steel shows early traction

Daido Steel and its subsidiary Daido Electronics have already commercialized neodymium magnets for hybrids that use no heavy rare earths. Their approach refines grain size inside the magnet, producing much finer crystal grains. That raises coercivity and stabilizes performance when the motor heats up. Honda adopted these magnets in hybrid models in 2016, a first for a major automaker.

Demand signals are rising again. Daido Steel reports increased inquiries from automakers in Japan and the United States for hybrid and battery electric applications. To meet expected orders, the company plans to invest 5 billion yen in a Daido Electronics plant in Nakatsugawa in Gifu Prefecture. The goal is to lift monthly capacity to about 45 tons by spring 2026 and to around 150 tons in fiscal year 2030.

The company is also advancing hot deformed magnet technology that avoids heavy rare earths and lowers power consumption during manufacturing compared with conventional sintered routes. That can cut carbon output at the factory level and reduce exposure to the tightest parts of the rare earth market. Daido Electronics is spreading production and customer support across Japan, Thailand, China and the United States, including plans to manufacture traction motor magnets in Ohio.

Can the new magnets meet EV heat loads

Traction motors in a family car can see internal temperatures well above 150 degrees Celsius, and localized hot spots higher still under steep grades or repeated acceleration. Heat drives down magnet strength and can cause irreversible loss if intrinsic coercivity is not high enough. Heavy rare earth additions raise H_cJ, which is why they became standard in the toughest grades.

Proterial says it achieved adequate H_cJ and B_r without dysprosium or terbium by controlling impurities and texture during sintering. Analysts welcome the progress but will look for third party validation. Performance needs to hold over thousands of thermal cycles, across the full range of speed and load, and after exposure to humidity and salt spray. Early industry commentary also asks whether the new magnets match or exceed the best dysprosium bearing grades on both performance and cost.

What engineers will verify

Design teams will plot full demagnetization curves at operating temperatures, then test for irreversible loss after overload events. They will check torque and efficiency against the generator and inverter pairing, not just stand alone magnet properties. Mechanical integrity matters too. Magnet grade, shape, coating, adhesive, and rotor sleeve all have to withstand repeated thermal and mechanical stress.

Validation also includes production consistency. A grade that meets spec in a pilot run must do so every month at scale. Suppliers will ask for statistical process control data, traceability, and failure analyses from accelerated life testing. That process can take months for lab work and a year or more once parts are built into prototype vehicles.

The global scramble and alternatives

Rare earth policy has become a pressure point for the auto sector. China controls the bulk of refining and around 90 percent of magnet production. During recent permit slowdowns, European suppliers temporarily shut lines and some automakers warned that factory idling could follow without reliable magnet deliveries. The anxiety recalls the semiconductor crunch, and it is pushing companies to diversify both technology and geography.

Alternative motor designs are part of the toolkit. Wound rotor synchronous units, induction motors, and switched reluctance machines avoid permanent magnets. Some use ferrite magnets, which are abundant but weaker, combined with novel geometries to recover performance. Several European brands have introduced magnet free motors in select models. Tesla has said its next generation permanent magnet unit will not use rare earths, which has encouraged wider search for new materials and topologies. Market research indicates permanent magnet motors still hold more than three quarter share in electric cars between 2015 and 2022, with reduced rare earth content and a gradual rise in alternatives.

Countries outside China are rushing to fill gaps. In India, motor makers and startups are licensing magnet free traction designs based on ferrite magnets and reluctance principles, while domestic recyclers work on recovering rare earths from electronic waste. The aim is not just a stopgap. It is to build a regional supply chain that can support fast growing vehicle programs.

Recycling and new processing hubs are gaining momentum in North America. Ontario based Cyclic Materials reached an offtake deal with chemical group Solvay for recycled rare earths, and Canada is investing in processing capacity to supply customers in the Americas and Europe. Industry leaders say the trade tensions have galvanized plans to build independent supply. Pat Ryan, CEO of UCore, captured that sentiment in a recent statement on the policy shift.