Introduction: The Allure and Challenge of Korea’s Coffee Market

South Korea has emerged as one of the world’s most dynamic and competitive coffee markets, attracting global giants and fostering a vibrant local café culture. With per capita coffee consumption among the highest in Asia—averaging over 400 cups per adult annually—Korea’s urban centers are saturated with coffee shops, from international chains to innovative independents. Yet, for global brands like Blue Bottle and Tim Hortons, success in Korea is far from guaranteed. The market’s unique blend of fast-paced consumer expectations, price sensitivity, and a deep appreciation for both convenience and quality presents a formidable challenge for newcomers and established players alike.

- Introduction: The Allure and Challenge of Korea’s Coffee Market

- Why Korea’s Coffee Scene Is So Unique

- The Rise and Recalibration of Global Coffee Chains

- Local Chains and the Power of Price

- Specialty Coffee and the Pursuit of Quality

- Market Saturation and the First Signs of Contraction

- Innovation, Digitalization, and the Future of Coffee in Korea

- Reverse Trends: Korean Chains Go Global

- In Summary

Why Korea’s Coffee Scene Is So Unique

Korea’s coffee culture is not just about the beverage—it’s a social and cultural phenomenon. Cafés serve as meeting places, workspaces, and social hubs, reflecting the country’s busy urban lifestyle and the importance of communal spaces. Seoul alone boasts over 18,000 coffee shops, making it one of the most café-dense cities globally. This density is driven by several factors:

- High Coffee Consumption: Koreans drink more than double the global average, with coffee accounting for over 30% of the national beverage market.

- Social and Work Culture: Cafés are integral to daily life, offering spaces for study, business meetings, and socializing.

- Design and Experience: Many cafés are design-led, offering unique interiors and experiences that go beyond just serving coffee.

As Min-jun Park, a local tech entrepreneur, notes,

“Seoul’s cafés understand the needs of remote workers. They offer comfortable seating, ample outlets, and they never rush you out, even after several hours.”

This environment has made Seoul a haven for digital nomads and locals alike, blending tradition with modernity and fostering a café culture that is both innovative and deeply rooted in Korean society.

The Rise and Recalibration of Global Coffee Chains

Global coffee brands have long eyed Korea as a lucrative market, but the path to success is fraught with challenges. The stories of Blue Bottle and Tim Hortons illustrate the complexities of adapting to Korean consumer preferences.

Blue Bottle: From Artisanal Rituals to Rapid Delivery

When Blue Bottle entered Korea in 2019, it positioned itself as a purveyor of artisanal coffee, emphasizing slow brewing and personal interaction. However, the realities of the Korean market—where speed and convenience are paramount—have forced the brand to adapt. Blue Bottle has expanded its delivery options through local apps like Baemin and Coupang Eats, and introduced perks such as size upgrades and app discounts. While these changes have increased accessibility, they risk diluting the brand’s original identity.

Despite a 17% increase in annual sales to 31.2 billion won in 2024, Blue Bottle’s operating profit plummeted, and the company posted its first net loss since entering Korea. Industry insiders warn that in a market “awash with cheap caffeine and fast service,” maintaining core values is increasingly difficult.

Tim Hortons: Price Perception and Market Realities

Tim Hortons, a Canadian staple known for affordability, entered Korea in 2023 with high hopes. However, its premium pricing—1.5 to 2 times higher than in Canada—clashed with its reputation and local expectations. The closure of its flagship store in Cheongna, Incheon, and subsequent promotional campaigns, including steep discounts and free Americano coupons, highlight the brand’s struggle to find its footing.

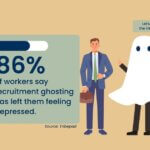

Tim Hortons’ experience underscores a key lesson: Korean consumers are highly price-sensitive, especially with the proliferation of budget chains like Mega Coffee, which offers Americanos for as little as 2,000 won compared to Tim Hortons’ 4,000 won and Blue Bottle’s 5,900 won.

Starbucks: The Early Mover and Market Leader

Starbucks, which entered Korea in 1999, has become the dominant force in the market, with over 1,900 stores and a reputation for innovation. The brand was among the first to introduce mobile ordering, cashless stores, and robust app-based rewards. Starbucks’ ability to localize—through community initiatives, heritage preservation, and tailored product offerings—has cemented its status as Korea’s “third place” for work, study, and socializing.

As Emmy Kan, president of Starbucks Asia Pacific, explains,

“We are proud of all that we have accomplished together in Korea, where we continue to elevate coffee culture, reimagine the third place and iconic Starbucks experience for our customers and communities.”

Starbucks’ sustained growth, despite the rise of budget competitors, demonstrates the power of brand adaptation and community engagement in Korea’s café landscape.

Local Chains and the Power of Price

While global brands grapple with adaptation, local chains like Mega Coffee, Compose Coffee, and Ediya Coffee have thrived by offering affordable prices and rapid expansion. Mega Coffee, for example, has grown to over 2,700 franchises, leveraging celebrity endorsements and aggressive pricing to capture market share. Compose Coffee, now with more than 2,400 outlets, has also seen explosive growth, aided by digital innovation and strategic partnerships.

These budget chains appeal to a broad demographic, from students to office workers, and have forced even premium brands to reconsider their pricing and service models. The success of local chains is not just about price—it’s also about understanding Korean consumer behavior, which values convenience, customization, and a sense of community.

Specialty Coffee and the Pursuit of Quality

Amidst the battle between premium and budget chains, Korea’s specialty coffee scene has flourished. Independent roasters and cafés like Terarosa, Coffee Libre, and Fritz Coffee Company have introduced concepts such as single-origin pour-overs and “seed-to-cup” transparency. The country’s hosting of the World of Coffee Asia event in Busan in 2024, including the World Barista Championship, signals Korea’s growing influence in the global specialty coffee community.

Charles Costello, founder of Caffeine Compass, observes that Korea’s specialty coffee sector is “continuously innovating,” with a new generation of baristas and roasters pushing the boundaries of quality and experience. This segment caters to discerning consumers willing to pay a premium for unique flavors, ethical sourcing, and expert craftsmanship.

Market Saturation and the First Signs of Contraction

Despite the ongoing growth in coffee consumption, Korea’s café market is showing signs of saturation. According to the National Tax Service, the number of coffee shops nationwide dipped to 95,337 in the first quarter of 2024—a decline of 743 from the previous year and the first recorded drop since 2018. This contraction reflects intense competition, rising labor costs, and shifting consumer preferences.

Industry experts note that the proliferation of both premium and budget chains has led to decreased sales per outlet, particularly among low-priced brands. To counteract this, many are diversifying their menus with bakery and dessert items, enhancing the overall café experience and encouraging higher customer spending.

Innovation, Digitalization, and the Future of Coffee in Korea

Korea’s coffee market is not just about quantity—it’s also a hotbed of innovation. Digital ordering, app-based rewards, and cashless payments are now standard, with brands constantly seeking new ways to engage tech-savvy consumers. The rise of design-led cafés, co-working spaces, and community-focused initiatives further distinguishes Korea’s café culture from other markets.

International brands looking to succeed in Korea must balance their global identity with local adaptation. As one industry official puts it,

“Korean coffee consumers move fast and expect brands to keep pace. Striking the right balance between brand roots and local flavor is critical to success.”

This means not only adjusting pricing and service models but also embracing the cultural and social dimensions of coffee in Korea.

Reverse Trends: Korean Chains Go Global

Interestingly, the flow of coffee culture is not one-way. Korean chains like Ediya Coffee are now expanding abroad, with recent openings in Malaysia and plans for further international growth. These brands leverage their experience in Korea’s hyper-competitive market to differentiate themselves overseas, focusing on affordability, quality, and customer experience.

Such expansion reflects the growing influence of Korean café culture on the global stage, as well as the increasing interconnectedness of the international coffee industry.

In Summary

- South Korea’s coffee market is one of the world’s most competitive, with high consumption rates and a dense concentration of cafés.

- Global brands like Blue Bottle and Tim Hortons have struggled to adapt, facing challenges related to pricing, speed, and local consumer expectations.

- Starbucks remains the market leader, thanks to early innovation, localization, and community engagement.

- Local budget chains such as Mega Coffee and Compose Coffee have thrived by offering affordable prices and rapid expansion.

- The specialty coffee segment is growing, driven by consumer demand for quality, transparency, and unique experiences.

- Market saturation has led to the first decline in the number of coffee shops, prompting brands to diversify offerings and enhance customer experience.

- Digital innovation and design-led spaces are key differentiators in Korea’s café culture.

- Korean coffee chains are now expanding internationally, exporting their successful models abroad.

As Korea’s coffee market continues to evolve, the ability to balance global brand identity with local adaptation will determine which players thrive in this ever-changing landscape.